An economic slowdown coupled with energy reforms has adversely affected domestic fuel consumption growth across most of the GCC, and in some cases even led to negative growth. Saudi Arabia, the region's largest fuel consumer, saw a 10% decrease in demand for diesel in 2016, while gasoline demand flatlined. Kuwait, Qatar and Bahrain have also experienced a drop in gasoline consumption since major reforms were introduced in 2016. Lack of transportation alternatives has resulted in greater fuel switching, as consumption of premium grade gasoline in Oman declined and was offset by larger volumes of the lower grade fuel. Having implemented energy liberalisation plans in August 2015 – leading to lower domestic prices and falling global crude prices – the UAE is the only country where demand for both gasoline and diesel increased in 2016.

Ever since January 2015, oil prices have teetered around the $50 mark, placing huge fiscal pressures on net oil-exporting countries. Declining GDP growth rates and reduced government revenues led many countries in the region to initiate energy reforms and cut subsidies. While the new prices were still low by international standards, the reforms represented a fundamental shift in economic and social policies. The resulting effects of higher domestic energy prices and lower economic growth have in turn driven domestic demand for petroleum products down. This development means that net energy exporters have benefitted from higher export volumes than they would have otherwise, slightly offsetting the lower revenues. But oil prices have failed to recover, despite a collective agreement from OPEC in November 2016 to cut output. In the 16 years since the turn of the century, the MENA region added more than 4.8m b/d to global oil demand, second only to China's 7.9m b/d and ahead of Africa, Latin America and the rest of Asia (excluding China). But demand will likely slow down further as countries in the region continue to undergo energy reforms.

Slowing GCC demand sends mixed signals

Rapidly growing demand for petroleum products has long been typical for the GCC countries. High population growth, robust economic performance until recently, and low fuel prices led to rising demand for gasoline and diesel in the transportation sector, and in the case of Saudi Arabia and Kuwait, rising demand for liquids in the power sector. Governments therefore prioritised the expansion of the downstream sector, adding 1.2m b/d of refining capacity in the last five years, with diesel representing more than half the additions and 350k b/d of gasoline. In early 2016, the GCC introduced energy price reforms that led to a hike in domestic prices, including gasoline and diesel. Whilst prices remained relatively low by global standards, the region began to experience a slowdown in demand growth and in some cases negative growth.

Annual gasoline demand growth averaged 6.2% between 2010 and 2015 but shrunk to 0.4% in 2016. The change in diesel demand was even more significant, going from an average of 4% growth between 2010 and 2015 to a 6% decline in 2016. Beyond the impact of the reform, the slowdown in economic activity also contributed to lower demand growth, and as these economies recover, some of this demand growth will gradually return.

Policy reform and slowing economy dampen KSA consumption

Saudi Arabia – the region's largest economy – represents 70% of the GCC's total demand for diesel and gasoline. The kingdom saw gasoline demand grow from 447k b/d in 2011 to 568k b/d in 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 China MENA Asia (exc China) L. America Africa 600 700 800 900 1000 1100 0% 2% 4% 6% 8% 10% 2012 2013 2014 2015 2016 Bahrain Kuwait Oman Qatar KSA UAE Gasoline Diesel 2 Vol. 02 No. 11 | September 2017 2015, and at the same time diesel demand grew by 128k b/d to reach 779k b/d. But in 2016, demand for gasoline remained the same year-on-year and demand for diesel declined by more than 10% due to a slowdown in the economy as well as the Kingdom's energy price reforms. The impact on gasoline demand was less significant given Saudi Arabia's reliance on personal transport and the lack of public transportation options. Instead, households – particularly those who had previously consumed high-grade gasoline – switched to lower grade options.

