Ship-owners are faced with a number of important decisions in terms of investment and trading if they want to do business within the future sulphur limits of Emission Control Areas (ECAs). The deciding factors influencing the investment decision for installation of a scrubber are the fuel cost spread and the time spent in an ECA. In

this article, BIMCO has tried to abridge the issue to facilitate decision-making.

The core issue is that the sulphur content of bunkers used by ships sailing in North American and Northern European ECAs is limited to 1.00% m/m until 2015, where the limit will be lowered to 0.10% m/m. As a consequence vessels sailing inside ECAs are required to either use distillate fuel, which is sold at a clear mark-up over normal heavy fuel oil (HFO) or find other ways of being compliant.

If the chosen solution is the fuel option it means that vessels sailing in ECAs are required to use low sulphur fuel oil (LSFO) until 1 January 2015, which is currently approx. USD 12 per mt more expensive than HFO and after 2015 required to use the much costlier marine gas oil (MGO) representing a current mark-up of USD 258 per mt over HFO. Instead of paying a fuel premium for distillate fuel, the ship-owner has the option to invest in a LNG solution or a scrubber; the latter enables him to use the cheaper HFO fuel. LNG appears for most circumstances too expensive while scrubbers could be seen as a real alternative. There is some debate regarding the efficiency of scrubbers, but in the following we assume that the scrubber will be fully compliant on selected ship types such as MR tankers and most bulk carriers. In this debate it has also been brought forward that on board other ship types it is not today possible to use scrubbers such as very large container ships and some ferries. We will not go into any details here but simply note this debate and focus on the trades where scrubbers positively could be applied. The scrubber requires a significant upfront cost as well as slightly elevated OPEX, but the savings in fuel expenses may outweigh the installation costs depending on the actual time spend in ECAs and the fuel cost spread. In addition to this the remaining commercial life of the vessels is highly relevant to consider prior to the decision-making.

Chief Shipping Analyst at BIMCO, Peter Sand, says: “The oldest vessels in the fleet are not candidates to a scrubber installation due to inability of repayment of the investment before the end of its commercial life. But for many newer vessels, installing a scrubber could help you save money if you plan on trading a significant amount of time in ECAs. For a ship with 10 years of commercial life left, the vessel should sail in an ECA 33% of the time for a scrubber to break even”.

Understanding the impact of the fuel spread

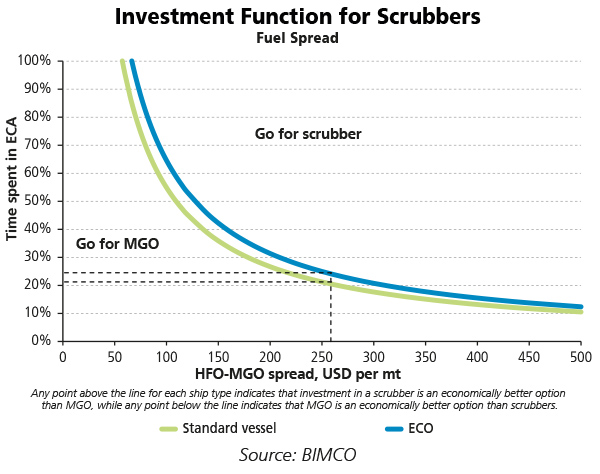

One of the most important factors in determining the economic viability of a scrubber is the future HFO-MGO spread. In the following, we assume that the fuel spread remains unchanged at USD 258 per mt during the vessel lifetime. The average HFO-MGO fuel cost spread for the last year was USD 321 per mt. Our results show that a recently delivered standard MR tanker should spend more than 21% of the time in an ECA to benefit from a scrubber. We also ran the calculations for a newly delivered ECO design (assumed 15% more efficient than the current standard ship), which should spend more than 24% of the time in an ECA to profit from installing a scrubber and continue to burn HFO, as compared to burning MGO without a scrubber. The difference between the two types of tankers is due to the lower fuel consumption of an ECO-ship, which means that the effect from the fuel spread is lower.

