Too many new ships continue to plague the chemical shipping market, with a recent report citing the growth of vessel tonnage for depressing freight rates on major US trade lanes.

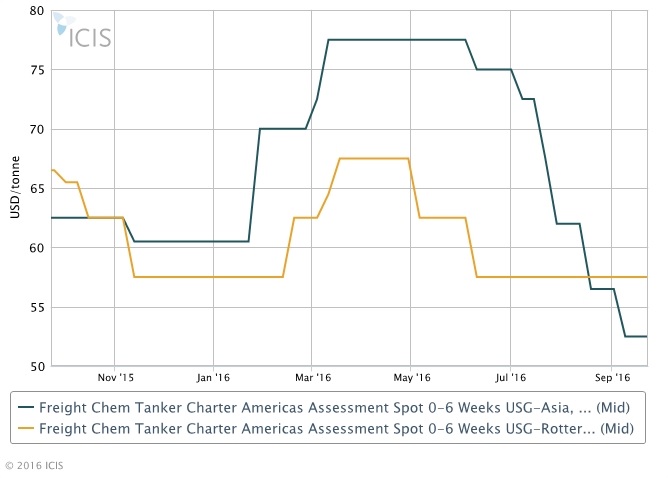

Freight rates on two major routes this year are flat to down, according to ICIS. Eastbound transatlantic rates for 5,000 tonnes remain flat compared to early January figures, while rates for the US Gulf-Asia route are down 13% for the year.

The latest report from SPI Marine says many players are reasonably optimistic that the usual late-year rally will materialise in the fourth quarter.

“However,” the report adds, “looking at the latest chemical fleet figures, it will be interesting to see how the markets will absorb the orderbook that is still scheduled for delivery this year.”

The SPI report states that the chemical tanker fleet of 4,244 vessels had increased 3% by the end of August in terms of total tonnage, and will increase another 3% by the end of this year.

The report says that many players feel the market is soft and suffering from a general lack of enquiries, but it adds: “What we have seen is a huge rise in tonnage supply which has been a major factor for downward pressure on freight rates.”

Shipping consultant Charles Barton at KTR Maritime agreed that over-ordering of ships – “often by investment trusts that do not know the market” – is to blame for the poor market.

US chemical shipping brokers confirm that there are too many new ships.

“In the end, it is a simple supply/demand issue,” a Texas broker said.

That broker counted 67 ships delivered so far this year in the 10,000-36,000 dwt (deadweight tonnes) category, and another 45 scheduled to be delivered. The broker said 79 vessels are scheduled for 2017 and 40-plus for 2018.

“It does not look that rosy,” the broker said, adding that trading has turned down this year, with sporadic loadings for larger cargoes of methanol, ethanol and aromatics.

“It all adds up to a soft market,” the broker said.

Another US broker agreed that too many ships are chasing too few cargoes.

“Nonetheless, I think rates will see some improvement in the fourth quarter,” that broker said. “Rally is probably a strong word. I look for moderate improvement over the next few months.”

Barton said this has happened before.

“We are three-quarters of the way through the year and it has been a bad one for the industry so far,” he said. “At the end of last year, we waited for the New Year to be over before an improvement. Then it was Chinese New Year, Easter … So what now?”

Barton said the shipping industry historically gets in a too-many ships bind and finds itself waiting for next year.

“We are always waiting for something that seems to be just around the corner,” Barton said.

Source: ICIS