The impact on diesel demand was greater for several reasons. First, and perhaps most obviously, due to the marginally higher subsidy cut in diesel compared with motor gasoline. Second, diesel demand declined in the power sector – displaced by greater consumption of fuel oil, which in 2016 grew by 16% compared with 5% the year before. But diesel in the power sector also declined due to the Saudi Electricity Company (SEC) relying more on gas thanks to the ramp up of the 26 billion cubic meter (bcm) Wasit gas facility. Third, diesel demand tends to develop in lockstep with economic activity. In 2016, the construction sector's real GDP contracted by 3.3% as less contracts were awarded. In 2017, the decline continued at a rate of 3.2% year-on-year. Cement production dropped by 9% in 2016 from its 2015 peak and fell a further 19% in the first seven months of 2017. By extension, demand for transportation diesel – particularly for trucks and other heavy goods vehicles – also declined. Until 2014, Saudi Arabia had historically been a net importer of diesel. But the surge in new diesel-oriented refineries meant that exports reached 350k b/d in 2016, with slowing domestic demand having played a contributing role. Likewise, the absence of significant demand growth in gasoline meant that, for the first time in many years, the Kingdom became a net exporter of gasoline in 2016, albeit a modest 5k b/d up from a net import level of 54k b/d in 2015. The year 2017 shows a similar trend. Although gasoline demand recovered on the year before, net exports continued to increase and averaged 39k b/d. Meanwhile, demand for diesel declined further, having fallen by 14% between January and June this year compared to the year before. As a result, exports of diesel increased by 75k b/d, despite similar levels of production.

Oman switching to lower grade fuel

Coming from a peak in 2013, domestic demand for both gasoline and diesel has been falling in Oman. With lower fiscal buffers, Oman's economy is one of the most vulnerable in the GCC region to the oil-price slump. Gasoline demand hit a peak of 82k b/d in 2013, but declined at an average rate of 14% per year for the next two years, whilst diesel demand declined at a rate of 8% per year for the same period.

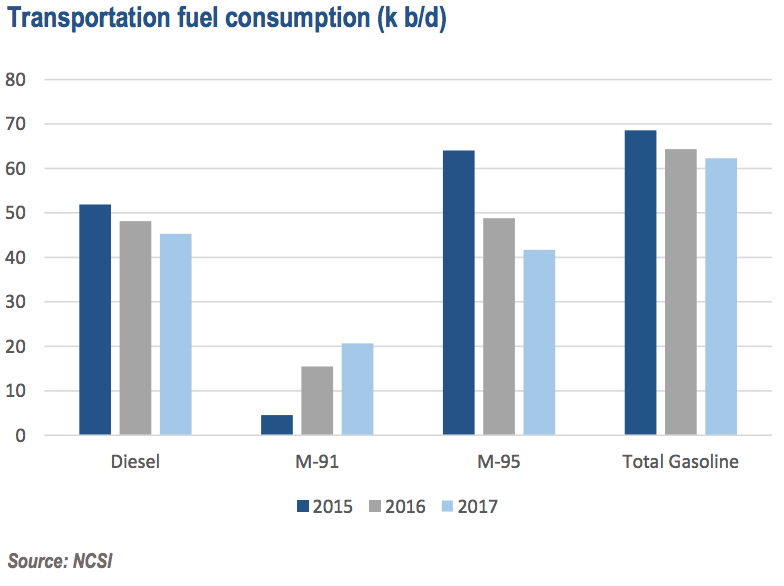

In 2016, Oman also reduced subsidies on domestic energy, increasing gasoline prices by 47% from $0.30 to $0.45 per litre ($/l) and diesel prices by 10% from $0.44 to $0.49/l. The resulting effect saw gasoline consumption decline by 6.2% in 2016 compared with 2015 and diesel consumption fall by 7.2%. Furthermore, there is clear evidence of fuel switching as consumption of premium gasoline (M-95) dropped from 64k b/d in 2015 to 49k b/d in 2016 and consumption of lower grade fuel (M-91) went up from 5k b/d to 16k b/d retrospectively. Data for 2017 (until end of July) indicates further demand contraction, with consumption of gasoline and diesel both down 3% and 6%. Fuel switching also continued into 2017 as lower grade gasoline increased from 7% of total gasoline consumption in 2015 to 33% of total consumption in 2017.

