On a Week 36, the MABUX World Bunker Index did not show any significant changes. The 380 HSFO index rose by 0.74 USD: from 456.68 USD / MT to 457.42 USD / MT, the VLSFO index increased by 1.09 USD: from 551.67 USD / MT to 552.76 USD / MT, while the MGO index added 2.59 USD (from 646.79 USD / MT up to 649.38 USD / MT).

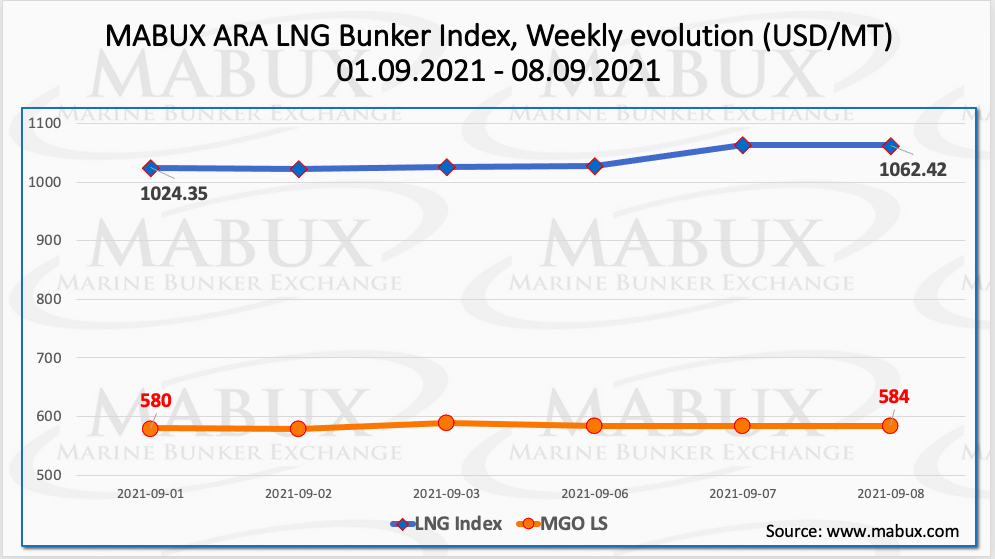

The energy sector prices in Europe have been rallying, while the most significant upward factor was a rebound in Asian spot LNG prices, which could translate into lower LNG deliveries to Europe. MABUX ARA LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the ARA region, continued to grow over the Week 36 from 1,024.35 USD / MT to 1,062.42 USD / MT (plus 38.07 USD). At the same time, the average LNG Bunker Index increased by 78.65 USD compared to the previous week. The average price of MGO LS in Rotterdam for the same period increased by 10.83 USD / MT, and the average price difference between bunker LNG and MGO LS in Rotterdam rose by 67.81 USD and again significantly exceeds the 400 USD mark: 454.24 USD (versus 386.43 USD last week). LNG bunker fuel prices continue to rise an the Port of Rotterdam and gas tankers are forced to switch to traditional bunker fuels to maintain profitability of operations. LNG bunker price indices are available in the LNG Bunkering section of www.mabux.com.

The average weekly Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – remained virtually unchanged over the week: $ 94.43 (versus $ 93.25 last week). At the same time, the average SS Spread in Rotterdam was consistently above $ 100 mark: $ 108.00, while SS Spread in Singapore has not exceeded $ 95 during the week, and its average value fell to $ 90.17. More information is available in the Differentials section of www.mabux.com.

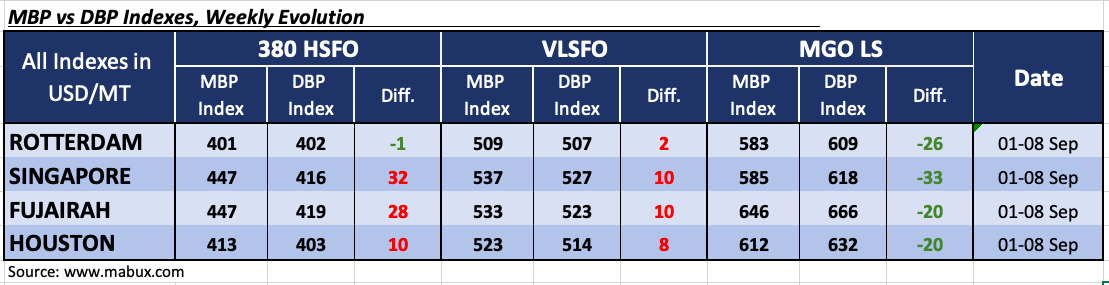

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel was overvalued in three of the four selected ports: in Singapore, the overpricing averaged plus $ 32 (versus plus $ 25 a week earlier), in Fujairah – plus $ 28 (vs. plus $ 22), in Houston – plus $ 10 (no change). The only port where 380 HSFO fuel grade remains undervalued is Rotterdam – minus $ 1 versus minus $ 3 last week.

VLSFO fuel, according to the MABUX MBP / DBP Index, was overpriced in all selected ports. The undercharge margins were registered as: in Rotterdam – plus $ 2 (versus minus $ 3 a week ago), in Houston – plus $ 8 (plus $ 9), in Singapore – plus $ 10 (plus $ 7), in Fujairah – plus $ 10 (versus plus $ 4). In general, the overvalue ratio of this type of fuel have changed insignificantly over the week.

As for MGO LS, on a Week 36 the MABUX MBP/DBP Index registered an undercharge of this fuel grade at all selected ports: minus $ 20 (minus $ 23 last week) in Houston, minus $ 26 (minus $ 24) in Rotterdam, minus $ 33 (unchanged) in Singapore and minus $ 20 (minus $ 10) in Fujairah. The most significant change was another increase of underestimation ratio in Fujairah by $ 10.

The International Bunker Industry Association’s (IBIA) Bunkering and Shipping in Transition online conference reported last week that bunker volumes in key markets in the Americas are still being impacted by the COVID-19 pandemic. Volumes in markets such as the US Gulf are still 10% or more down on pre-pandemic levels – and while there was something of an uptick recently, there are concerns that the spread of the Delta variant of COVID-19 could delay the recovery process. It was noted that the pandemic has not had a uniform impact across the shipping industry. While some segments – with the cruise industry being perhaps the most obvious example – are still struggling, the container ship sector is looking healthy, buoyed up by an increase in consumer spending in online goods.

Source: www.mabux.com