This week we’ll run a 3-part series on LNG terminal logistics. We are going to take a closer look at some of the exciting challenges you’ll find at so-called multi-user terminals – these are terminals which capacities are shared between a number of different users.Today, we’ll have a look at why LNG terminal logistics is

important, and why it is going to be even more important in the future.

Tomorrow, we’ll look at some very basic mathematics explaining the

logistics of a multi-user terminal. On Wednesday, we’ll take a look at

slot management and how this puzzle can cause headaches.

Historically, LNG trades were predictable point-to-point trades where

one company controlled the whole supply chain. Today, the LNG marked has

become much more liquid, with many more players, and with much greater

demand for flexibility. And flexibility has a flip side; it’s called

congestion. Effective logistics management is how you offer the

flexibility, yet avoid the congestion. It is easier said than done.

Let’s just take a look at a few long term trends in the LNG industry:

* LNG export terminals are moving offshore and getting smaller

* LNG import terminals are moving offshore and getting smaller

* LNG carriers are getting bigger

* Import terminal capacity is split among several capacity holders

*

All these four trends have one thing in common; they are drivers for

increased pressure on logistics throughout the LNG supply chain; Bigger

ships taking LNG from smaller export locations to smaller import

locations is a recipe for trouble. What to do when a ship is late and

the export terminal is fully loaded? Who pays for demurrage when the

import terminal can’t accommodate the entire cargo from the ship that

had a legal right to a specific slot?

Over the past 5 to 10 years, many LNG import terminals are set up for

capacity sharing and multiple users, but their maximum capacity has

hardly been tested. As we all know, import terminals in the US are not

tested at all. In Europe, there have been much more import capacity than

actually imported volumes, and some of the new multi user terminals

have operated with very low throughput only. The real test of maximum

capacity will come when all users want to utilise their contracted

volumes over an extended period of time. Rest assured, this time will

come.

Why is logistics a special challenge for multi-user terminals?

It is not intuitive is it? If you take a typical LNG terminal, keep its

number of jetties, regasification capacity, and storage capacity

unchanged. Then divide all these capacities on two users. Why would that

become a strain on terminal logistics?

There is a simple answer; it’s because the size of the ship remains unchanged.

When the users of the terminal only have half capacity, it means their

regasified volumes out of the terminal are cut in half, which again

means that the storage tank volumes are reducing at only half the rate.

When the second user then takes his ship in, half the volume from the

first user’s cargo is still in the tanks. After discharge the volume of

LNG in the storage tank is now 50% more than what it would have been

with only one user of the terminal. I have tried to illustrate this in

the figure; the first graph is the tank level with one user, the second

graph is the individual tank level for two users, and the third graph is

the combined tank level for two users.

From an engineering perspective, this can be accommodated in two

possible ways; either use smaller ships or install bigger tanks at the

terminal. Smaller ships are not available in the fleet, and it would

have a negative effect on shipping and portfolio flexibility to use a

dedicated ship size, so this option is out. Installing bigger tank

capacity is very expensive, and has a construction time of 3 years, so

this option is also out.

So that leaves it up the lawyers to find a solution, and what they have

invented is sharing agreements where users can borrow molecules from

eachother to meet their offtake agreements, this reduces their need for

individual storage capacity in the tanks. But it introduces a need for a

slot management system, to control the rights of each user.

The task of allocating a set of slots to a set of terminal users appears

straight-forward on first sight, but it quickly becomes troublesome.

Let’s consider a set of three users of the same terminal. They will all

have different ship sizes, different sailing schedules, and potentially

also different capacity entitlements at the terminal. As a base load

supplier of gas to their offtake customer, they will all need a new ship

to come in when their volume in the tank is running empty. This means

the slot schedule for each user will be dictated by their particular

ships and throughput volumes. When combining three schedules like this,

you’ll encounter two types of conflicts:

Two or three users will need the same slot

Terminal tanks can not accommodate the whole cargo of the ship

The first consequence of this is that one of the users will run of out

gas before their next ship comes in. This, however, can be handled

through borrowing from other users as agreed in the terminal use

agreement. The second consequence, however, is that the ship will be

delayed, and this is more difficult to handle. Who’s fault is it that

the ship will have to wait for a later slot? And when is the next

available slot anyway? It may be weeks away.

By establishing a spreadsheet model and playing with different tank

sizes, ships sizes, and schedules, you’ll get a pretty good idea about

what works and what doesn’t, but you’ll quickly realize that there are a

lot of parameters to handle.

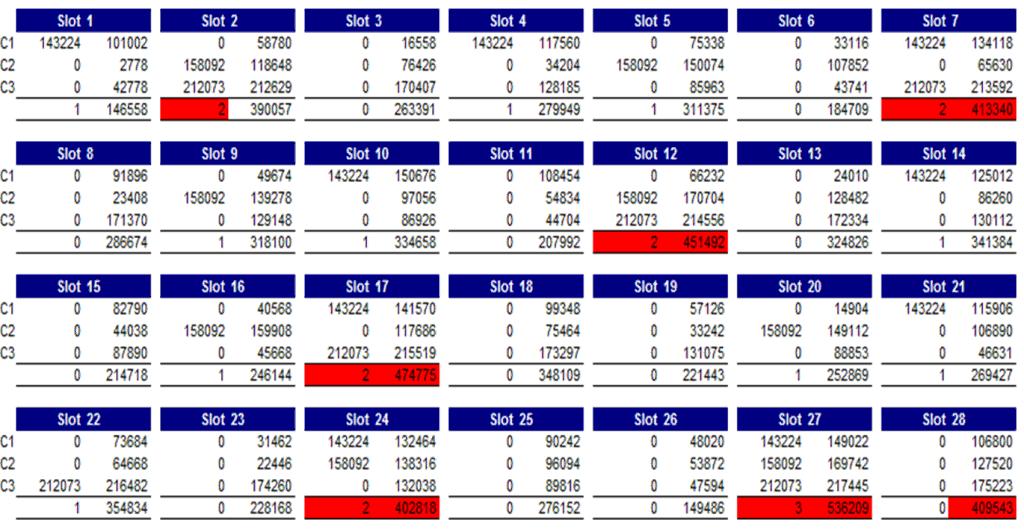

Slot allocation spreadsheet for three terminal users – red cells

indicate either two ships wanting the same slot or tank volume exceeding

maximum capacity.

Slot allocation spreadsheet for three terminal users – red cells

indicate either two ships wanting the same slot or tank volume exceeding

maximum capacity.

Source: DNV GL