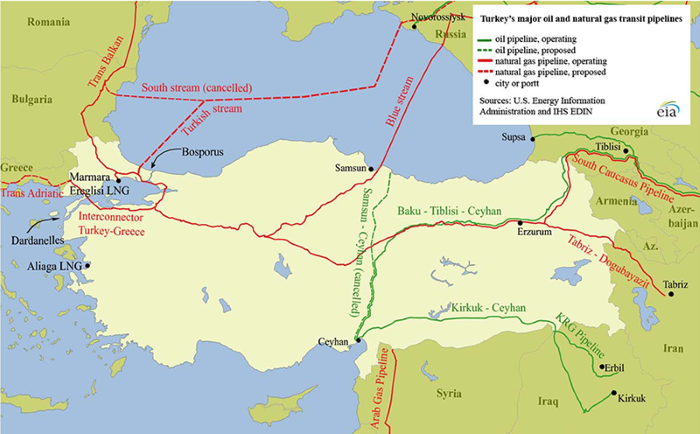

Turkey is an increasingly important transit hub for oil and natural gas supplies as they move from Central Asia, Russia, and the Middle East to Europe and other Atlantic markets. Turkey is well placed to serve as a hub for oil and natural gas supply headed to Europe and other Atlantic

markets from Russia, the Caspian region, and the Middle East (Figure 1). Turkey has been a major transit point for oil and is becoming more important as a transit point for natural gas. Growing volumes of Caspian oil are being sent to Black Sea ports such as Novorossisyk, Russia and Supsa, Georgia and then to Western markets by tanker via the Turkish Straits (Bosporus and Dardanelles waterways). Caspian oil and oil from northern Iraq also cross Turkey by pipeline, through the Ceyhan oil terminal on Turkey's Mediterranean coast.

Turkey is primed to become a significant natural gas pipeline hub. However, currently most of its natural gas pipeline connections only bring natural gas into the country, as growing demands have left little natural gas for export. Since 2010, Turkey has experienced some of the fastest growth in total energy demand among countries in the Organization for Economic Cooperation and Development (OECD). Unlike several other OECD countries in Europe, Turkey's economy has avoided the prolonged stagnation that has characterized much of the continent for the past several years.

Petroleum & other liquids

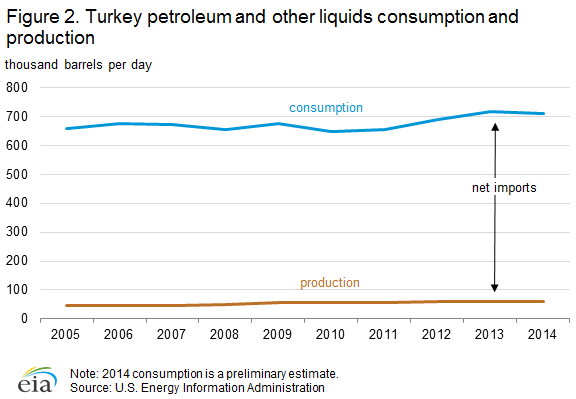

Over the past decade, Turkey's economy has expanded, and its petroleum and other liquids consumption has increased. With limited domestic reserves, Turkey imports nearly all of its oil supplies.

As of January 1, 2015, the Oil & Gas Journal (OGJ) estimated Turkey's proved oil reserves at 296 million barrels,1 located mostly in the southeast region of the country. Turkey's petroleum and other liquids production peaked in 1991 at 85,000 barrels per day (b/d), but then production declined each year and bottomed out in 2004 at 43,000 b/d. Although Turkey's production of liquid fuels has increased since 2004, it is much less than what the country consumes each year (Figure 2).

Sector organization

Türkiye Petrolleri Anonim Ortaklığı (TPAO) is the dominant exploration and production entity in Turkey. As a state-owned firm, TPAO has preferential rights in petroleum exploration and production, and any foreign involvement in upstream activities is limited to joint ventures with TPAO. In 2013, TPAO produced 34,000 b/d of crude oil accounting for 73% of the total crude oil production in Turkey.2

Exploration and production

Most of Turkey's 296 million barrels of proved oil reserves are located in the Batman and Adiyaman Provinces in the southeast (where most of Turkey's oil production occurs), with additional deposits found in Thrace in the northwest. In 2014, Turkey produced an estimated 61,000 b/d of petroleum and other liquids, accounting for about 9% of Turkey's oil consumption.

