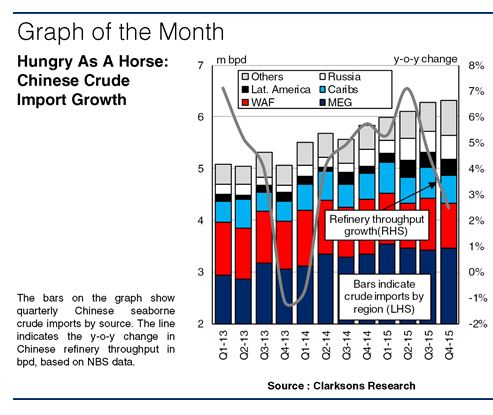

While China’s slowing economic growth had negative impacts on a number of major shipping sectors in 2015, Chinese seaborne crude imports still expanded robustly by 9% y-o-y to 6.2m bpd. China is the world’s largest seaborne crude importer, accounting for more than 15% of global

imports in 2015, and is a key driver of global crude oil trade, with plenty of scope remaining for further firm expansion in 2016.

Rising Tiger

Expansion in China’s seaborne crude oil imports is estimated to have accounted for more than a third of global seaborne crude import growth in 2015. Chinese refinery throughput increased at a fairly strong pace of 5% last year, in line with estimated expansion in domestic oil demand, despite a slowing of growth in the final quarter. Imports were also boosted by the filling of China’s Strategic Petroleum Reserve (SPR), with eight SPR sites operational by mid-2015. The volume of oil stored at these sites had reportedly doubled between November 2014 and July 2015 to stand at around 190m bbls, equivalent to roughly 75% of capacity of phases one and two of the SPR.

Who’s Snaking Ahead?

The growth in China’s imports last year was spread fairly evenly across key supplier regions, keeping the average haul of China’s imports relatively steady for a third successive year at around 7,400 miles. The Middle East remained the largest supplier of crude to China last year, accounting for 3.5m bpd (56%) of imports, up 6% y-o-y. Chinese imports from Latin America nearly doubled y-o-y in 2015, partly as a result of a number of ‘loans for oil’ deals. However, imports from the region totalled 0.3m bpd, still only accounting for 5% of the total. Long-haul imports from the Caribbean also grew strongly, by 8% to 0.6m bpd. However, this growth was offset by a 9% y-o-y decline in long-haul imports from West Africa to 0.9m bpd (15% of the total). Short-haul imports from eastern Russia also rose very strongly in 2015, by more than 70% to reach 0.4m bpd.

Strong As An Ox?

2016 looks set to remain a challenging year for the Chinese economy as it transitions into a new stage of growth. Despite a slowdown in oil demand growth (and refinery throughput) in Q4 2015, the outlook remains broadly positive for 2016, with expansion in oil demand of around 3-4% expected. Crude imports are also likely to be supported by two additional factors. Firstly, China has sought to open up the crude market to independent refiners. Six independent refiners have now been given approval to import crude oil, whilst 14 more refiners have received approval to process up to 1.1m bpd of imported crude in 2016. Secondly, China is expected to build up its SPR further in 2016, with the IEA estimating that a further 94.5m bbls of storage capacity will be completed this year.

So, despite concerns over the Chinese economy, there remain plenty of reasons to be positive for the short-term outlook for Chinese crude imports, with current projections indicating growth of 10% in seaborne imports to 6.8m bpd this year. This expansion would account for almost half of the expected growth in world seaborne crude imports this year, and so in the crude trade at least, China remains at the forefront of supporting global growth.

Source: Clarkson Research Services Limited