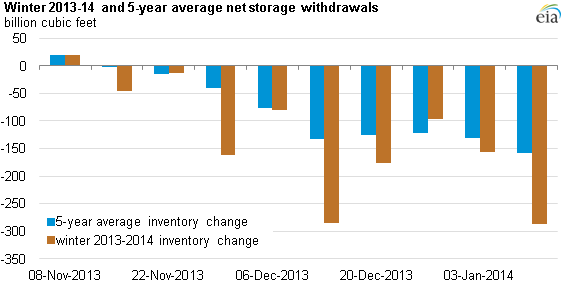

Last week's widespread, record-breaking cold weather had significant effects across virtually all segments of the U.S. natural gas market. The frigid temperatures led to record highs in demand, storage withdrawals, and prices.The week ending January 10 posted a record-high net withdrawal of 287 billion cubic feet (Bcf) from

underground, natural gas storage

facilities. The January 10 withdrawal is the largest for the 20 years

for which data exist and the latest in a season already characterized by

withdrawals much larger than average. This week's storage withdrawal

was the second record-breaking weekly stock draw this season; the

withdrawal of 285 Bcf for the week ending December 13 exceeded the

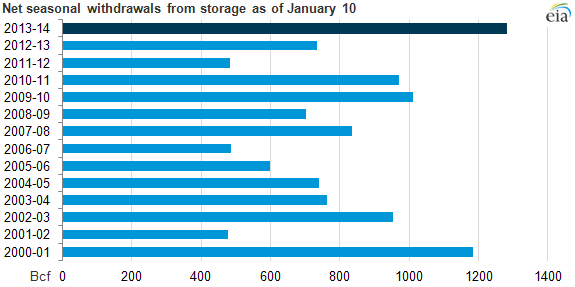

previous record of 274 Bcf from January 2008. Cumulative net

withdrawals, as of January 10, 2014, exceeded the previous record levels

posted during the 2000-2001 heating season. Bentek Energy estimated

stock draws hit 57.1 Bcf on January 6, and then 67.9 Bcf the following

day. The next-highest draw was 52.9 in February 2011.

Source: U.S. Energy Information Administration, Weekly Natural Gas

Storage Report

High storage withdrawals were expected to meet surging demand for

heating from the residential, commercial, and electric power sectors,

with analyst estimates, as published by Bloomberg, ranging between 278

and 321 Bcf. The cold weather also impacted natural gas production.

Freeze-offs occurred in the parts of the Marcellus Shale in northeastern

Pennsylvania and in the Fayetteville Shale in Arkansas, according to

Bentek Energy. Dry natural gas production dropped to 61.9 Bcf on January

8, the lowest level since September 2012, and has been gradually

increasing since then, reaching nearly 66 Bcf as of January 16.

Source: U.S. Energy Information Administration, Weekly Natural Gas

Storage Report

Note: Data above reflect withdrawals between October 31 and January 10. 2008-13 average = 780 Bcf.

In the Northeast, where more than half of homes use natural gas as their

primary space-heating fuel, several pipelines issued critical notices

and operational flow orders (OFOs) to prevent system imbalances.

Additionally, Texas Eastern Pipeline, a major interstate pipeline

supplying the Northeast, issued a force majeure (which frees both

parties from upholding contractual obligations in the event of

extraordinary circumstances) following unplanned maintenance at a

compressor station in Pennsylvania.

Natural gas prices in the Northeast spiked to between $30 and $40 higher

than the benchmark Henry Hub price. On the Transcontinental Pipeline's

Zone 5 line, which serves Mid-Atlantic customers, prices reached

$72.43/MMBtu on Monday. Prices in New York and New England also rose far

into the double digits, with Transco's Zone 6 delivery point, serving

New York City, at $56.59/MMBtu, and the Algonquin Citygate, serving

Boston, at $34.14/MMBtu.

The extreme cold temperatures that affected Northeast natural gas

markets during the first half of last week arrived earlier in the

Midwest, where about 68% of households use natural gas for heating.

While it is common for prices to spike in the Northeast during times of

high demand, Midwest prices are normally close to Henry Hub prices, as

the region does not typically have major supply bottlenecks. Prices at

the Chicago Citygate rose to levels almost $10/MMBtu greater than Henry

Hub prices on Friday, January 3, as temperatures in the Midwest dipped

to levels that prompted the Chicago Zoo to bring its polar bear indoors.

Both ANR Pipeline and NGPL, major interstate pipelines that send

natural gas to the Midwest, issued OFOs, and many other pipelines in the

region issued critical notices that curtailed normal gas-flow

scheduling to maintain balance on their systems.

Source: EIA