This report examines U.S. refinery outages planned for the fourth quarter of 2015 and the implications for available refinery capacity, petroleum product markets, and supply of gasoline, diesel fuel, and heating oil. Dissemination of such analyses can be beneficial to market participants

who may otherwise be unable to access such information.

This issue of the refinery outage report uses the same methodology as the First-Half 2015 issue and focuses on how planned refinery outages may affect the adequacy of regional distillate fuel and gasoline supplies, as defined by Petroleum Administration for Defense District (PADD) areas. Therefore, this report does not include a discussion of national-level balances.

Planned refinery maintenance during the fourth quarter of 2015 is not expected to adversely affect the supply of gasoline and distillate. The effect of refinery outages on product supplies depends on many factors, including petroleum product demand, the availability of product supplies from available refinery capacity, inventories, imports and redirected exports, as well as actual levels of both planned and unplanned refinery outages. Barring unusually high unplanned outages, planned outages that extend beyond the planned period, or higher-than-expected demand, supply of gasoline and distillate should be adequate in all regions during the fourth quarter.

Demand for distillate (diesel fuel and heating oil) in the United States through the first half of 2015 averaged 4.1 million barrels per day (b/d), an increase of 4,000 b/d (0.1%) year-over-year. EIA's October Short-Term Energy Outlook (STEO) expects distillate demand to average 4.1 million b/d in the fourth quarter of 2015, and to remain at that level through 2016. However, colder-than-expected winter temperatures could cause distillate demand to be higher than expected in New England (PADD 1A) and in the Central Atlantic (PADD 1B) states.

U.S. gasoline demand is typically lower in the winter; it increases in the spring as the driving season begins. Through the first half of 2015, U.S. motor gasoline demand averaged 9.0 million b/d, a year-over-year increase of 266,000 b/d (3%). EIA's October STEO expects gasoline consumption to average 9.3 million b/d and 9.1 million b/d in the third and fourth quarters of 2015, respectively.

Like the First Half 2015 issue, this edition of the report considers the supply of distillate fuel and gasoline supply on regional (both PADD and sub-PADD) levels, rather than at a national level. National balances have very limited meaning for the adequacy of distillate fuel and gasoline supply because pipeline infrastructure, geography, and marine shipping regulations constrain the amount of product that can flow among the different regions of the United States.

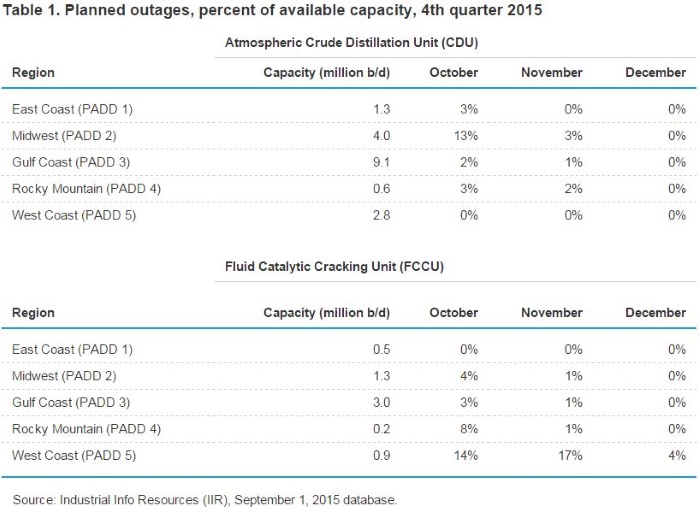

Across the country fourth-quarter 2015, planned refinery maintenance on atmospheric crude distillation units (ACDU) and fluid catalytic cracking units (FCCU), two refinery units that are strongly associated with distillate and gasoline production, during the fourth quarter of 2015 is concentrated in October. Table 1 provides a monthly summary by PADD of the percentage of available refining capacity expected to be out of service for maintenance during the fourth quarter of 2015.

Planned maintenance in PADD 1 (East Coast) is light, with no FCCU work scheduled as of the start of September and ACDU maintenance planned only for October. East Coast gasoline inventories have been above the five-year range in all but one week since mid-December 2014, and given the availability of gasoline supply to the region from the global market, gasoline supply should be adequate to meet demand. PADD 1 distillate inventories have been above the five-year average since July.

Planned maintenance in PADD 2 (Midwest) is concentrated in October, when an average of 535,645 b/d of ACDU capacity is expected to be offline. This level of planned maintenance is significantly higher than the 10-year average and exceeds the 10-year maximum. November ACDU planned maintenance, at 110,400 b/d, is lower than the 10-year average and the 2014 level. There is no planned ACDU maintenance in December as of the writing of this report. Supplemental supply of gasoline and distillate from the Gulf Coast should be available, if needed. However, the time required for resupply to reach the Midwest from the Gulf Coast does vary considerably across the region because of its size. Resupply can reach Oklahoma, Kansas, and Missouri from the Gulf Coast within 7-10 days, but it may take close to 30 days to reach the northernmost states at the end of the supply line. Fourth-quarter planned FCCU maintenance in PADD 2 is minimal, with 8,533 b/d offline in November.

In PADD 3 (Gulf Coast), very little FCCU and ACDU maintenance is planned for fourth quarter 2015. Last year, both FCCU and ACDU maintenance levels were elevated in October, setting 10-year highs. In 2015, planned maintenance is below average in October and November, and no planned maintenance is scheduled for December as of the writing of this report. As Gulf Coast gasoline inventories are above the five-year average (76.9 million barrels as of October 2), supply of gasoline should be adequate. Distillate inventories are also ample, near the five-year average and above both 2014 and 2013 levels. In addition, substantial volumes of gasoline and distillate are exported from the Gulf Coast. Exports generally act as a stabilizer in U.S. product markets, similar to inventories, as they can be diverted to domestic markets if product balances tighten.

There is little maintenance planned for PADD 4 (Rocky Mountain), and inventories of gasoline and distillate are above the five-year average. As a result, supply is expected to be adequate.

PADD 5 (West Coast) planned ACDU maintenance is minimal over the period, but planned FCCU maintenance in October and November is more than 50,000 b/d higher than the 10-year average and more than 25,000 b/d higher than the 10-year maximum. The ongoing unplanned FCCU outage following the February 18 explosion at the ExxonMobil refinery in Torrance, California, has continued to put upward pressure on gasoline prices in the region. Imports of total motor gasoline to California ranged between 28,000-68,000 b/d in March through July, compared with an average of 5,000 b/d in 2013-14. Further outages, either planned or unplanned, would exacerbate the supply situation. PADD 5 gasoline inventories declined steadily during the summer driving season, reaching a multiyear low of 25.7 million barrels on August 21. Since then, gasoline inventories have rebuilt and are now in the five-year range and have been above the five-year average since September 11. Distillate inventories have been above the five-year average for much of the year.

Summary findings for each region (PADD) of the country are provided in the next section. Current market conditions, more detailed discussions of refinery maintenance in each region, and a discussion of other factors that affect the market are provided in subsequent sections. Additional data for planned maintenance on catalytic reforming units (CRU) and hydrocracking units (HB) are provided in Chapters 5-9.

Full Report

Source: EIA