Offshore and shale reserves may become a future source of Turkey's oil supply. There may be significant reserves under the Aegean Sea, although this has not been confirmed because of ongoing territorial disputes with Greece. The Black Sea may also hold significant oil production potential for Turkey. After collecting and evaluating seismic data, Shell and TPAO began exploratory drilling in the Black Sea in January 2015. Shell and TPAO are also cooperating on a joint venture which has drilled two wells in the Dadas shale in the southeast of Turkey in Diyabakir Province.3

Consumption and imports

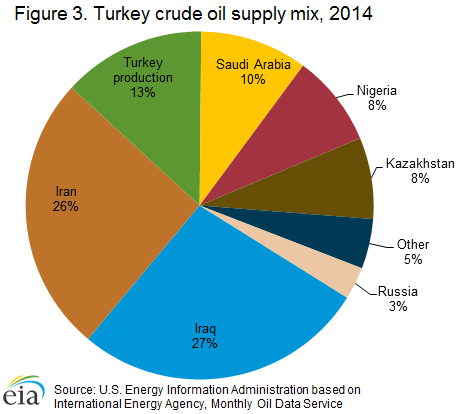

In 2014, Turkey's total liquid fuels consumption averaged 712,000 b/d.4 More than 90% of total liquid fuels came from imports. According to the International Energy Agency (IEA), Turkey's crude oil imports are expected to double over the next decade. In 2014, most of Turkey's crude oil imports came from Iraq and Iran (Figure 3),5 with each supplying slightly more than a quarter of the country's crude oil. The share of crude oil from Russia, once the largest source country of Turkey's crude oil, has fallen as Russian crude oil is increasingly being directed toward Asian markets.

International oil transit

Turkey plays an increasingly important role in the transit of oil. It is strategically located at the crossroads between the oil-rich former Soviet Union and Middle East countries, and the European demand centers. It is home to one of the world's busiest chokepoints, the Turkish Straits, through which almost 3 million b/d flowed in 2013.

Turkish Straits

The Turkish Straits, which includes the Bosporus waterway and the Dardanelles waterway, is one of the busiest maritime chokepoints in the world. Significant volumes of Russian and Caspian oil move by tanker via the Turkish Straits to Western markets. An estimated 2.9 million b/d of petroleum liquids flowed through the Turkish Straits in 2013. About 70% of this volume was crude oil, and the remainder was petroleum products.6

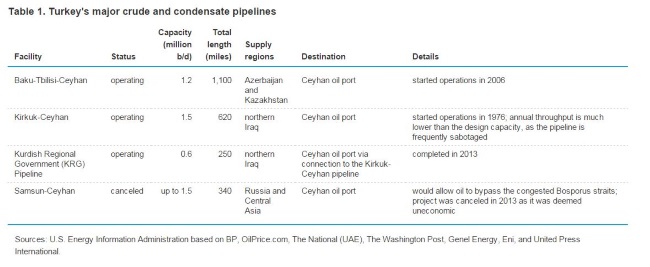

Pipelines

Turkey currently has two crude oil import pipelines (Table 1),7 the Baku-Tbilisi-Ceyhan (BTC) pipeline from Azerbaijan and a pipeline from northern Iraq to Ceyhan, Turkey. The Iraq pipeline has two branches. The original line of the Iraq pipeline stretches from the Iraq-Turkey border to Kirkuk, Iraq. However, little oil has flowed on this part of the pipeline since the Islamic State of Iraq and Syria (ISIS) began seizing territory in the area in early 2014 and the pipeline was sabotaged. The BTC pipeline has also been targeted in the past. In August 2008, an explosion in eastern Turkey shutdown the BTC pipeline for more than two weeks. The explosion was reportedly either coordinated with a cyber attack on the pipeline's computer systems or was caused by the cyber attack.8

