Fitch Ratings-London-08 June 2020: The OPEC+ agreement to extend by one month record oil production cuts should accelerate market rebalancing, Fitch Ratings says. This is further supported by a commitment to improve compliance from those countries that were unable to reach full conformity with the cuts.

The OPEC+ countries have made radical production cuts in the stress scenario, but it may be more difficult to reach a consensus when the worst of the crisis is over. And it is unclear whether the recovery in oil prices to date is sustainable. Furthermore, demand and production in non-OPEC+ countries, notably the US, will continue to have a significant impact on the supply-demand balance and prices. We believe that a normalisation of oil inventory built up in 1H20 will take at least several months.

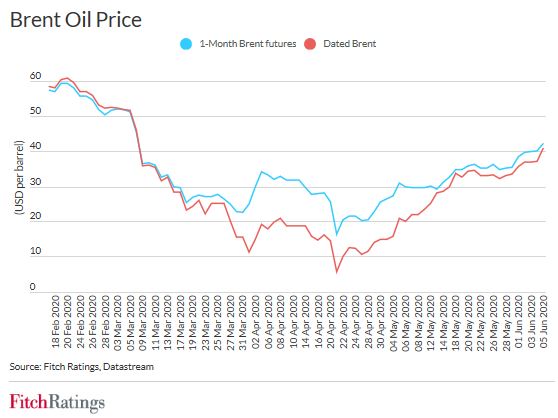

Crude oil prices rose significantly in May and continued to improve in early June, because the surplus has been reduced materially. A price differential between the physical and financial markets has disappeared, pointing to crude oil market tightening. We believe that a stress case scenario with prices falling significantly below USD30/bbl is now less likely. The market is likely to experience a production deficit in 2H20 due to gradually improving demand and reduced supply.

The OPEC+ cuts were the major contributor to market rebalancing. We estimate that the OPEC+ countries reduced production by around 7.5mmbpd in May compared to March. The cumulative OPEC+ cuts should exceed 9mmbpd in June as Saudi Arabia, Kuwait and UAE have committed to cut an additional 1.1mmbpd, while Iraq and Nigeria, which underperformed in May, have promised to improve compliance in June. A resumption of production in Libya, which is not subject to the OPEC+ deal, may increase supply but should be more than offset by additional cuts elsewhere.

Furthermore, production fell in the US as a result both of shut-ins and reduced drilling activity by almost 2mmbpd at end-May compared to March, while Canada cut around 1mmbpd. The number of active drilling rigs in the US declined by 64% compared to the beginning of the year. Production in North America may continue to shrink for a while, but the pace is likely to decelerate due to increased prices. We believe that at USD30/bbl, many producers should be able to stabilise production, while at USD40/bbl or above some would be tempted to increase output, which could limit price recovery.

Estimates suggest crude oil demand increased in May compared to April, and we believe it will improve further from June due to the gradual lifting of lockdown restrictions. Implied oil products consumption in the US improved from a 28% drop in April yoy to a 20% drop in May, driven mainly by increased gasoline consumption (a yoy decline of 25% in May compared to a 44% decline in April), while the consumption of jet fuel remained flat. We believe consumption patterns are similar in Europe, while demand in China bottomed out in February.

Demand recovery is now key in achieving balance in the oil market. It could be undermined in the event of a second coronavirus wave and the re-introduction of lockdowns, although it is not our base case. While consumption of gasoline and diesel could recover by the year-end, jet fuel may lag behind as international travel restrictions may remain in place and demand for business travel may be structurally impaired.

Our ratings are informed by companies’ projected performance at end-2021, rather than in 2020, provided their liquidity is adequate, as we rate “through the cycle”. While we may recalibrate our near-term oil price assumptions to the pace of market rebalancing, our ratings already assume that the market will recover gradually; therefore the most recent improvements will not prompt portfolio-wide rating actions.

Source: Fitch Ratings