Following the El–Sharara field’s start up, Libya’s crude production is

now around 500 tbpd, double the Dec-13 level of 250tbpd, but even if

the field returns to its full capacity of about 3 00 tbpd, Libyan

production would only rise to 600 tbpd — less than half of the 1.4 mbpd

Libya was pumping a year ago.Moreover, it may take

some time for the additional oil to reach Libya’s

customers, for it would take several days to refill storage tanks at

Zawiya, while a local refinery will also absorb some of the extra

production.

A further output recovery is uncertain, since the central government is

unlikely to accede to the eastern rebels’ demands for autonomy, warning

them that they would not allow oil tankers to load at seized ports and

would stop doing business with any companies that buy oil sold by them.

Also worrying is the situation in Iraq where government forces in Anbar

province are co-operating with local tribal leaders to push out

al-Qaeda militants, who have taken over parts of Ramadi and Fallujah.

Instability in Iraq ahead of parliamentary elections in April was

expected, however, and key oil production facilities in the south should

remain largely unaffected by the violence; indeed, Iraq’s oil exports

may actually increase because of more Kurdish supplies via Turkey.

Oil supplies may suffer further disruption in South Sudan, where

production has declined by 45 tbpd since fighting erupted a month ago,

delaying peace talks, but for now around 200 tbpd is still being shipped

through Sudan.

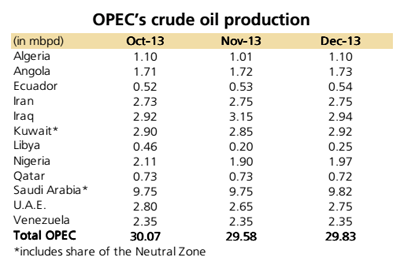

Overall OPEC production in Dec-13 rose to 29.83 from 29.58 mbpd in Nov,

an increase of 250 tbpd mainly due to rises in Saudi Arabia, Algeria,

UAE, Kuwait and Nigeria. Increases in these countries managed to offset a

210-tbpd decline in Iraqi production because of bad weather in the

south, which impeded crude liftings.

Source: CGES