Global and International container terminal operators seeking further growth are increasingly looking at new expansion opportunities in Africa.The recent announcement by APM Terminals of its investment in Nigeria underlines the growing interest of global and international container terminal operators in Africa. Apart from the company’s continuing terminal/port modernisation programme in the region, APM Terminals is now examining the proposed new port of Badagry in Nigeria, the importance of which was emphasized in its African strategy released during June.

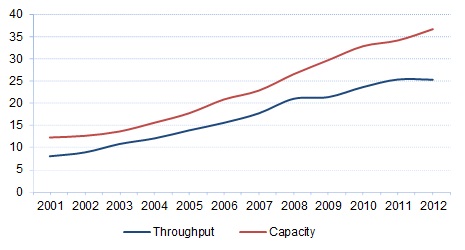

In contrast to mature US and Western European markets, Africa is still deemed to offer high growth potential due to comparatively low levels of containerisation and rising demand for finished goods. Compound annual growth of container traffic passing through the continent’s ports already reached 11% between 2001-2012, with even higher growth of 13% in North Africa due to its location just off the arterial routes between Asia and Europe. Container handling capacity also increased up to an estimated 37 million teu in 2012. The capacity growth was, again, highest in North Africa, where a CAGR of 12% was achieved between 2001-2012.

Global and international container terminal operators (GTOs and ITOs) have been at the forefront of this expansion.

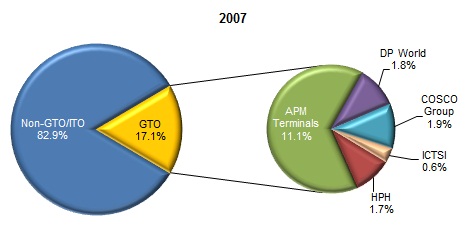

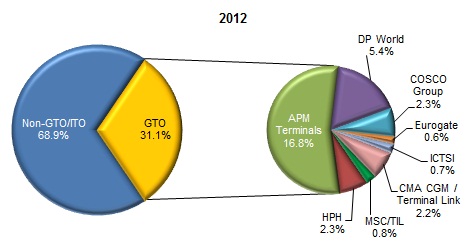

Based on Drewry’s annual Global Container Terminal Operators report, GTOs/ITOs controlled 17% of the continent’s total container traffic in 2007 (equity teu throughput, defined as each operator’s share of terminal throughput based on the size of the shareholding held). The most prominent player at that time was APM Terminals, with smaller portions of cargo handled by Cosco Group, DP World, HPH and ICTSI. However, by 2012, the equity throughput of GTOs/ITOs increased to 31%, with increased throughputs reported by all the earlier players, plus a number of new market entrants including CMA CGM/Terminal Link, MSC/TIL and Eurogate.

Equity Throughput of Global and International Terminal Operators (GTO/ITO) in Africa

Apart from western and northern Africa, the presence of GTOs/ITOs in Africa is still minimal, due, in part, to differing levels of privatisation. The potential for growth remains high in the eastern and southern part of the continent, therefore.

Currently APM Terminals is involved in 11 terminals in West Africa, and has recently signed a concession agreement with Bollore and Bouygues for Abidjan’s second terminal. Involving a planned investment of $590 million, the new facility will have a have 1,100 metres of quay capable of accommodating vessels of up to 8,000 teu capacity. Bollore is itself a major player in Africa, especially West Africa, and has aggressive expansion plans both in the region and beyond.

DP World is also increasing its presence in Africa, having handled 5.4% of its port traffic (equity throughput) in 2012, compared to only 1.8% in 2007. It is particularly active in Senegal and Djibouti. In 2010, the operator also signed a 35-year concession agreement with the Red Sea Port Authority to develop and operate the new terminal in El Sokhna, which, at full capacity, will be able to handle 1.75 million teu/annum. Moreover, it is expanding its presence in Senegal, having signed a 100% concession to build a new 1.75 million teu terminal at Dakar by 2016.

CMA CGM/Terminal Link has also not been quiet in Africa. Apart from its established presence at three terminals in Morocco and the Ivory Coast, it signed a 65-year concession agreement with the São Tomean government in August 2008 for a large greenfield terminal on the island (off the coast of Gabon). However the operation date has yet to be declared.

The African continent’s other major terminal operator, Transnet, handled more than 4 million teu in 2012. However, the state-owned company is still only interested in South Africa, so is really only a local player in regional terms.

Our View

Although much of Africa remains politically and economically fragile, Drewry expects GTOs/ITOs to increase their presence on the continent through greenfield investments and privatisations. Bigger and better ports/terminals are urgently required, and they have the expertise and financial resources to provide them more than most.

Source: Drewry