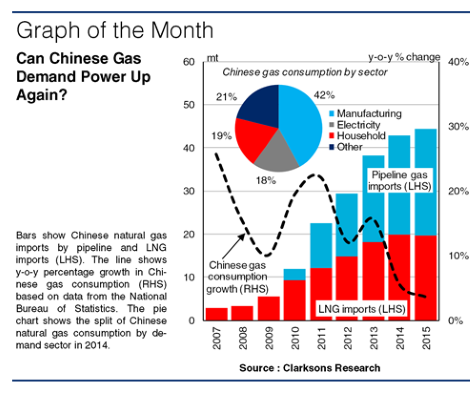

Following average growth of 15.8% p.a. in 2009-13, expansion in China’s gas consumption slowed notably to 5.6% in 2014 and 3.6% in 2015. This slowdown contributed to an overall decline in China’s LNG imports in 2015. However, despite the trends seen in 2015, and continued questions over the long-term outlook, the government still has plans to raise domestic gas consumption significantly.

Step Off The Gas

Chinese gas consumption grew rapidly in 2003-13, supporting a firm increase in Chinese gas imports (see graph). Coal remains by far China’s dominant energy source, accounting for around 64% of energy use last year, and whilst the share of natural gas has increased from 4.0% in 2010 to 5.7% in 2014, this remains a relatively small proportion of the total. In 2014-15, expansion in Chinese gas demand eased notably, reflecting the slowing pace of growth in the economy and in power generation, increased use of alternative energy sources, and the impact of high domestic gas prices. While natural gas imports by pipeline increased by 7% to 24.6mt in 2015, LNG imports declined by 1% to 19.6mt, with some major gas companies re-selling their long-term contracted cargoes in the international LNG market.

Projects In The Pipeline

However, there remains significant potential for rapid growth in the Chinese gas market. China aims to raise the share of gas in total energy use to 10% by the end of 2020, which would require average annual growth of around 14% p.a. over the next five years. If the targets for both gas consumption and domestic gas production are met, this would imply required total gas imports of more than 75mt by 2020, up from 44mt imported in 2015.

While the government targets seem ambitious, projects to facilitate a ramp-up in imports appear to be in place. At the start of 2016, China had almost 50mtpa of gas pipeline capacity, and the construction of the Central Asia-China ‘D-Line’ and the Russia-China ‘Power of Siberia’ pipeline could double pipeline capacity by 2020. Meanwhile, China’s LNG regasification capacity remains underutilised. Moreover, China has also signed several LNG import contracts in recent years, including with Russia’s Yamal project, and one estimate has China’s LNG imports more than doubling by 2020.

However, there are a number of downside risks to potential import growth. LNG project development remains at risk of delays or cancellations in the current low energy price environment, whilst the slowing of Chinese economic growth has limited expansion in power consumption.

A Question Of Power

Nevertheless, China seems committed to reducing coal use, and this could bolster demand for cleaner energy sources such as natural gas in coming years. As part of this, China significantly reduced domestic gas prices in late 2015, which may make natural gas more competitive against other energy sources. For now, there are a number of hurdles for China’s gas sector to overcome in the short-term. Whilst an increasing share of gas imports could be transported via pipeline in coming years, if China’s targets come to fruition, in the longer-term China’s LNG demand could still power on.

Source: Clarksons