Non-OPEC supply set to grow

2022 is set to see strong non-OPEC supply growth which is expected to help push the global oil market back into surplus. We estimate that non-OPEC supply will grow by 2.65MMbbls/d next year, compared to an estimated 900Mbbls/d in 2021.

The bulk of this increase will be driven by the US, where we expect supply to grow by 800Mbbls/d. This would mean that US supply will average 11.9MMbbls/d next year, while finishing 2022 with production in the region of 12.3MMbbls/d, a little more than 700Mbbls/d below the record levels seen in November 2019. There are clear risks to output growth, the biggest being that it disappoints to the downside, which would leave the global market tighter.

While the US oil rig count has increased by 295 since bottoming out in August last year, at 467 it still stands at 216 below levels seen in March 2020. The pickup in drilling activity has been more measured compared to previous up cycles. We are seeing a change in behaviour from US producers where there is more focus on capital discipline and shareholder returns, while uncertainty over future policy could also be holding producers back. A lot of the recovery in US production since Covid appears to have been driven by the completion of drilled but uncompleted wells (DUCs). The DUC inventory in the US has fallen by almost 3,800 since June 2020 to a little over 5,100, which is the lowest DUC inventory since December 2014. This suggests that the US industry will be unable to rely as much on DUCs to sustain production levels. Instead, we will need to see a pick-up in new drilling.

Elsewhere, non-OPEC supply is also expected to grow, including in Canada, Brazil and Norway. The non-OPEC members of the OPEC+ deal will also see supply grow as they continue to ease supply cuts through 2022.

Slow & steady from OPEC+

OPEC+ has been consistent and cautious with its production policy since the start of the pandemic and it appears that this approach will continue into 2022. The group is increasing supply by 400Mbbls/d per month, which means that cuts should be completely unwound by the time we get to September/October next year. However, it is more complicated than that particularly with concerns over the Omicron variant. There may be hiccups along the way, which will require the group to delay their easing plans. In addition, the market is set to return to surplus over various stages in 2022 and if that puts enough downward pressure on prices, OPEC+ may decide they need to act.

By the end of 2021, the group would have brought back 5.9MMbbls/d of the original 9.7MMbbls/d of supply cuts, which leaves them with 3.8MMbbls/d to bring back over 2022.

The one key upside risk for the market is the issue of spare OPEC capacity. At the moment there are a number of the smaller producers whose output is below their agreed levels, suggesting they do not have the capacity to increase output further. Therefore, while the headline number suggests that OPEC+ still has 3.8MMbbls/d to return to the market from January, in practice the amount they can bring back will likely be lower.

Oil demand back to pre-pandemic levels

The outlook for the oil market will really depend on how demand plays out. There is clearly still plenty of uncertainty in the market and this is evident through the sell-off we have seen towards the end of this year due to the Omicron variant. Clearly, if we see countries tightening Covid related restrictions this will have an impact on demand. The most immediate at risk would-be jet fuel demand as countries enforce more onerous border restrictions. This will be a worry for the market, given that a large part of oil demand growth in 2022 is expected to be driven by a further recovery in international air travel.

Oil demand is currently estimated to grow by a little more than 3.3MMbbls/d in 2022 (compared to growth of 5.5MMbbls/d this year), which would leave oil demand averaging 99.7MMbbls/d next year. This would take demand back to basically pre-pandemic levels. However, there is plenty of uncertainty given the lingering of Covid and its multiple variants.

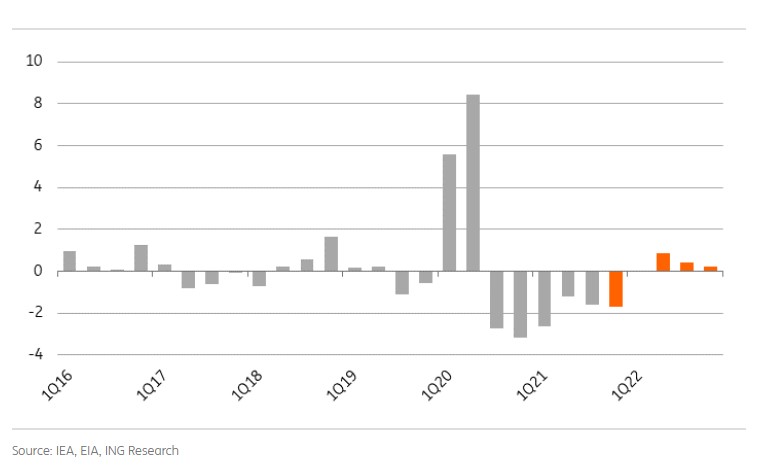

Quarterly global oil balance (MMbbls/d)

Back to surplus

Given the continued unwinding of OPEC+ supply cuts, along with strong non-OPEC supply growth, the global oil market could return to surplus as soon as the first quarter of next year. This should keep the market from trading back towards the recent highs we have seen in 2021. The bulk of the surplus is estimated in 2Q22, which suggests that this is where we could see some downward pressure on prices. As a result, if we are to see OPEC+ pause its supply increases it will likely occur around this period.

We expect that ICE Brent will average US$76/bbl over 2022, down from the high levels we have seen over much of the 2H21, but still well above the average levels seen since 2015. Longer-term concerns over the lack of investment in upstream oil and falling OPEC spare capacity next year (as the group eases cuts) will likely put a floor under the market.

There are several risks to this view. Clearly, the largest downside risk is further Covid related restrictions going into 2022 which could hit oil demand. Already, we have seen a sizeable move lower in the market with the uncertainty over the Omicron variant.

The upside risks include falling OPEC capacity, US oil growth falling short of expectations and Iranian supply remaining flat over 2022. We currently expect that Iranian flows will trend higher through the year. However, for that to happen, we need to see a breakthrough in Iranian nuclear talks.

Source: ING

Source: ING