In 2013, the Kurdish Regional Government (KRG) completed construction of a second line of the Iraq pipeline, beginning at Taq Taq field near Erbil in the KRG controlled portion of northern Iraq, which joins the existing pipeline to Ceyhan, Turkey near the Iraq-Turkey border. Initial flows on the KRG line were low, as the Iraqi central government objected to the KRG selling oil without central government approval or involvement. The two sides reached an agreement, and in January 2015, the KRG began exporting its volumes as well as the central government controlled oil that was produced in northern Iraq. The agreement calls for exports of 250,000 b/d of crude from KRG controlled territory and 300,000 b/d from central government controlled fields around Kirkuk, Iraq, all of which is to be marketed by Iraq's State Oil Marketing Organisation.9 Actual oil exports have varied from month-to-month, but in May 2015, exports to Ceyhan, Turkey via the KRG line exceeded 550,000 b/d, including about 400,000 b/d of crude from KRG controlled fields.10

Ports

The port of Ceyhan has become an important outlet for both Caspian oil exports as well as oil shipments from northern Iraq. In addition to the two crude oil pipelines that terminate in Ceyhan, Turkey (BTC and Iraq-Turkey), crude and condensate are also trucked in from northern Iraq. In 2014, the port of Ceyhan handled more than 650,000 b/d of Caspian crude oil exports and more than 130,000 b/d of Iraqi crude oil exports, most of which were destined for Europe.11

Refinery sector

As of January 1, 2015, Turkey had six refineries with a combined processing capacity of 663,000 b/d, according to OGJ.12 Tüpraş is Turkey's dominant refining firm and operates four refineries accounting for 85% of the total refining capacity. Tüpraş also owns about 59% of the total petroleum products storage capacity in Turkey.13 Tüpraş was formerly state-owned, but has been 51% owned by the Koc-Shell Joint Venture Group since 2005, with 49% of shares publicly traded.

Natural gas

Turkey has a strategic role in natural gas transit because of its position between the world's second-largest natural gas market, continental Europe, and the substantial natural gas reserves of the Caspian Basin and the Middle East.

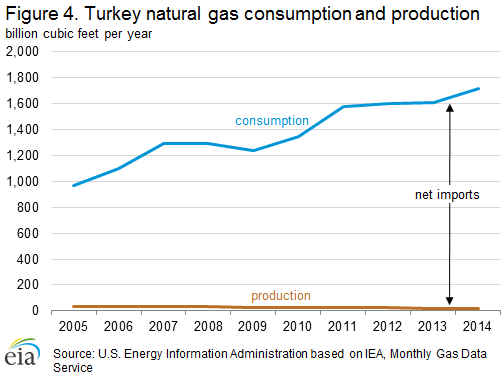

As of January 1, 2015, the OGJ estimates Turkish natural gas reserves at 218 billion cubic feet (Bcf).14 Turkey produces only a small amount of natural gas, with the total production amounting to 19 Bcf in 2013 (Figure 4). With 11 Bcf in 2013, TPAO accounted for most of Turkey's natural gas production.15

Turkey is an important consumer of natural gas and is becoming an important transit state for natural gas. Turkey is one of the few countries in Europe where natural gas consumption continues to show strong growth. Turkey's growing consumption has helped spur development of multiple pipelines to bring natural gas into the country, and while it has left little natural gas available for export, new supplies have been contracted and new pipelines are under construction that will increase both Turkey's imports and exports of natural gas.

Sector organization

The state-owned Petroleum Pipeline Corporation (BOTAŞ) dominates the natural gas sector, although most of the market is open to competition. BOTAŞ is vertically integrated across much of the natural gas sector. BOTAŞ accounts for about 80% of natural gas imports; it builds and operates natural gas pipelines in Turkey; it accounts for most of the wholesale market; and it accounts for most exports of natural gas.

Turkey began liberalizing its natural gas market in 2001 with the Natural Gas Market Law, which required that BOTAŞ be legally unbundled—broken up into separate legal entities for natural gas transport, operating liquefied natural gas (LNG) terminals and storage facilities, and trading and marketing. Several draft and enacted laws since 2001 have also required BOTAŞ to be unbundled, including most recently, a draft bill submitted to parliament in 2014. Timelines for completing the unbundling have not been binding and have repeatedly been extended.

