Global oil market fundamentals continued their strong recovery to pre-COVID-19 levels for most of the first half of 2022, albeit signs of slowing growth in the world economy and oil demand have emerged. Global oil supply has risen steadily this year, including from countries participating in the Declaration of Cooperation (DoC), amid their continuing efforts to stabilize the oil market. However, ongoing low overall investment in the upstream and capital discipline are limiting non-OPEC oil supply growth potential.

The oil market has been dominated by elevated price volatility since March 2022, fuelled by the intensifying geopolitical concerns in Eastern Europe. Sanctions on Russian oil by some major oil-consuming countries have sharply raised the risk premium in oil prices, particularly for Brent. Moreover, this has resulted in major changes in inter-regional trade flows, exacerbating concerns about physical oil supply at the onset of the summer holiday season. Consequently, pressure increased on oil markets in some regions, specifically Europe, resulting in crude differentials soaring to record-high levels in 2Q22, along with steepening backwardation structures. Tight oil product markets, specifically for diesel and gasoline, have also pushed up crude oil prices.

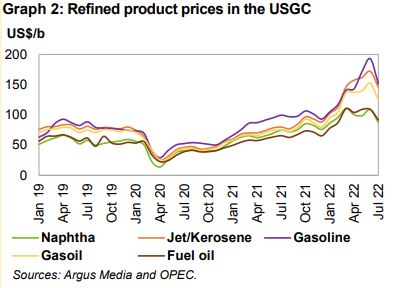

While physical oil market fundamentals remain strong, volatility in futures markets remained fuelled by expectations of lower GDP growth, amid rising global inflation, which prompted key central banks to begin raising interest rates. The US dollar’s value strengthened further against a basket of major currencies, which also added concern. Moreover, price volatility contributed to reduced market liquidity, as seen in declining open interest. Combined futures and options open interest in ICE Brent and NYMEX WTI dropped in July 2022 to the lowest since June 2015. On the product side, fuel prices surged in the first half of the year due to lower supplies amid COVID-19- related refinery closures and a heavy refinery turnaround season. In addition, stronger fuel consumption at the onset of the summer season, as COVID-19-related mobility restrictions were lifted in most regions, and product flow adjustments linked to the geopolitical developments in Eastern Europe further aggravated product tightness, which ultimately pushed product prices to record highs in June. At the same time, jet fuel, the second strongest performer in the US product market, saw its price benefit from improving international air travel activity, leading to notable jet fuel margin gains.

Fuel prices peaked in June with US gasoline prices reaching $193.06/b, up by $97.79/b, or 103%, y-o-y. However, rising refinery run rates in July alleviated some of the tightness, mostly in the USGC, where product prices across the barrel declined by $26.83/b on average. In Europe, average prices declined the least by $20.24/b, m-o-m. Looking ahead, refined product markets in 2H22 are likely to continue to see seasonal support from transport fuels in the coming months, while fuel sales could benefit from moderating product prices – if the recent trend continues. At the same time, available refinery capacity will be supported by the ongoing operational ramp-up of at least two large capacity additions last year, mainly in the Middle East. The countries participating in the DoC will continue to closely monitor ongoing market developments and encourage investment in the upstream sector to ensure adequate levels of capacity along the value chain, in their efforts to maintain a stable oil market balance in the interest of producers and consumers alike.

Source: OPEC