Following the robust growth seen this year, oil market developments are expected to slightly moderate in 2019, with the world economy and global oil demand forecasts to grow slightly less, while non-OPEC supply growth is projected to remain broadly steady. According to the initial forecast, the world economy is expected to expand by 3.6% in 2019, slightly below the 2018 growth forecast of 3.8% (Graph 1).

Graph 1: GDP Growth Forecast For 2019

This reflects some slowdown in the OECD economies, mainly due to the expected monetary tightening, in particular in the US, to some extent in the Euro-zone, and less so in Japan. In the major emerging economies, performance will range from slight growth in India, supported by government spending to a slight deceleration in China as a consequence of the country's continued financial tightening. Russia will remain broadly steady while Brazil will pick up slightly. The re-emergence of global trade barriers has thus far only had a minor impact on the global economy. The 2019 forecast considers no significant rise in trade tariffs and that current disputes will be resolved soon. The increase in global trade has been a significant factor lifting world economic growth to higher levels in both 2017 and 2018. Hence, if trade tensions rise further, and given other uncertainties, it could weigh on business and consumer sentiment. This may then start to negatively impact investment, capital flows and consumer spending, with a subsequent negative effect on the global oil market.

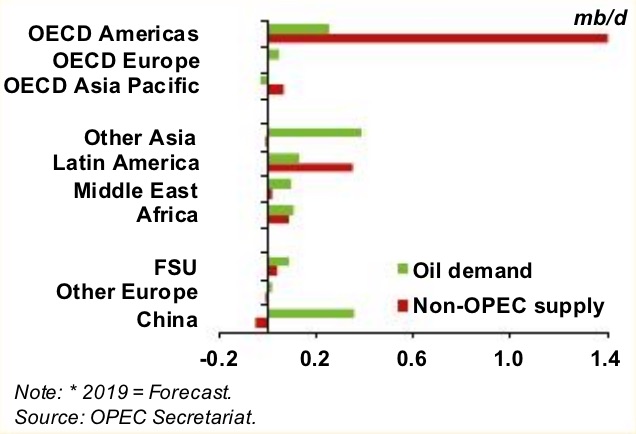

World oil demand in 2019 is forecast to grow by 1.45 mb/d y-o-y, compared to 1.65 mb/d in 2018. The OECD region is anticipated to grow by 0.27 mb/d, with demand in OECD Americas driven by solid NGL and middle distillate requirements. Europe is projected to continue see an expansion, albeit at a slower pace, as economic growth projections ease slightly, while Asia-Pacific oil demand is anticipated to weaken in light of planned substitution programmes. In the non-OECD region, growth is anticipated at around 1.18 mb/d. Slightly lower Chinese oil demand growth, compared with 2018, is expected to be offset by higher oil requirements, mainly in Latin America and the Middle East. As for products, the focus will be on light and middle distillates to meet demand from the growing petrochemical sector, industrial activities, as well as expanding global vehicle sales. However, risks remain, related to economic developments in major consuming nations; substitution with natural gas and other fuels; subsidy programmes and their removal strategies; the commissioning and possible delays, or cancellation, of petrochemical projects; and programmes for fuel efficiencies, especially in the transportation sector.

Graph 2: Growth Forecast In Oil Demand And Non-OPEC Supply In 2019

Non-OPEC oil supply for 2019 is forecast to grow by 2.1 mb/d y-o-y, broadly unchanged from 2018. This is mainly due to the expected increase in North America and new project ramp ups in Brazil. Leading the non-OPEC supply declines are Mexico, Norway and China, mainly due to the absence of new projects and heavy declines in mature fields. The pace of US shale growth will slow down considerably in 2H18 and continue into 2019 as the Permian faces take-away capacity constraints. Some of the planned pipeline capacity increases have been delayed, and as a result, the takeaway capacity issue could remain a major constraint until next winter. Moreover, the rig count, along with well completions, could start to slow and well productivity could decline as operators expand production beyond ‘sweet spots'. Elsewhere, production ramp-ups through new projects are anticipated to support supply in Brazil next year, while Canada continues to expand its oil output, particularly from oil sands. The forecast suggests that demand for OPEC-15 crude is expected to average 32.2 mb/d in 2019, down by around 0.8 mb/d from 2018. Therefore, if the world economy performs better than expected, leading to higher growth in crude oil demand, OPEC will continue to have sufficient supply to support oil market stability

Source: OPEC