Another goal of market liberalization has been to reduce the dominance of BOTAŞ in the market segments in which it operates to foster competitive markets. BOTAŞ is required to reduce its share of imports to no more than 20% of annual consumption by gradually selling off its import contracts.16 There has been progress in BOTAŞ selling off its import contracts: BOTAŞ has transferred 350 Bcf of import contracts, equal to about 20% of Turkish natural gas consumption, to seven private companies.17 Russia's state-owned natural gas company, Gazprom, has a 71% stake in Bosphorus Gaz (which holds import contracts for 26 Bcf per year and 62 Bcf per year; about 5% of Turkish consumption), and Gazprom has filed an application with Turkey's antimonopoly regulator to buy a controlling interest in Akfel Gaz (contracts for 79 Bcf; about 4.5% of Turkish gas consumption).18

Consumption, imports, and exports

Turkey is increasingly dependent on natural gas imports as its domestic consumption, especially in the electric power sector, continues to experience significant growth.

Natural gas consumption in Turkey has increased rapidly over the past decade and reached a new high of 1.7 trillion cubic feet (Tcf) in 2014. Natural gas is mainly used in power generation, which accounted for more than 40% of consumption in 2012. Most of the remaining consumption is nearly evenly split between the buildings sector (residential and commercial) and the industrial sector. Consumption growth is expected to remain strong as industrial sector growth and rising electricity consumption continue to spur demand.

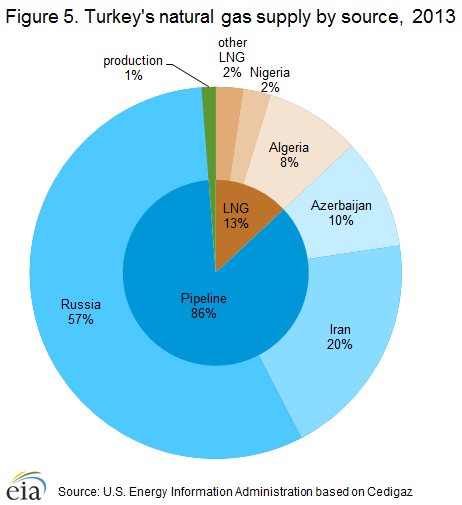

In 2014, Turkey imported 1.7 Tcf of natural gas, accounting for 99% of total natural gas supply.19 Through LNG and multiple pipeline connections, Turkey has a reasonably diversified supply mix. However, Russia's Gazprom is by far the largest single supplier, accounting for 57% of Turkey's total natural gas supply in 2013 (Figure 5).20 Turkey is Russia's second-largest export market for natural gas, after Germany. In 2013, BOTAŞ exported just 23 Bcf of natural gas.21

Because of rapid demand growth, Turkey's annual natural gas consumption is approaching the annual capacity limits of the country's import infrastructure (pipeline and LNG). However, Turkey's natural gas demand is not flat over the course of the year, but peaks in the winter months, when natural gas use for power generation and space heating is highest. Additionally, Turkey has little natural gas storage capacity and primarily relies on increased imports to meet the seasonal increase in demand. Natural gas shortages are not uncommon in winter, as the pipeline capacity is insufficient to meet peak winter demands.

Natural gas consumption in Turkey and exports from Turkey are also highly vulnerable to supply disruptions. Natural gas imports to Turkey have frequently been reduced or temporarily suspended because of insurgent attacks on import pipelines or because of cold weather in countries that export to Turkey. These disruptions can be mitigated by other suppliers if there is spare pipeline capacity. Russia, in particular, has on multiple occasions sent extra natural gas to Turkey when needed.

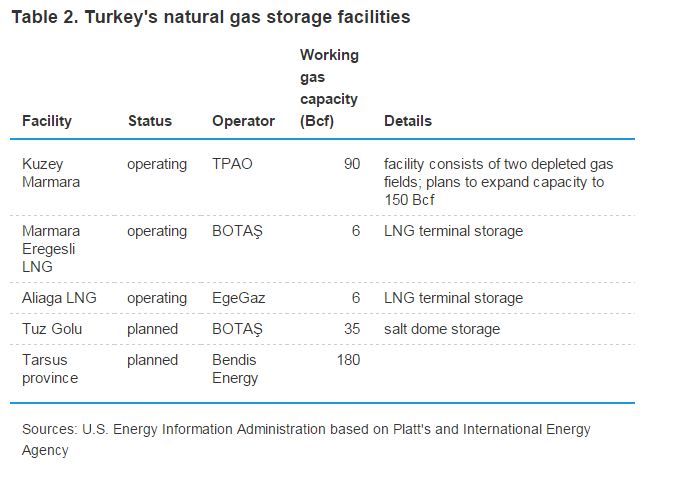

Storage

Companies importing natural gas into Turkey are required to hold rights to storage capacity equal to 10% of their annual imports. However, Turkey currently has one operating underground storage facility (Table 2)22 with total storage capacity of about 5% of Turkey's imports of natural gas. For comparison, the 28 countries of the European Union (EU) collectively have storage capacity equal to a little less than 20% of total annual consumption.23 If all the storage capacity currently proposed in Turkey is realized, capacity will amount to about 20% of annual imports for domestic consumption.

