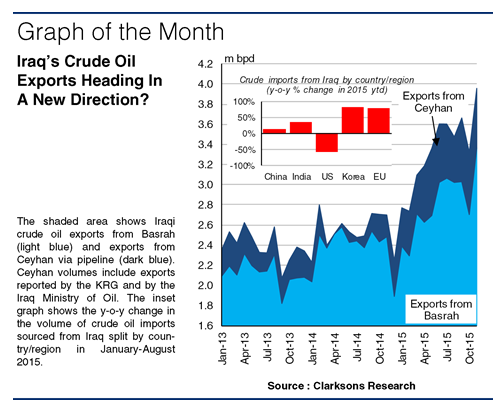

2015 has been a very positive year for Iraqi crude exports, with total volumes up by around 30% y-o-y in January to November. Total exports are expected to reach around 3.3m bpd in the full year, following much slower growth in 2014 and a decline in 2013. This year’s notable growth has

been achieved despite unrest, bottlenecks and weather disruptions, and exports could rise further next year.

Location, Location, Location

In January-November 2015, total crude exports from Iraq, OPEC’s second largest oil producer, averaged 3.3m bpd, up from 2.5m bpd in 2014. The increase has partly been driven by a rise in Iraqi oil output, which looks set to have grown significantly in 2015 to 4.1m bpd. A number of ‘supergiant’ oil fields are located in southern Iraq, away from much of the recent ongoing conflict in the North, allowing oil producers to ramp up output. Firm growth in exports can also be attributed to improvements in infrastructure and storage capacity at the Basrah Oil Terminal.

Furthermore, since June 2015, shipments have been bolstered by splitting out Basrah crude into two streams, light and heavy, in order to resolve quality concerns expressed by some importers earlier in the year. However, weather disruptions and bottlenecks remain an issue, which have limited export growth.

Taking To The North

The rise in Iraq’s crude shipments has not only been from the southern oil terminals. Exports via the Kirkuk-Ceyhan pipeline from Iraq’s northern oil fields recovered by almost four-fold y-o-y to average 0.5m bpd in January-November 2015, following damage to the pipeline in 2014 and upgrades in 2015 and despite some more recent attacks on the pipeline. Exports have also been boosted by the Kurdish Regional Government (KRG) increasing independent oil sales as part of efforts to reduce dependence on the Central Government for revenue. The recent surge in Ceyhan exports pushed total Iraqi exports up to almost 4m bpd in November. The KRG has indicated that it plans to raise Kirkuk exports to 0.9m bpd by the end of 2015.

Up, Up, Up…But To Where?

Trends in import demand in key crude importing nations this year have led to further shifts in the destination of Iraq’s exports. Imports into the EU rose 68% y-o-y to 0.4m bpd in the first eight months of 2015, supported by the low oil prices. Meanwhile, Iraqi shipments to both India and China grew notably to 0.4m bpd in the same period on the back of a continued expansion in Indian refinery capacity and the filling of China’s SPR, while exports to South Korea grew firmly to 0.2m bpd. Elsewhere, US imports from Iraq fell to 0.1m bpd, reflecting firm growth in domestic shale output.

So, Iraq’s crude exports recorded very firm growth in 2015 in spite of bottlenecks at Basrah, conflict in the North and budget disputes between the KRG and Bagdad. Iraq’s southern terminals are expecting a moderate rise in shipments to around 3.2m bpd in 2016, and there could be further growth in exports from the north. While the pace of growth in exports is likely to slow compared to this year, strong oil production is likely to support a continued higher level of exports.

Source: Clarksons