The current conventional wisdom is that the market for subsea installation and maintenance is slightly more insulated from the worst effects of the oil price fall, given the long project timelines and high capex involved. But with new short-term investment set to be cut, and reports of declining vessel utilisation, it seems likely that the potentially positive longer-term trend will be preceded by short-term challenges.

Subsea Construction

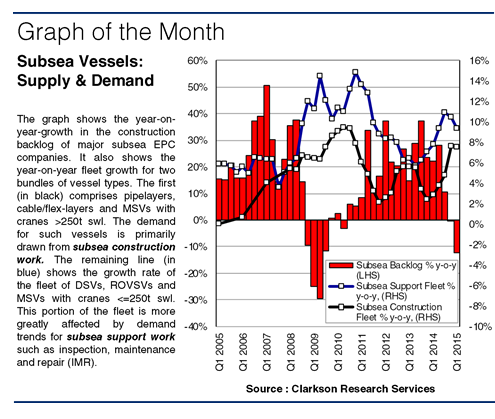

A key indicator of subsea construction demand is the backlog for EPC work held by major subsea companies. The growth rate of this year-on-year is shown on the graph (red line). Broadly, this follows the oil price, going into negative territory in Q1 2015, just as it did during 2009.

The remaining two lines on the graph show the year-on-year growth in two parts of the fleet related to subsea construction and subsea support. Growth in both accelerated in 2009 (albeit from a relatively small fleet). A rush of deliveries hit the wrong part of the market cycle and exacerbated the demand weakness caused by the 2009 oil price drop. It is also noticeable that, back then, the growth of the support fleet was more rapid than growth in the fleet of the larger construction assets, despite the fact that the IMR fleet was already 91% larger.

Calm Beneath The Storm?

Of course, the key question now is: will it happen again? The industry is likely to have to weather multiple quarters of declining backlog given that oil price weakness is discouraging IOCs, whilst another major demand source, Petrobras, clearly has issues to resolve. Unfortunately, the answer is, to some degree, yes. Ordering in the last few years means that fleet growth is set to accelerate in 2015.

So will it matter? Again, the answer may well be yes, in the short term. Few would deny that all markets, including subsea, face short-term challenges. However, the longer-term fundamentals give cause for optimism. As subsea well completions age, their maintenance requirements are likely to increase. A decade ago, 15% of installed subsea wells were over 15 years of age: today 35% are, and the volume of such “middle-aged” subsea structures has been growing at 20% per annum. This is a supportive trend for the longer-term future of the IMR fleet, whilst those assets focussed on new construction are more dependent on the fortunes of EPC companies’ backlogs, which, as shown below, are currently in decline.

Beneath The Waves

A wildcard which may help the IMR fleet is the share of smaller-craned units ordered by new, Asian players. The Asian share of the MSV orderbook is now 25%: double that in 2005. The largest areas for subsea production (the North Sea, Brazil, West Africa) are in the Atlantic. If operators there take an attitude of preferring more experienced subsea owners, this could constrain vessel supply in the Atlantic more than the orderbook picture would suggest.

So, weaker markets are already very evident, with declining backlogs, idle vessels and companies announcing job cuts. Yet there are reasons to be optimistic about the longer term future, particularly for maintenance requirements. However, the market will clearly first have to surmount a short-term future of excess supply and muted demand.

Source: Clarksons