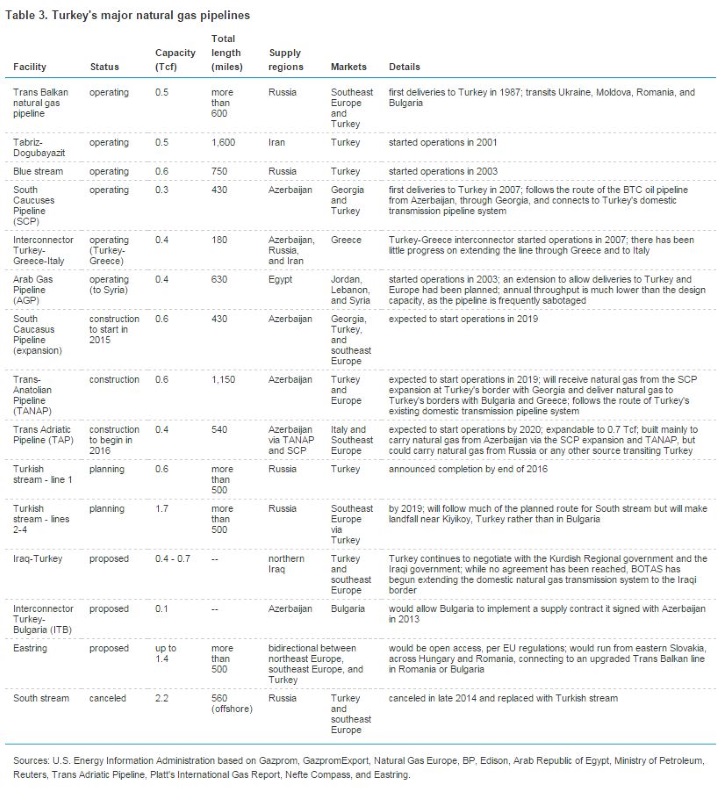

Pipelines

At the end of 2013, BOTAŞ had more than 7,600 miles of natural gas pipelines in Turkey, including interconnections to four international import pipelines and one international export pipeline (Table 3).24 With several pipelines under construction or scheduled to begin construction in 2015 and 2016, Turkey is expanding its pipeline system to better accommodate growing domestic natural gas consumption as well as to transit more natural gas to European consumers.

International and regional politics play a role in any pipeline that crosses borders, but politics is particularly critical in realizing pipelines proposed to transit Turkey. Russia-Ukraine relations and Russia-EU relations have both had a prominent role in Gazprom's planned Turkish stream pipeline. Relations between Turkey the Kurdish Regional Government and the Iraqi central government will likely affect plans to build a pipeline from northern Iraq to Turkey. Additionally, insurgents in Turkey and in neighboring countries have, on several occasions, attacked natural gas pipelines.

Liquefied natural gas

In 2013, Turkey imported liquefied natural gas (LNG) from seven countries (Algeria, Nigeria, Qatar, Norway, Egypt, Netherlands, and France), which accounted for 13% of Turkey's total natural gas supply according to Cedigaz.25 LNG volumes arrive at the country's two terminals, Marmara Ereglisi in Tekirdag and the Aliaga terminal in Izmir. Marmara Ereglisi has been in operation since 1994 and is owned by BOTAŞ. Marmara Ereglisi has an annual capacity of 280 Bcf. The Aliaga terminal is owned by EgeGaz, and has an annual capacity of 210 Bcf of natural gas.26

Although Turkey is encouraging natural gas transit across Turkey via pipelines, it is discouraging LNG transit. Ukraine, Romania, and Bulgaria have all, at one time or another, proposed building LNG import facilities on their Black Sea coasts. However, the only way for an LNG tanker to reach such a facility would be through the Turkish Straits, and Turkish authorities have indicated that they would not allow LNG vessels to transit the straits for safety reasons. Additionally, the straits are already a major shipping chokepoint, especially for cargo classified as hazardous (which includes LNG as well as crude oil and other petroleum liquids).

