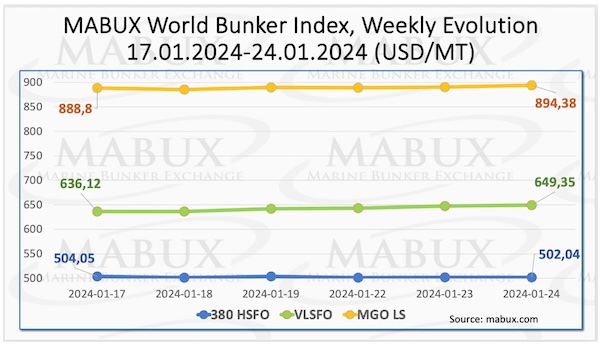

Over the Week 04, the MABUX global bunker indices continued irregular changes with no clear trend. The 380 HSFO index fell by 2.01 USD: from 504.50 USD/MT last week to 502.04 USD/MT, edging closer to the 500 USD threshold. Conversely, the VLSFO index saw an increase of 13.23 USD, reaching 649.35 USD/MT compared to the previous week’s 636.12 USD/MT. The MGO index also increased by 5.58 USD (from 888.80 USD/MT last week to 894.38 USD/MT). At the time of writing, there was still no clear trend in the market.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to widen: plus $15.24 ($147.31 versus $132.07 last week). The weekly average SS also increased by $10.18. In Rotterdam, SS Spread rose by $26.00 (from $102.00 last week to 128.00), surpassing the $100 mark, with the weekly average rising by $18.34. In Singapore, the 380 HSFO/VLSFO price difference expanded by $25 ($172.00 versus $147.00 last week), while weekly average surge of $28.33. The steady upward trend in SS Spread affirmed the increasing profitability of the HSFO+scrubber combination. More information is available in the “Differentials” section of mabux.com.

Benchmark gas prices in Europe hit a two-year low last week due to higher-than-usual inventories and reduced industrial gas demand. Despite the recent deep freeze across much of Europe and the temporary halt in Red Sea LNG traffic, the market remains well-supplied, ensuring ample natural gas in storage for the remainder of the winter season. As of January 16, European Union gas storage sites were at 77.9% capacity, significantly surpassing the 5-year average of 68% for this time of year.

The price of LNG as bunker fuel in the port of Sines (Portugal) sustained its downward trend, reaching 604 USD/MT on January 22 (minus 70 USD compared to the previous week). At the same time, the price gap between LNG and traditional fuel expanded further on January 22, standing at 263 USD in favor of LNG compared to 181 USD a week prior. On that specific day, MGO LS was priced at 867 USD/MT in the port of Sines. More information is available in the LNG Bunkering section of mabux.com.

During the 04th week, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in four selected ports: Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, Houston moved into the undervalued area, joining the other selected three ports. The weekly average underpricing increased by 21 points in Rotterdam, 11 points in Singapore, 7 points in Fujairah and 37 points in Houston. The MDI index in Fujairah consistently exceeds the $100 mark.

In the VLSFO segment, MDI indicated that Singapore, Fujairah, and Houston were in the overcharge zone, with Houston approaching a 100% correlation between market price and digital benchmark. Weekly average weekly overprice premiums increased by 14 points in Singapore, but fell 2 points in Fujairah and 4 points in Houston. Rotterdam remained the sole underpriced port in this bunker fuel segment, with the weekly average ratio increasing by another 3 points.

In the MGO LS segment, Fujairah has shifted to the undercharge zone, signifying the underestimation of this fuel type in all four selected ports. Average weekly premiums of underestimation increased in Rotterdam by 2 points, in Singapore by 10 points, in Fujairah by 19 points and in Houston by 3 points.

The overall dynamics of the MDI index in the world’s largest hubs indicate a gradual shift towards the underestimation of bunker fuel in the “market price-digital benchmark” ratio.

More information on the correlation between market prices and the MABUX digital benchmark is available in the “Digital Bunker Prices” section of mabux.com.

The Union Database for Biofuels (UDB), established under the auspices of the European Commission (EC), officially commenced online registration for biofuel stakeholders last week. This initiative, mandated by the 2018 Renewable Energy Directive, aims to enhance the traceability of biofuels, prevent double counting, and address concerns related to fraud within the industry. In an official statement, the EC highlighted its collaborative efforts with pertinent stakeholders and market players in developing the database. Furthermore, it announced the imminent opening of the registration process for gaseous renewable and recycled carbon fuels in the forthcoming months. The Union Database serves as a comprehensive global traceability tool, designed to monitor shipments of renewable and recycled carbon fuels along with the corresponding raw materials utilized in their production. This tracking spans from the origin of the raw materials to the stage at which fuels are introduced into the European Union market for final consumption.

SEA-LNG has highlighted a concern regarding the use of grey methanol, grey ammonia, and grey hydrogen as marine fuels, stating that they could result in higher greenhouse gas (GHG) emissions compared to the conventional marine fuels they aim to replace. According to SEA-LNG, the methanol, ammonia and hydrogen used by shipping will need to be green, or at least a blend with large volumes of green fuels, simply to achieve parity with VLSFO and comply with regulations such as FuelEU Maritime. The challenge lies in the fact that currently, these alternative fuels are predominantly sourced in fossil or grey forms, and the transition to sufficient quantities of green fuels within the maritime industry is expected to take time. In contrast, SEA-LNG emphasizes that the use of liquefied natural gas (LNG) as a marine fuel can yield immediate benefits, because even grey LNG offers a reduction in GHG emissions of up to 23%, after accounting for methane slip, for two-stroke engines. Moreover, further advancements can be realized by transitioning to bio-LNG and e-LNG.

We expect the global bunker market to maintain the potential for an uptrend in bunker prices next week.

Source: By Sergey Ivanov, Director, MABUX