Black Sea container terminals of Ukraine, Romania, Russia, and Bulgaria handled 587 168 TEU in Q1 2016, including empty containers, excluding transshipment.

This review observes only full containers of the region – 425 953 TEU. Total drop suffered by these five countries in Q1 2016 was 2,94%, compared to the same period last year.

In Q1 2016 general decrease in laden containers was 2,94%

Black Sea region turnover, Q1 2016 and Q1 2015, TEU, full

The laden turnover increase was in all countries of the Black Sea region except Georgia. It suffered significant laden volume drop of 36,75%, while Ukraine and Russia achieved laden volume growth of 5,98% and 4,63% respectively.

Full containers turnover by countries, TEU

During this period, 52,62% of full containers handled were imported, with 47,38% of the volume being exported. It is estimated that laden container share was 72,54% and empty container share was 27,46%.

52,62% of laden container volume at the Black Sea was imported

Export volumes from the aforementioned countries increased by 9,12% compared to Q1 2015. The highest export volume drop was shown by Georgia – 33,64%. In Russia, Ukraine and Bulgaria there was an increase of laden export, moreover Russia and Ukraine achieved growth of 60,34% and 11,94% respectively. Imports to the region decreased by 11,73%, mainly because of Georgian import volume drop of 37,36%. There was an increase of laden import volume in Romania, Bulgaria and Ukraine – 8,12%, 2,24% and 0,02% respectively, while Russia suffered drop of 14,35%.

Georgia had a record in decrease of laden import volume –37,36%

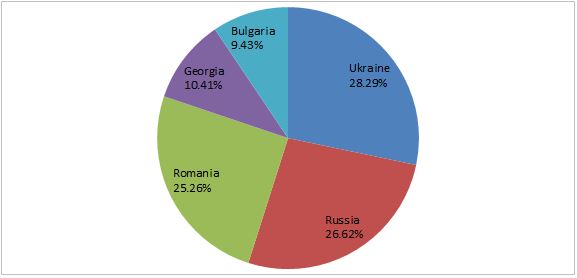

Thus the percentage of laden volume handled by each country in Q1 2016 distributed as follows: Ukraine – 28,29%, Russia (Black Sea) – 26,62%, Romania – 25,26%, Georgia – 10,41%, Bulgaria – 9,43%.

Black Sea countries shares by laden container turnover, Q1 2016

The top-five container terminals of the region in Q1 2016 have changed their positions in total volume handled: DPW (Constanta, Romania) still was on the first place, APMT Poti (Georgia) moved from the second place to the fourth, NLE (Novorossyisk, Russia) moved from the fourth to the second place, HPC Ukraine (Odessa, Ukraine) moved from the fifth to the third position and NUTEP (Novorossiysk, Russia) moved from the third to the fifth place. Among TOP-5 terminals of the Black Sea region NLE (Novorossiysk, Russia) and HPC Ukraine (Odessa, Ukraine) achieved volume increase of 7,26% and 4,82% respectively.

Black Sea Container Terminals shares by total turnover, Q1 2016

As for the leading carriers of the region, there was a new leader – MAERSK overcame MSC, while ARKAS overcame ZIM and became fourth largest carrier of the region. TOP-5 carriers of the region were: MAERSK, MSC, CMA CGM, ARKAS and ZIM. These carriers controlled 74,36% of this market.

MAERSK, MSC, CMA CGM, ARKAS and ZIM controlled 74,36% of the Black Sea market

Lines' shares at the Black Sea region by full containers turnover, Q1 2016

Since the middle of 2014 the service of former G6 was re-built (Hapag Lloyd, OOCL, MOL, NYK, HMM, APL). Thus, OOCL moved to ABX service (ZIM) and G6 alliance became G5. In Q1 2015 G5 members controlled 5,21% share of total laden container volume, but in Q1 2016 G5 members controlled 5,33% of the market, but this share increase can be explained by the merger of Hapag Lloyd and CSAV, while market shares of other G5 members, except Hapag Lloyd and NYK, have decreased in Q1 2016. At the same time in Q1 2015 OOCL had 1,73% of market share, but in Q1 2016 its share increased by 0,25 p.p. and stated 1,98%.

In Q1 2015 2M (Maersk and MSC) and Ocean Three (CMA CGM, CSCL, UASC) alliances started their activity in the Black Sea region. In Q1 2015 total market share of Maersk and MSC was 45,43%, but in Q1 2016 it has decreased by 0,49 p.p. to 44,94%. In Q1 2015 total laden container market share of Ocean Three alliance members was 16,53%, but in Q1 2016 it has grown by 0,29 p.p. to 16,82%.

Also it has to be mentioned that in 2015 there were some structural changes of the Black Sea container market. For example, WHL and KLINE have temporarily suspended their activity here, while CSAV merged with Hapag Lloyd that is why CSAV volume significantly decreased at this market. At the same time a new player had entered the Ukrainian container market – TURKON Line, which is a well-known player on the Mediterranean – North American trade. Entering this market on a slot agreement basis with Admiral Container Line, TURKON Line tried to find an opportunity to grow business and after Q1 2016 it had 0,24% share of total laden container volume of the region and now it has a positive trend for further growth.

Source: Informall