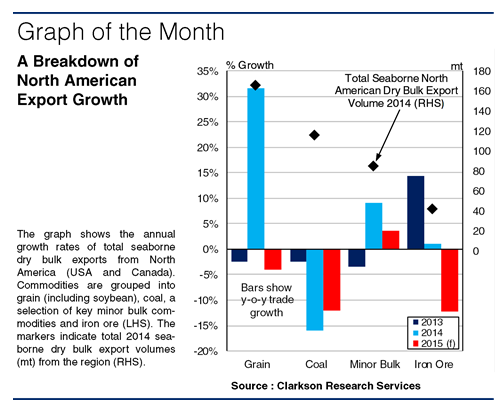

North America is an important region for dry bulk trade, with exports exceeding 400mt in 2014, accounting for around 10% of global seaborne dry bulk exports. However, as much of North American mineral production is at the higher end of the cost curve and international dry bulk commodity prices remain depressed, exporters from the region are increasingly finding themselves priced out of the market.

Sliding Coal Production

North American coal exports have been under particular pressure in recent years, with exports dropping 16% y-o-y to total 116mt in 2014. Miners have been forced to cut production on the back of depressed international spot prices, weakening domestic consumption and a drop in Chinese and EU import demand. The EIA has projected US coal production to drop 7% y-o-y in 2015, to hit a 28-year low of 926mt. US seaborne coal exports fell 16% y-o-y in the first two months of 2015, while Canadian seaborne coal exports dropped 9% y-o-y in Q1 2015. Overall, North American seaborne coal exports are projected to drop 12% y-o-y to reach just over 100mt in 2015.

Crumbling Iron Ore Exports

Meanwhile, North American iron ore exporters enjoyed a period of sustained expansion for six years, until falling international spot prices saw growth cut to 1% y-o-y in 2014. Cliffs Natural Resources was forced to cease output at Bloom Lake in Canada (8mt capacity) in January 2015, while several US mines have also announced plans to scale back until prices recover. Overall, total iron ore exports from the region are expected to drop 12% y-o-y in 2015, to reach around 36mt.

Grain Export Growth Stemmed

Grain exports have historically been a central component of North American dry bulk exports, comprising the largest proportion in 2014. A bumper harvest and favourable market conditions saw North American seaborne grain (including soybean) exports increase 32% y-o-y to reach 165mt in 2014. This growth rate is expected to fall in 2015, largely due to the strong US dollar undermining the country’s price competitiveness, combined with a hike in European and Russian exports. North American grain exports are projected to drop 4% y-o-y in 2015, to around 158mt.

Minor Source of Optimism

Minor bulk exports stand out as a solitary source of healthy export growth potential, with current projections indicating a 4% y-o-y increase in 2015. North American minor bulk exports have been supported by the US and Canada maintaining their positions as the leading exporters of petcoke (37.1mt) and potash (8.1mt) respectively in 2014. Exports of both commodities from the region are currently projected to increase around 10% y-o-y in 2015.

A Difficult Year Ahead?

So, growth rates for many North American dry bulk exports are expected to drop in 2015, highlighting the impact of price pressures even on established exporters. While North America is likely to remain a major exporting region, its share of international dry bulk export trade is currently under some threat.

Source: Clarksons