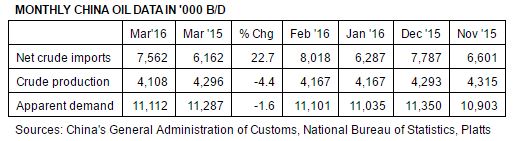

China’s apparent oil demand* contracted by 1.6% in March 2016 from a year earlier to 11.11 million barrels per day (b/d), according to a just-released analysis of Chinese government data by S&P Global Platts, the leading independent provider of information and benchmark prices for the commodities and energy markets.

Refinery throughput in March averaged 10.62 million b/d, data from China’s National Bureau of Statistics (NBS) showed April 14. This was a 0.6% decrease year over year, as well as a 0.2% contraction from the prior month.

However, net imports of key oil products fell 20% from a year earlier to an average 493,000 b/d in March, driven by significant exports of transport fuels, according to data from the country’s General Administration of Customs.

In the first quarter (1Q) of 2016, apparent oil demand in China averaged 11.08 million b/d, registering zero growth from the first three months of 2015. This compared with a 7.5% expansion in apparent oil demand during the same period last year.

China’s oil demand growth is expected to moderate significantly in 2016 as gross domestic product (GDP) growth slows on the back of economic rebalancing. The Chinese economy expanded by 6.7% in the first quarter of this year, down from 6.8% in the fourth quarter of 2015, according to the government.

China’s apparent oil demand this year is forecasted to grow by less than 2%, according to Song Yen Ling, senior analyst with Platts China Oil Analytics, an on-line platform for supply/demand and trade data, of S&P Global Platts.

Gasoil

“Gasoil apparent demand fell by 7% in the first quarter to 3.35 million b/d and is a further reflection of lower consumption by industry in China,” said Song.

Gasoil is the most widely consumed oil product in China and is used in the transport sector and by industry. Demand for gasoil has been hit in the last three years because of declining economic growth. With demand stagnant, refiners have experienced growing inventories during the last few months. The culmination was record high exports in March at 1.2 million metric tons (mt) or 300,000 b/d. In March alone, apparent demand for the fuel slumped 11.7% year over year, marking the seventh straight month of contraction.

Gasoline

Apparent demand for gasoline averaged 2.82 million b/d in March, which was an 8.2% increase from the same period a year ago. Growth was attributed to higher car sales, with 1Q sales of sports utility vehicles rising 51.5%. However, gasoline sales by state-owned refiners continued sluggish on competition from independent refiners and fuel blenders for end users. As a result, gasoline exports from China in March, handled predominantly by state-owned refiners, rose 9.1% year over year and 4.5% month over month to 184,000 b/d.

Fuel Oil

China’s fuel oil apparent demand in March declined some 18.7% from a year earlier to 753,000 b/d. China’s fuel oil consumption has fallen since late 2015, when the government started allowing more independent refiners to import crude oil. Prior to this, these refiners which had limited access to crude oil had to rely on fuel oil as an alternative processing feedstock. Since the second half of 2015 however, Beijing has approved more than 1 million b/d of crude oil import quotas for independent refiners.

China’s crude oil imports over the first three months of this year have increased 12.1% to an average 7.71 million b/d. Platts China Oil Analytics estimates that around three-quarters of this increase has been driven by new demand from independent refiners. As a result, total fuel oil imports by China over the period fell 30% to about 300,000 b/d.

Month-to-month demand in China is generally viewed to be subjected to short-term anomalies which are of interest and important to note, but often fail to reveal the country’s underlying demand trends. Year-to-year comparisons are viewed by the marketplace to be more indicative of the country’s energy profile.

*S&P Global Platts calculates China’s apparent or implied oil demand on the basis of crude throughput volumes at the domestic refineries and net oil product imports, as reported by the NBS and Chinese customs. Platts also takes into account undeclared revisions in NBS historical data.

The government releases data on imports, exports, domestic crude production and refinery throughput data, but does not give official data on the country’s actual oil consumption figure and oil stockpiles. Official statistics on oil storage are released intermittently.

In view of some significant shifts in Chinese consumption and trade patterns in recent years, Platts has revised its methodology starting July 2015 to include production and net imports of LPG, as well as imports of petroleum bitumen blend, a popular imported feedstock for China’s teapot refineries.

S&P Global Platts has also refined its calculation of exports of jet fuel and fuel oil to exclude international marine bunker sales and aviation fuel delivered to international flights. This also impacts net imports, and hence apparent demand calculations.

All historical figures used for comparison have also been calculated using the new methodology to ensure consistency.

Platts aims to release its monthly calculation of China’s apparent demand between the 18th and 26th of every month via press release and via its website, although the timing of release may vary. Any use of this information must be appropriately attributed to S&P Global Platts. Platts uses a conversion rate of 7.33 barrels of crude per metric ton, the widely-accepted benchmark for markets East of Suez.

Source: S&P Global Platts