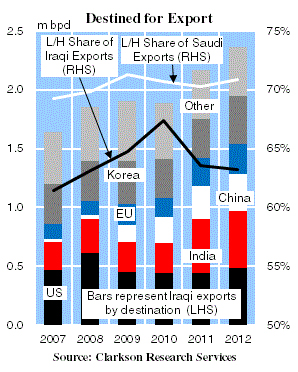

It is ten years since the invasion of Iraq. In that period, the country has undergone sizeable changes, not least to its oil industry. Crude production in 2013 is projected to reach 3.29m bpd, compared to a low of 1.32m bpd in 2004. Since 2007 crude exports have increased from 1.64m bpd to 2.36m bpd in 2012.

Catch the Dragon

Iraqi exports to the US and EU fell by 4.8% between 2007 and 2010 to 0.77m bpd, while exports to the Asian ‘Big 3’ of China, India and South Korea increased by 64.5% in the same period to 0.64m bpd. The share of long-haul (L/H) exports, those to the Far East and the US, from Iraq also increased. As shown on the Graph of the Month, this increased from 61.4% in 2007 to 67.4% in 2010. By comparison, the L/H share of Saudi exports in this period increased 1.5%. Iraqi exports to China, which increased to 0.23m bpd in 2010 from 0.03m bpd in 2007 (an increase in share of Iraqi exports from 1.7% to 11.9%) helped to support L/H growth and boost tanker demand.

Short and Sour

In 2011, crude exports from Iraq increased further, rising 14.5% y-o-y. This was driven by growth in Indian imports, which firmed 79% y-o-y to 0.46m bpd. Starting with the opening of the Jamnagar plant in 2009, Indian refinery capacity grew 46.1% between 2009 and 2012. As a result, the Indian share of Iraqi exports increased from 13.5% in 2009 to 21.2% in 2011. While this supported the tanker market, the relatively short distance between the Middle East Gulf and India limited the impact of the added volumes on tanker demand. The L/H share of Iraqi exports did decline to 63.6% in 2011, though Korean exports grew 51.4% y-o-y, limiting the decline in L/H share.

Share and Share Alike

Iraqi crude exports increased 9.2% y-o-y in 2012, driven by an increase in production (10.5%), as well as the US embargo against Iranian crude exports. Iraqi exports to Europe increased 23.8% y-o-y in 2012. Coupled with a 17.8% y-o-y decline in Kirkuk-Ceyhan pipeline exports in 2012, this has led to more crude cargoes travelling further (through the Suez Canal and round the Cape), helping to absorb tonnage. However, while eastbound exports increased 8.2% y-o-y, growth was limited by the impact of US embargo waivers, allowing countries to continue importing crude from Iran. While the waivers were not specific, extensions by the US were dependent on the receiver country cutting imports by an appreciable amount. Thus, China cut Iranian imports 21.0% y-o-y in 2012, and had its waiver extended. This effectively limited the opportunity for Iraqi crude exports to further displace Iranian market share.

Despite this, the combination of firming Iraqi output and increasing exports has generated significant crude tanker demand since the fall of Saddam Hussein. However, the surge in short-haul volumes to India muted the boost in tanker demand, and reduced the share of L/H cargoes. Nevertheless, Iraqi production is projected to increase 11.5% y-o-y in 2013, while exports are expected to rise 14.4%. Therefore, Iraq is likely to continue to increase its presence in the global oil market, offering continued support to crude tankers.

Source: Clarksons