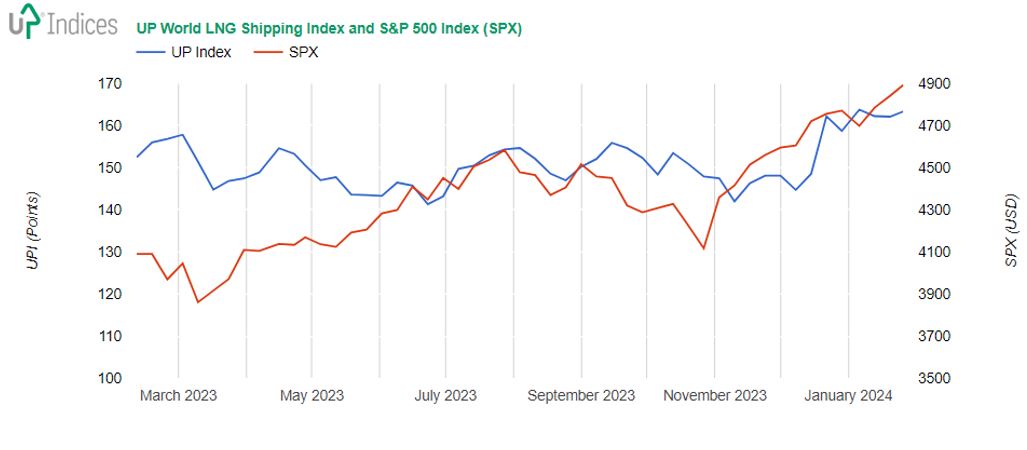

Last week, the UP World LNG Shipping Index (UPI) gained 1.22 points or 0.75%, closing at 163.28 points. This index tracks the performance of LNG shipping companies. The S&P 500 (SPX) index, representing U.S. stocks, experienced a gain of 1.06%. You can find both indices in the image below.

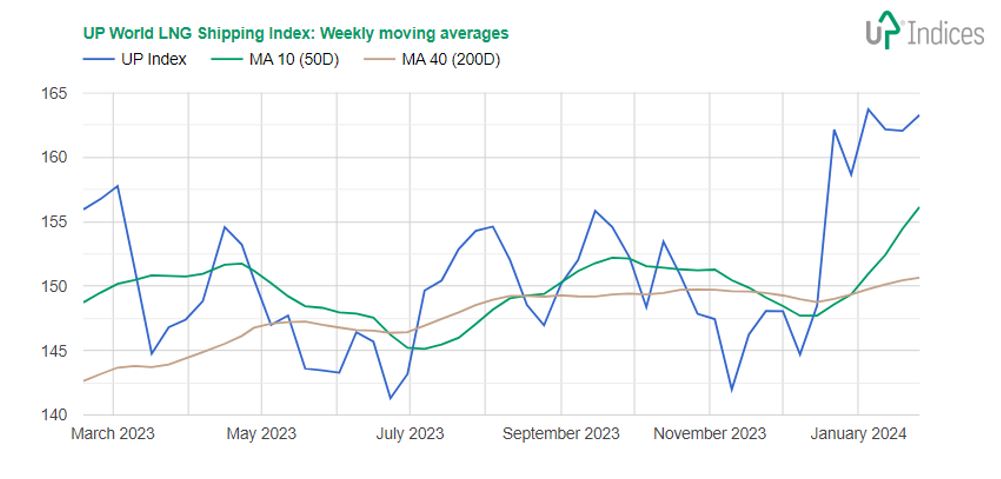

Week 5-2024: Chart of the UP World LNG Shipping Index with moving averages (Source: UP-Indices.com)

Today, we added a second chart to this weekly report. Moving averages cross into a bull signal as many constituents go sideways or decline. The slower MA 40 (equivalent to 200 days) is now lower than the faster MA 10 (equal to 50 days). What does it mean?

There is growing uncertainty among investors in LNG shipping as many UPI constituents are waiting for a new trend to emerge. Stocks of different companies have been rising one week and declining the next, making it difficult to predict market direction. However, there have been some promising signs of growth from a support line, which occurred frequently last week. As we noted previously, only four constituents are currently in an uptrend, which has not changed. Despite the small movements, the UPI is still trading at high levels, and the growth from the previous week may indicate a rapid upswing shortly. However, this is not entirely clear when looking at the development of individual constituents.

Week 5-2024: Chart of the UP World LNG Shipping Index with S&P 500 (Source: UP-Indices.com)

Last week, Chevron (NYSE: CVX) and Shell (NYSE: SHEL) experienced growth from the support line in gas and oil drilling. BP (NYSE: BP) returned to the range after a previous breakdown of the support line. CVX and BP gained around 5%, while Shell added 3.4%. Meanwhile, Excelerate Energy (NASDAQ: EE) has risen for the third consecutive week from its support line, gaining 4.2%.

Golar LNG (NASDAQ: GLNG) and Flex LNG (NYSE/OSE: FLNG) also rose in their ranges, with GLNG gaining 4.5% and FLNG growing by 3.5%.

However, Japanese companies NYK Line (TSE: 9101), MOL (TSE: 9104), and “K” line (TSE: 9107) weakened. This trio, plus Capital Product Partners (NASDAQ: CPLP), pushed UPI higher in previous weeks. CPLP also paused but still gained 0.8%

Korea Line Corporation (KSE: 005880) returned to the range, declining 14.2%. Dynagas LNG Partners (NYSE: DLNG) also returned to the range, losing 4.2%.

UP World LNG Shipping Index, established in 2020, is a rules-based stock index family designed to show and measure the performance of worldwide publicly traded companies involved in the maritime transport of liquefied natural gas (LNG). This unique index covers 18 companies and partnerships worldwide, like the USA, Qatar, Japan, Norway, South Korea, and Malaysia. The index covered over 65% of the world’s LNG carrier fleet in 2020. UP Index is a premium service. We offer freemium (the basic chart of the UP Index and S&P 500 index) and trial access to all charts.

Source: By Tomas Novotny, UP-Indices.com