At the risk of stating the obvious, commodity prices have taken a beating over the past year – and no subsector has experienced as much negative sentiment as the Canadian oil sands. Throughout this commodity cycle, many commentators have openly

discussed the demise of the oil sands industry.

It’s no secret that oil sands development is exceptionally costly given the large initial capex requirements and ongoing operating spend. However, what is often lost in translation is that once upfront capital is spent, the remaining life economics of these projects are competitive. Three steam-assisted gravity drainage (SAGD) projects recently reported operating costs lower than C$10/bbl, proving that even top-tier projects can make positive margins with bitumen price realizations now below C$35/bbl. Luckily for oil sands producers in the Great White North, differentials have cooperated (for the most part!) while the significant depreciation of the Canadian dollar has also helped cushion the blow from low prices.

For oil sands producers, there’s more to the story than today’s price. For starters, the companies engaged in oil sands development have long-term project views of 25 to 35 years. Given such a long timeframe and the high capital requirements, oil sands companies are generally large and well-capitalized and can weather price volatility. On that note, we’ve seen some casualties over the past year among smaller operators that, while successful in securing capital and starting projects, were unable to remain liquid and weather the downturn in prices.

Secondly, oil sands development presents an attractive portfolio addition for companies. Oil sands projects are very large with a long reserve life and well-documented geological properties. Once the bitumen resource is identified and delineated, the resource risk is significantly reduced. In addition, oil sands production has a very limited (and well-understood) decline profile. Unlike conventional/unconventional resource development, which experiences significant near-term declines, oil sands projects are known to provide more consistent production. While capital intensive, these projects provide diversification for operators with higher exploration or above-ground risk portfolio projects.

Sticking with price, once these capital-intensive projects are brought online, they generally stay onstream regardless of commodity prices. There are a few reasons for this – first, remote projects have high fixed operating cost components which include staffing, steam generation, trucking and ore preparation. Secondly, there is a lot of geological and engineering risk in shutting down a SAGD operation. If you stop steaming you run the risk of losing your steam chamber and causing potentially irreversible reservoir damage.

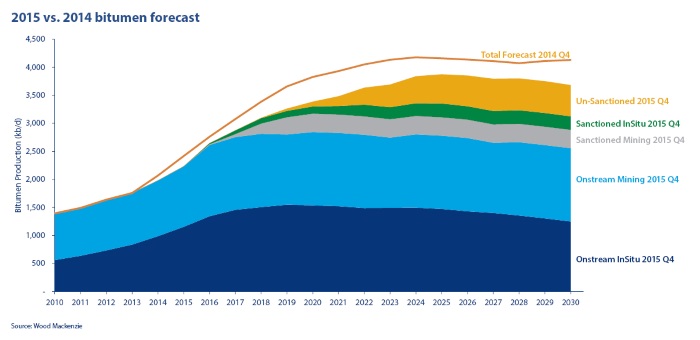

Given these factors, we expect oil sands producers to not only continue to produce but to increase their volumes [Chart 1]. While the current commodity environment has seen many operators cut capital budgets and delay project phase additions [Chart 2], there remain numerous projects and phases that are sanctioned, have spent the majority of capex and will continue to be built and brought on-stream.

As mentioned, projects further in the future have been delayed, but near-term volumes are expected to continue to grow with an aggregate forecast of 2.5 mm b/d today to just under 4.0 mm b/d by the mid-2020s. In fact, we count 16 project phases that have or will start producing in 2014 or 2015 which we estimate will add total output of 562,000 b/d.

We expect some of these projects to progress once prices stabilize. For SAGD projects, we see breakevens (10% IRR) of between US WTI$55-70/bbl with mining projects coming in at US WTI$80/bbl and above. At today’s commodity prices, these economics hardly look compelling so the delays are justified.

The reality is that oil sands production is here to stay and, quite frankly, the world should be happy it is. The global refining mix has increasingly been built to handle heavier crude feedstocks, with a lot of that complex refining capacity located in the more convenient US Gulf Coast.

With 170 billion barrels of known resource, Canadian oil sands are too important in the global oil supply/demand balance to be ignored or stopped. The biggest problem oil sands developers face is getting this world-class source to market given the existing infrastructure bottlenecks, such as Keystone XL. But that’s a discussion for another day…

Source: Wood Mackenzie