EIA projects average U.S. household expenditures for natural gas, heating oil, electricity, and propane will decrease this winter heating season (October 1 through March 31) compared with last winter, which was 11% colder than the previous 10-year average nationally. Projected average household expenditures for

propane and heating oil are 27% and 15% lower, respectively, because

of lower heating demand and prices. Lower heating demand and higher

prices contribute to natural gas and electricity expenditures that are

5% and 2% lower than last winter.

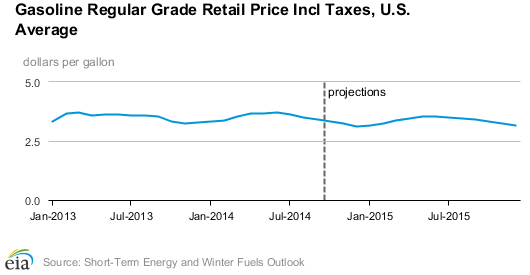

Driven in large part by falling crude oil prices, U.S. regular

gasoline retail prices fell to an average of $3.41/gallon (gal) in

September, 29 cents below the June average. U.S. regular gasoline retail

prices are projected to continue to decline to an average of $3.14/gal

in December. EIA expects U.S. regular gasoline retail prices, which

averaged $3.51/gal in 2013, to average $3.45/gal in 2014 and $3.38/gal

in 2015.

Weakening global demand helped North Sea Brent crude oil spot prices

fall to an average of $97 per barrel (bbl) in September, the first month

Brent prices have averaged below $100/bbl in more than two years. EIA

projects that Brent crude oil prices will average $98/bbl in

fourth-quarter 2014 and $102/bbl in 2015. The WTI discount to Brent,

which averaged $11/bbl in 2013, is expected to average $7/bbl in both

2014 and 2015.

Total U.S. crude oil production averaged an estimated 8.7 million

barrels per day (bbl/d) in September, the highest monthly production

since July 1986. Total crude oil production, which averaged 7.4 million

bbl/d in 2013, is expected to average 9.5 million bbl/d in 2015. If

realized, the 2015 forecast would be the highest annual average crude

oil production since 1970. Natural gas plant liquids production is

expected to increase from an average of 2.6 million bbl/d in 2013 to 3.2

million bbl/d in 2015.

Natural gas working inventories on September 26 totaled 3.10 trillion

cubic feet (Tcf), 0.37 Tcf (11%) below the level at the same time a

year ago and 0.40 Tcf (11%) below the previous five-year average

(2009-13). Projected natural gas working inventories reach 3.53 Tcf at

the end of October, 0.28 Tcf below the level at the same time last year.

Despite the lower stocks at the start of this winter’s heating season,

EIA expects the Henry Hub natural gas spot price to $4.00/million

British thermal units (MMBtu) this winter compared with $4.53/MMBtu last

winter. This price forecast reflects both lower expected heating demand

and significantly higher natural gas production this winter.

Source: EIA