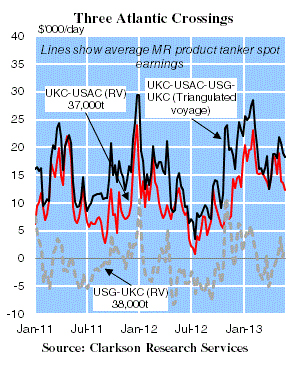

A shipowner generally tries to maximise his opportunities for laden voyages. Thus, along with round voyages (RVs), ‘triangulated’ routes have often emerged. One of the most liquid is the middle distillate MR triangle between the EU and the US.Graph of the Week-Point to Point:

The triangle is possible due to the different car markets on either side of the Atlantic. EU cars are increasingly fuelled by diesel, while those in the US largely use gasoline. Therefore refineries in the EU and US create gasoline and diesel surpluses respectively. In 2012, 0.28m bpd of gasoline was exported from the UKC to the US, while 0.22m bpd of diesel moved the other way. The Graph of the Month shows average MR spot earnings on the triangulated voyage, based on standard vessel and voyage assumptions. Earnings on the two component RV routes are also shown, although it should be borne in mind that generally the fronthaul UKC-USAC route remains much more liquid than the backhaul USG-UKC. Earnings on the triangulated UKC-USAC-USG-UKC route have been consistently higher than on the fronthaul and backhaul RVs: the differential between the triangle and the UKC-USAC route averaged $4,941/day in 2012.

A Love Triangle

What separates the earnings on the triangulated voyage from the fronthaul RV? The most important factor is the reduction in ballast time. On a RV, the ballast distance is the same as the laden, which for the UKC-USAC route stands at approximately 3,400 miles. By contrast, the ballast part of the triangulation is only around 2,000 miles, 20% of the total distance. Comparing the three routes, the average cost in 2012 of bunkers as a share of freight stood at 46% for the triangle, 55% for the fronthaul and 91% for the back-haul round voyage.

Acute Opportunities

MR product tanker earnings on the fronthaul leg of the triangle are also driven by the gasoline arbitrage window between Rotterdam and Houston gasoline prices. When the former (plus freight) is cheaper per barrel than the latter, one might expect to see an increase in cargoes. Generally, the opening of the window is good for MRs, generating increased demand and improving earnings. Between February and April 2013, the window averaged $2.03/bbl, while earnings averaged $19,209/day, an increase of 41% compared to the same period in 2012, when the arbitrage window was closed. However, the opening of the window has not always been beneficial: between June and July 2012, the brief opening of the window led to a flood of tonnage entering the UKC, causing the freight rate on the fronthaul route to fall by 21% m-o-m, leading to earnings declining to an average of $2,268/day in July.

Undoubtedly, this Atlantic triangle has helped reduce owners’ exposure to weak market conditions and high bunker prices. But it is no panacea, and market conditions for MR owners operating in the Atlantic remain weaker than pre-recession. Yet the triangle represents a good option in a market with gradually improving fundamentals, and has helped to generate some optimism in the MR product tanker market.

Source: Charles Mantell, Clarksons