Refining margins typically improve when crude oil prices experience a structural decline, as refined product prices lag those of crude. Hence, refiners experience a period of a few months when the difference in price between refined products and their crude oil

feedstock is larger than normal, so improves their earnings. The performance of the refining sector during the recent crude oil price collapse of 2014/15 is, however, different from that of 2008/09.

The figure below compares Wood Mackenzie’s Northwest Europe reference refining margin for these two periods, adopting an index basis on monthly average margins. (The reference refinery processes light North Sea crude in a gasoline oriented configuration, typical of the European refining industry). The index sets the monthly average refining margin at 100 for the month when the price of Brent crude oil peaked (denoted as month zero on the chart). The 2014/2015 data terminates at August 2015, month 14.

In both 2008/09 and 2014/15, refining margins increased strongly over the three months that immediately follow the month of peak crude oil price. After this initial period, refining margins declined. However, in the 2014/15 period, refining margins returned to strong growth after month 6 (December 2014) and continued to grow, with July 2015 monthly margins being almost 11 times the refining margin prevailing that of June 2015, before dropping modestly in August.

The key driver of this difference has been gasoline, which has achieved record premiums to crude oil in North West Europe, particularly in Q2 2015, while the pricing of other refined products remained within historical norms. Incidentally, in itself, this is unusual reflecting the surplus of crude oil, as strength in one product is typically accompanied by weakness in another. Similar pricing relationships between gasoline and crude has prevailed in other regions, with North America being strongest and Asia weakest. High price gasoline has been driven by market tightness in the Atlantic basin.

Low crude oil prices have reduced the retail price of gasoline in the US, which has prompted higher consumption. This demand growth has, however, been met by domestic supplies, as US gasoline net trade has remained largely unchanged from historical norms during Q1, as shown below. Imports rose strongly in Q2 due unplanned refinery outages.

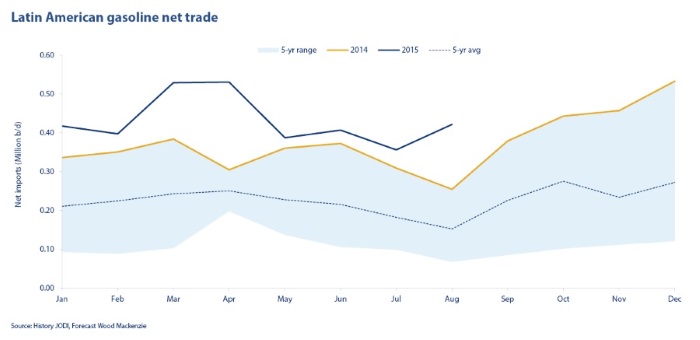

Latin America has been primarily responsible for the Atlantic Basin market tightness in Q1 due to unplanned outages in Venezuela and delayed completion of refinery investments, notably in Brazil. Consequently, the region importing significantly more gasoline than historical norms, as shown below. Also Mexican refiners have continued to operate at a low utilization, leaving the wider region short of gasoline and so importing from the United States and Europe.

This period of exceptional refining margin performance does not reflect a new paradigm, because the medium term fundamentals indicate a return to historical norms. The challenge is the timing of the transition (and whether the August declines are sustained), given seasonal declines in gasoline demand are being countered by unplanned refinery outages in the United States and forthcoming seasonal refinery maintenance.

Source: Wood Mackenzie