The South East Asia Oil Producing Area, consisting of Brunei, Myanmar, Indonesia, Malaysia, the Philippines, Thailand and Vietnam, accounted for 6.4% (1.6m bpd) and 16.8% (16.5 bcfpd) of global offshore oil and gas production respectively in 2012. Its 409 active offshore fields – 63.8% of those in the Asia Pacific – are mostly fixed platform developments. However, indicators suggest this historical tendency may be changing.

Shallow Water Bonanza

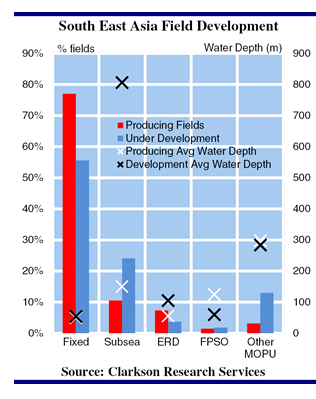

As the Graph of the Month shows, shallow water development types predominate within South East Asia. Together, fixed platforms, subsea tie-backs and extended reach drilling (ERD) accounts for 95% (388) of producing oil and gas fields in the area, reflecting the historical concentration of E&P activity in shallow Malaysian and Indonesian waters. The average water depth of producing fields is 70m and only nine are located in depths of more than 200m. SE Asia is thus comparable to the North Sea, where these development types also equate to 95% (614) of active fields and average field water depth is 91m.

Topsides Upside

Unlike in the North Sea though, active fields in South East Asia are heavily skewed towards fixed platforms: 77% (315) of active fields produce via fixed platforms in SE Asia. For the North Sea this figure is 40% (258). For every field exploited by subsea tie-back or ERD, there are 7.3 (for subsea) or 10.5 fields (for ERD) developed by fixed platforms in SE Asia. The equivalent global ratio is 2.9 or 9.0 fixed field developments per subsea or ERD field. SE Asia is also likely to remain a source of fabrication contracts for the foreseeable future: development by fixed platform accounts for 56% of fields under development in the area.

Subsea Rising

However, the Graph of the Month also shows a pronounced rise in subsea development: 11% of active fields are subsea tie-backs but 24% of fields under development are such. The average water depth of existing subsea fields in SE Asia is 150m whereas for fields under development by subsea tie-back, the average is 806m. The comparable figures for the North Sea are 129m and 168m. Rather than combining with existing platform infrastructure (as in the North Sea), subsea growth in Asia seems to be being driven by deepwater projects like Gehem, Gendalo and satellites like Gandang (off Indonesia).

MOPUs Multiplying

This suggestion is reinforced by the trend in Mobile Production Unit deployment in the region. While 5% of active fields in the OPA are MOPU developments, 15% of fields under development will employ MOPUs. In deep water, satellite fields with subsea producers are often tied to MOPUs, especially in later project phases. South East Asia accounts for 44% of global developments by MOPUs other than FPSOs (e.g. TLPs or jack-ups).

Fixed platforms will remain common in Asia, particularly given a push to develop many marginal Malaysian fields. Yet equipment and service suppliers will be encouraged by the growth in more complex development types, as more fields are developed and then start up in deeper waters.

Source: Clarkson Research Services