UAE demand least affected The UAE was the only country where demand for both gasoline and diesel increased in 2016 compared with the year before (20% and 40%, respectively). It was also one of the first countries in the region to liberalise gasoline and diesel prices back in August 2015. The government sets the domestic price on a monthly basis, but these are directly linked to international prices. The trend in gasoline demand since 2010 has been upwards, having increased each year with the exception of 2014 when it slipped from 70k b/d to 63k b/d. Meanwhile, demand for diesel had been shrinking marginally from 85k b/d in 2010 to 71k b/d in 2015. But, a significant increase to 99k b/d could be observed in 2016, when domestic retail prices dropped further in line with international prices. With the continued slump in oil prices, the initial impact on gasoline was negligible as prices were already close to international levels. For diesel, however, the situation is different: a prolonged trend of price cuts continued into 2016, with prices dropping to their lowest level in July. This contributed to an increase in demand for both products. Average demand for gasoline in 2015 jumped up from 69k b/d in the first half of the year to 108k b/d in the second half. Similarly, average demand for diesel increased from 69k b/d to 74k b/d over the same timeline. Although prices have fluctuated this year, they have remained on a relatively low level. Notably, there did not seem to be a correlation between monthly prices and demand, but an upside trend in demand could be noticed throughout the year.

Similar trends in the rest of GCC

Kuwait and Qatar are amongst the wealthiest states in the region, but still progressed with their energy reform plans. Qatar's demand growth for gasoline averaged 13% between 2010 and 2015, despite having inflated gasoline prices by 25% in 2011. But in January 2016, Qatar announced an additional 30% hike in gasoline prices, taking regular unleaded up to $0.31/l. In May of the same year, the government decided to liberalise prices. Gasoline demand in 2016 declined by 12%, while retail prices, in line with international prices, continued to increase in 2017 as compared to the previous year, reducing demand by 7% for the first half of 2017. Kuwait ramped up diesel prices by more than 300% in 2015, but made a U-turn following parliamentary opposition only a month later. The government pledged to adjust fuel prices in line with market shifts every three months, and in September 2016, subsidy cuts led to a price increase for premium fuel by 83% and for regular fuel by 42%. Subsequently, average demand for 2016 dropped to 68k b/d compared with 70k b/d in 2015, saving the government $229m. Since the beginning of 2017, demand continued to decline, averaging 62k b/d in the first five months. Bahrain opted to follow suit and raised transportation fuel prices for the first time in 33 years, leading to an increase of 56-60% on premium and regular gasoline. Whilst domestic demand is lower compared with GCC peers, demand for the fuel declined from 18.4k b/d in 2015 to 17.6k b/d in 2016 and is currently averaging 17k b/d this year. In contrast, demand for diesel has remained relatively unchanged since 2015, standing at a little over 16k b/d.

What's next for the GCC?

In its July update, the IMF predicted a considerable slowdown in growth, especially if oil prices remain low. MENA GDP growth is expected to average 2.7% this year and to recover modestly to 3.3% by 2020. Oil prices might remain lower over the long term, meaning that further policy reforms will be necessary to alleviate fiscal pressures. But there is a bright spot amidst the gloom. Energy consumption growth is clearly slowing down in most countries in response to energy subsidy cuts, which will help regional governments save millions whilst also freeing up more products for exports. What is more, lower international oil prices will enable governments to progress with energy reforms, aiming to slowly bring domestic retail prices in line with global levels. Rapid demand growth in the past meant that the level of investment required to keep pace became unsustainable. Lower domestic demand levels will ensure that the region can maintain its position as a leading energy exporter, whilst simultaneously working towards economic diversification to reduce dependence on export revenues. This has already been pledged in the visions of many countries in the region, most prominently Saudi Arabia's Vision 2030 proposing gradual liberalisation of the fuel market. In the absence of economic recovery and with further reforms in the pipeline, demand growth for transportation fuel products could decline further. First waves of subsidy cuts have already negatively impacted gasoline and diesel demand, particularly in Oman and Saudi Arabia. Industry consumption of diesel has declined, and crude burn in the power sector is being displaced by natural gas. Whilst gasoline demand has not dropped significantly, not least due to fuel switching from premium to regular grades, governments need to invest more in public transport to reduce reliance on transportation fuel. Still, with a global oversupply of products, the GCC countries are challenged to ensure that they remain competitive. But, as the regional economies enter the recovery phase, we are set to see some of this demand growth gradually return.

Source: APICORP Energy Research