As the graph above reveals, the HFO-MGO spread should stay above USD 57 per mt for a standard vessel permanently employed in an ECA, while a ship with an ECO design should have a spread above USD 67 per mt. We consider it unlikely with the present global refinery configuration that the spread should fall to these numbers; therefore we believe that investing in a scrubber makes sense for vessels spending a substantial amount of time in an ECA. If the fuel spread increases to USD 500 per mt, the standard vessel need only to spend as little as 10% of the time in an ECA to profit from investing in a scrubber, while the ECO ship should spend at least 12% of the time in an ECA. Any point above of the line indicates that investing in a scrubber is good business taking our assumptions for granted.

Timing is of the essence

If the ship-owner invests in a scrubber today, he will have to pay a substantial amount of money now rather than in late 2014, foregoing almost two years of interest on this money. In short there is no business case for investing in a scrubber before end of 2014 regardless of the time spent in an ECA (Result holds for a MR tanker which forms the basis for this analysis).

This is because the HFO-LSFO (1.00%) spread is much lower than the HFO-MGO (0.10%) spread. The exception is vessels currently under construction, as the installation costs may then be lowered by approximately USD 1 million.

Likewise, a ship-owner with a mature fleet may decide not to invest in a scrubber even if the vessel is expected to spend a substantial amount of time in the ECA. A standard MR tanker with five years of commercial life left in 2013 would have to spend at least 72% of the time within the ECA before he should invest in a scrubber by the end of 2014. If a ship-owner expects that his standard MR tanker will spend 25% of the time inside an ECA, the vessel should have at least fourteen years of commercial life left in 2013 for a scrubber to be a better option than using MGO. The calculations are performed assuming the fuel spread remains unchanged at USD 258 per mt.

ECAs change the incentives of vessel positioning

The ECAs have and will change the market structure of seaborne transportation, where vessels with scrubbers and other sulphur reducing devices are naturally looking for fixtures inside ECAs to maximise their investment. The less obvious question is: If these vessels are too few to cater for the ECA demand, who will be joining them – ECO ships or standard vessels?

From an economic perspective, the most cost-efficient alternative will be the preferred choice. An ECO ship has the advantage of being more energy efficient, which alleviates the negative effect of an increased fuel spread. However, the energy efficiency can only be utilised while at sea, which means that a higher share of port days is not optimal for an ECO ship. Because routes with a high ‘ECA-content’ are typically shorter than other routes, the question boils down to a matter of comparing fuel expenses within and outside of ECAs. Before 1 January 2015, the fuel spread in question is the HFO-LSFO spread priced at USD 12 pr mt, which reduces the fuel costs of the ECO ship by USD 54 per day at sea (12*30*15%) compared to a standard vessel. Our calculations suggest that this reduction is too small to compensate any ECO ship-owner for the higher share of port days. Comparing a pure ECA route of 7.0 sea days (for a round voyage) with a non-ECA route, the latter becomes the profitable choice for these owners if the time spent on a route outside an ECA is longer than 7.4 sea days.

After 1 January 2015, the fuel spread in question changes to the HFO-MGO spread priced at USD 258 per mt. The higher spread provides an ECO ship with savings of USD 1,161 per day at sea compared to a standard vessel, which is enough to compensate for the shorter routes. Again, comparing a pure ECA route of 7.0 sea days with a non-ECA route, the latter should be longer than 47.88 sea days to become the profitable choice.

Peter Sand says: “Prior to 1 January 2015, the seaborne transportation inside ECAs will be performed as done by today. After that date the standard vessels will be replaced by ECO ships until (the date where) there are enough vessels with scrubbers and perhaps LNG-systems to cater for the ECA demand”.

The cost elements of installing and operating a scrubber and other assumptions

The expenses in relation to a scrubber can be divided into one-time costs and operational costs. There are three major one-time costs: The scrubber purchase, installation costs and the foregone earnings due to the installation. Industry sources estimate the upfront costs to be USD 3.78 million for a MR tanker. There are two major operational costs: Increased power/fuel consumption and scrubber maintenance. Moreover, if the vessel is engaged in fresh water, there may be an additional expense to caustic soda, but we assume that this is not the case. The power consumption is assumed to be 1% of engine consumption, while maintenance cost is set to USD 40,000 per year. We assume that the standard MR tanker consumes 30 mt of fuel per day at sea, and that the ECO ship consumes 15% less fuel. The tanker is believed to be operating 353 days per year; the transit rate is set to 75%, while the number of port days is 4 for a round voyage. We assume 20 years of commercial life for new buildings and a WACC of 7%.

Source: BIMCO