In many parts of the country, drivers frequently encounter road construction and a sign that says "New

Traffic Patterns" as highway infrastructure shifts. New traffic patterns are emerging also in crude oil movements.There has been much discussion about the resurgence in U.S. crude oil

production and the

abundance of crude in the Midcontinent

(PADD 2 and PADD 4) and the Gulf Coast (PADD 3).

On the West Coast (PADD 5), however, crude oil production has been

declining, especially in Alaska and California, and as a result, crude

oil supply patterns to West Coast refineries have been changing.

Currently, there are no major pipelines moving crude to the West Coast

from east of the Rockies. Marine transport to the West Coast involves a

lengthy and expensive trip from the U.S. Gulf Coast through the Panama

Canal.

Crude-by-rail, though, is becoming a viable alternative. Trade press and

company reports indicate that crude-by-rail infrastructure on the West

Coast has been expanding, with more planned. Further, while EIA

currently does not collect data on domestic movements of crude oil and

products on railroads, an examination of EIA data reveals that there is a

growing supply of crude to PADD 5 that is not explicitly accounted for

by production, imports, or other transfers. This unaccounted-for crude

is likely crude oil delivered via railroad to refineries on the West

Coast.

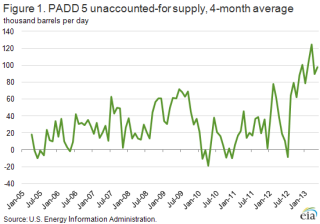

Figure 1 illustrates unaccounted-for supply as the difference between

PADD 5 refinery runs and stock change and the sum of imports, Alaska

production, and other PADD 5 production. Before 2012, the data show a

slight unaccounted-for supply, in the range of -20,000 (overestimation)

to 70,000 (underestimation) barrels per day (bbl/d) (Figure 1).

Underestimation of supply can be interpreted as domestically produced

crude oil shipped to PADD 5 from other PADDs via modes of transport not

captured in EIA surveys, mainly railroad and truck. Beginning in 2012,

the underestimated crude supply increased significantly, reaching more

than 100,000 bbl/d in the early months of 2013. This unaccounted-for

supply is likely crude delivered via rail.

The interpretation of unaccounted-for supply as an increase in rail

shipments is consistent with trade press reports. The refining center in

Washington state, the closest destination for both Canadian and Bakken

crudes, is where most of the refineries have built or are in the process

of building rail unloading facilities. Tesoro, the largest refiner on

the West Coast, opened a 40,000-bbl/d crude-by-rail unloading facility

at its Anacortes, Washington, refinery complex in 2012. The U.S. Oil

& Refining Company's Tacoma, Washington, refinery was the latest to

open a similar-sized crude-by-rail unloading operation in Washington.

Tesoro is also in the process of securing approval for a 120,000-bbl/d

rail-to-barge terminal in Vancouver, Washington. Alon USA Energy and

Valero are in the process of expanding facilities and securing approval

to build new crude-by-rail unloading facilities at their California

refineries.

In addition to refiners, merchant terminal operators, such as Westway

Terminals, NuStar Energy, and Plains All American, are also investing in

new rail-to-barge and rail unloading facilities. Global Partners LP, a

midstream energy logistics and marketing company, recently purchased an

existing petroleum products terminal in Portland, Oregon, that is linked

via rail to Global-owned crude-by-rail loading facilities in North

Dakota.

As the First Transcontinental Railroad united the West with the eastern

railroad system in 1869, railroads are now doing the same for crude oil

markets in the East and West, overcoming great distances and the

Continental Divide to deliver crude production to markets where it is

most highly valued.

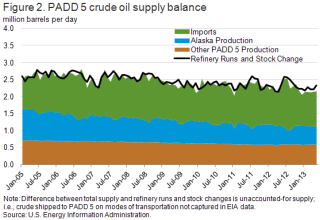

Background on PADD 5 Refining

There are three major refining centers in PADD 5: Washington state, San

Francisco, and Los Angeles. Historically, the refineries in Washington

and California were supplied from PADD 5 crude oil production and

imports (Figure 2). Alaska and California production is transported by

marine vessel and pipeline, respectively, to refineries. However,

production in both Alaska and California has been in decline over the

past decade. In 2012, PADD 5 production represented 48 percent of crude

runs at the region's refineries, down from 59 percent in 2005. As PADD 5

production declined over this period, waterborne imports of crude oil

increased. In 2012, imports were 51 percent of total PADD 5 crude

supply, an increase from 40 percent in 2005. The major sources of crude

imported into the West Coast thus far in 2013 are Canada, Saudi Arabia,

Iraq, and Ecuador. Because the West Coast relies so much on imports of

crude oil, similar to the United States overall, crude prices in the

region, including those for Alaska and California, have historically

been linked to seaborne Brent crude oil prices rather than to inland

West Texas Intermediate prices at Cushing, Oklahoma.

Gasoline and diesel fuel prices both decrease again

The U.S. average retail price of regular gasoline decreased seven cents

to $3.56 per gallon as of August 12, 2013, 16 cents lower than last year

at this time. Prices decreased in all regions except the Rocky

Mountains, where the price increased one cent to $3.64 per gallon. The

largest decrease came in the Midwest, where the price fell 11 cents to

$3.48 per gallon. The East and Gulf Coast prices both fell six cents, to

$3.57 per gallon and $3.39 per gallon, respectively. Rounding out the

regions, the West Coast price declined five cents to $3.84 per gallon.

The national average diesel fuel price decreased one cent to $3.90 per

gallon, seven cents lower than last year at this time. Prices decreased

in all regions, led by two-cent drops in the Midwest and the Gulf Coast,

to $3.86 per gallon and $3.82 per gallon, respectively. On the East and

West Coast the price is down one cent, to $3.91 per gallon and $4.05

per gallon, respectively. Rounding out the regions, the Rocky Mountain

price declined less than one cent to remain $3.93 per gallon.

Propane inventories slightly higher

Total U.S. inventories of propane rose slightly from last week to end at

61.9 million barrels, but are 7.2 million barrels (10.4 percent) lower

than the same period a year ago. Midwest inventories gained by 0.6

million barrels, while Rocky Mountain/West Coast inventories increased

by 0.1 million barrels. Gulf Coast stocks decreased by 0.6 million

barrels, while East Coast inventories remained flat. Propylene

non-fuel-use inventories represented 4.9 percent of total propane

inventories.

Source: EIA