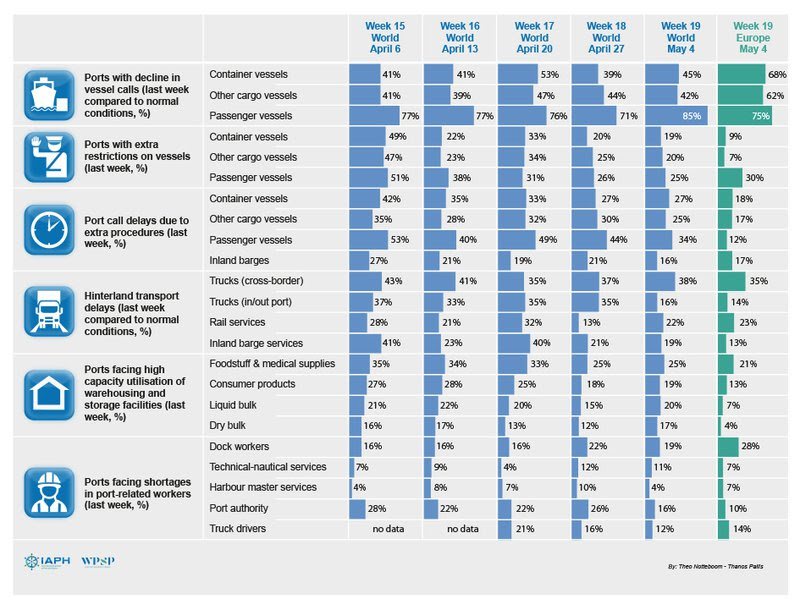

In the fifth report prepared and released by the WPSP-IAPH World Ports COVID19 Task Force, a focus on European ports reveals that many of them are already feeling a greater impact of reduced cargo vessel calls than other regions of the world. The European region also has a smaller share of ports now facing capacity shortages of warehousing and storage facilities with a progressive overall decline in utilization being reported over the time period. Also, it appears that the European Region is slightly more impacted by shortages of dockworkers, with 28% reporting this occurrence during the recent week.

Full impact of reduced cargo vessel calls yet to be felt

Despite the impact of vessel calls increasing across the board, almost all of the 76 ports taking part in this week's survey are reporting a 5 to 25% decrease. The share of ports facing significant decreases (in excess of a 25% drop) falls sharply from 10-11% in the previous two weeks to less than 2% this week. The situation for the other cargo vessels has remained fairly unchanged compared to last week. The number of ports reporting reductions of more than 25% remained at a level of 12 to 14% throughout weeks 16 to 19.

Co-author Professor Thanos Pallis commented : “The general loss of cargo for containers is probably less evident than expected, as April has closed with negative year-on-year figures that are much better than initially forecasted. The decrease in the number of container vessels is not always directly related to the COVID 19 crisis. Some report on the increase in blank sailings, mainly on the Europe-Far East routes, for others there are no more blank sailings registered but total calls are still down some 20% with respect to a normal fully operational week. Regional feeders in substitution of calls by mega vessels are working well, but shippers do not always welcome the longer transit times associated with transshipment.”

Barometer report co-authors Professor Theo Notteboom and Professor Thanos Pallis

Cross border controls persist for trucks in the hinterland

About 12% of the ports surveyed report delays (6-24 hours) or heavy delays (> 24 hours) in cross-border road transportation with 6% of the ports indicating that cross-border trucking has been discontinued. Although this is a minor improvement compared to last week, the situation remains precarious for a number of ports.

In some cases, ports have sought to alleviate congestion at the quayside caused by increased controls on trucks and truckers at borders by evacuating import containers en masse by rail, either to hinterland depots or to staging locations closer to the border away from the port. As an example, to facilitate improved quayside operations on the East African coast, inland rail services transporting up to several thousand TEU improves cross-border transit with landlocked countries.

Port of Mombasa (courtesy of Kenya Ports Authority)

Kenya Ports Authority Head of Corporate Affairs and member of the WPSP COVID19 Task Force Bernard O. Osero commented: “every day, we dispatch 10 trains from Mombasa carrying hinterland-destined cargo to Nairobi depot, 500 kilometers away. This is about 1000 TEUs a day. In addition, from this week, we have opened a special service directly from Mombasa to Naivasha depot 650 kilometers away from Mombasa and 400 kilometers from the border, specifically for transit traffic. This is an average of 100 TEUs and it is expected to increase.”

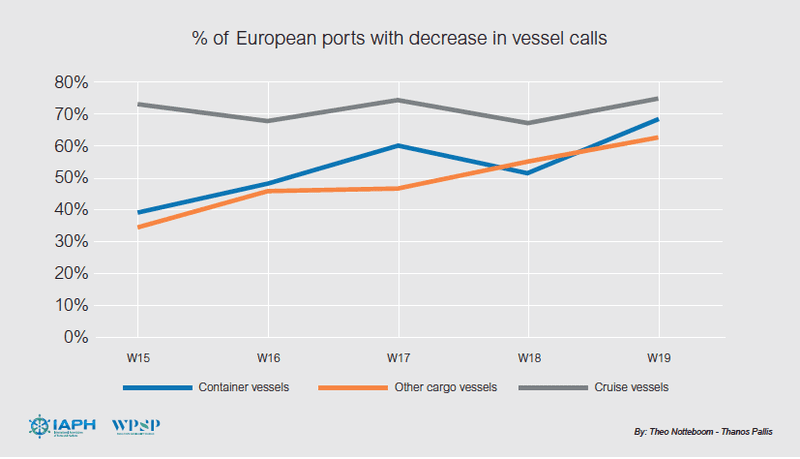

From this week onward, a new section has been added to the weekly barometer, which analyzes the results for the ports of a chosen region in more detail. This week's regional focus is on Europe. As mentioned earlier, European ports take the largest share of the weekly global port sample, accounting for between 38% and 54% of all received answers. As an example, the share of ports facing declines in weekly calls of cargo vessels is much higher in Europe than ports globally. As shown in the graph above, the situation in European ports for container vessels and other cargo vessels has gradually deteriorated compared to the first week of the survey.

Co-author Professor Theo Notteboom commented: “In the coming weeks, several of the larger ports anticipate significant downturns in volumes due to blank sailings in the container segment. We expect these larger hubs to be impacted the most. Nonetheless, how much impact this will have on the global supply chain and how quickly economies will restart, especially in Europe, will require close monitoring.”

Note : Professor Theo Notteboom will be joining Port of Los Angeles Executive Director Gene Seroka and UNCTAD's Chief Trade Logistics Branch Jan Hoffmann in the first of three IAPH Coronavirus Webinars next Wednesday. Entitled “Business as unusual – adapting port business models to survive and thrive in the post-COVID-19 era” the free-to-register seminar will include citations of the weekly Port Economic Impact Barometer.

Source: IAPH