Coal

Coal, particularly lignite, is Turkey's most abundant indigenous energy resource and is an important fuel for electricity generation.

In 2012, coal production accounted for 47% of Turkey's total primary energy production on a Btu basis. Most of Turkey's coal reserves are lignite reserves with about 300-500 million tons of hard coal reserves.27 Turkey's lignite reserves tend to be low quality reserves with a low heat content,28 and estimates of lignite reserves tend to be either about 2,000 million tons or about 10,000 million tons depending on the methodology used.29 In 2012, Turkey produced 77 million short tons (MMst) of total coal, 95% of which was lignite. Turkey also imported 32 MMst of coal in 2012, most of which was hard coal.

Coal-fired power stations are an important source for Turkey's electricity generation, and there is renewed interest in exploiting Turkey's domestic coal resources. Coal-fired generation accounted for 28% of total electricity production in Turkey in 2012, including 17% from lignite and 11% from hard coal.30 Turkey has several new coal plants under construction and more plants proposed.

Electricity

Following the restructuring of Turkey's electricity sector, both consumption and generation of electricity have expanded. Most electricity is generated using fossil fuel sources, although the government plans to displace at least some of this generation with nuclear power.

In 2012, Turkey's total electricity generating capacity was 57 million kilowatts, and total net electricity generation was 228 billion kilowatthours. Turkey's electricity consumption more than doubled between 2001 to 2012. Because of the economic slowdown, consumption declined by about 3% in 2009 compared with the previous year. Since then consumption has grown by 5% to 10% per year, accounting for much of the total growth since 2001.

Most of Turkey's electricity generation comes from fossil fuel-fired power plants (72% of total generation in 2012) with natural gas accounting for more than half of all fossil fuel-fired generation. Electricity from hydroelectric facilities also accounts for a significant share of Turkey's total generation (25%). Although Turkey does not currently generate any electricity from nuclear power, the government has been advocating construction of nuclear power plants to diversify Turkey's electricity supply portfolio.

Sector organization

The state-owned and vertically integrated Turkish Electricity Authority controlled generation, transmission, and distribution of electricity in Turkey prior to the electric sector reforms that began in the 1980s. Since then, the government has passed several laws which have unbundled and partially privatized the Turkish electric sector.

The state-owned Electricity Generation Company (EUAS) remains the largest electric generation company in Turkey controlling about 40% of all generation capacity in Turkey.31 The remaining generation comes from independent power producers and firms given special state concessions to build and operate power plants. The wholesale electricity market in Turkey is also open to private companies; however it is dominated by the state-owned Turkish Electricity Trading and Contracting company (TETAS).

Transmission and distribution services are separate (unbundled) from generation and marketing services. The Turkish Electricity Transmission Company, a state-owned enterprise, owns and operates the transmission system. There are 21 electric distribution regions in Turkey, most of which are operated by private companies.

Nuclear

Turkey plans to build nuclear power plants at three sites: Akkuyu, on the Mediterranean coast; Sinop, on the Black Sea coast; and a third yet-to-be-decided location. The formal ground-breaking ceremony marking the official start of construction at Akkuyu took place in April 2015. In accordance with an agreement signed by Turkey and Russia in 2010, Rosatom, Russia's state nuclear company, will build, own, and operate the Akkuyu plant. The Turkish state electric generation company, EUAS, is expected to take a stake in the power plant. The plant will have four units with a total capacity of 4.8 gigawatts, and the first unit is expected to begin operating about 2020.

Construction at Sinop for Turkey's second nuclear power plant is planned to start in 2017. The Sinop plant will be built by a Japanese and French consortium and operated by GdF Suez. EUAS is also expected to take a stake in the power plant. The Sinop plant will have four units with a total capacity of 4.6 gigawatts, with the first unit expected to begin operating in 2023.

Since November 2014, Turkey has been in exclusive negotiations with the State Nuclear Power Technology Corporation of China to build a third nuclear power plant in Turkey using reactors from U.S. firm Westinghouse. The location of the third plant has not been decided, and construction is not expected to begin until 2019 at the earliest.32

Source: EIA