Petrofin Research© presents, for the 22nd year running, an overview and an in-depth analysis of the bank loan portfolios to Greek shipping, as of 31st December 2022. Petrofin wish to thank all participating banks for their steadfast support, without which this research would not have been possible. The portfolios show both the shipping loans outstanding, as well as loans committed but undrawn. The committed but undrawn loans may be viewed as an indication of each bank’s ship lending momentum and / or the extent of its involvement in newbuilding finance.

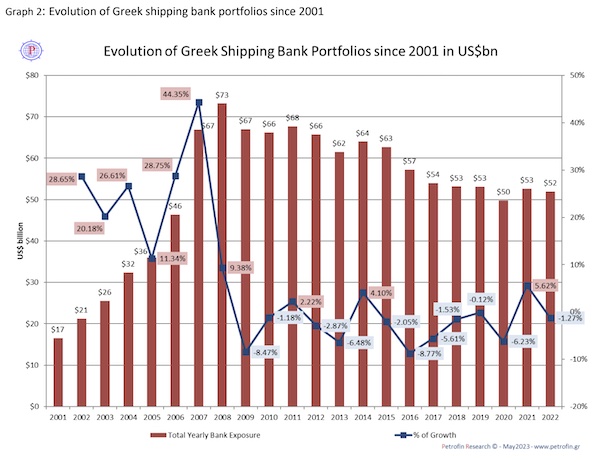

Bank shipfinance for Greek shipping has decreased during 2022 by 1.3%. The overall Greek loans (both drawn and committed but undrawn) booked both in Greece and worldwide as of 31/12/2022 are down to $51,909.77m, compared to $52,580.03m in 2021, $49,794.51m in 2020, $53,107.8m in 2019, $53,176.32m in 2018, $53,994.96m in 2017 and $57,211.35 in 2016.

* The Petrofin Index for Greek Shipfinance, which commenced at 100 in 2001 and peaked at 443 in 2008, shows a downward curve to 314 in 2022 from 318 in 2021. In the last 14 years the portfolio has reduced by 22.58%.

* International Banks without Greek presence showed the highest growth among the 3 bank groups with 5.66% increase in portfolio. The benefits of having a local presence have reduced over the years in light of efficient telecommunications while the costs of local presence have increasingly come under scrutiny.

* Greek banks show a moderate rise of 3.7% in 2022, compared to a more dynamic 14.2% growth in 2021. The upward trend continues uninterrupted since 2017.

* International banks with a Greek presence marked a significant reduction of 17.51% in 2022, after 2021’s small growth of 3% which had followed the significant drop of 19% in 2020.

* Drawn loans are down by 2.69% compared to 2021’s growth of 5.2%. Significantly, Commitments are up by 22.43% in 2022, continuing their growth of 2021 of 12.5%.

* The number of banks involved in Greek shipfinance has gone down to 50 from 56.

* Credit Suisse’ last entry in our research remains in the top position with a further portfolio reduction of 1.79% in 2022 following the portfolio reduction of 12.5% in 2021. The future of its loan portfolio is under internal review.

* The top 10 Greek ship financing banks stood at US$32.1m in 2022, compared toUS$30.45bn in 2021 marking growth of 5.4%. Their market share is up at 62%, compared to 57.9% in 2021 and 58.25% in 2020.

* The steady decrease of European banks’ exposure has resumed and now they own 72.89% of market share, compared to 74.33% in 2021, 73.84% in 2020, 75.8% in 2019, 76.9%, in 2018, 78.70% in 2017, 81.04% in 2016.

* The Lead Managers’ total is up by 12.61% in 2022, compared to a decrease of 5.29% in 2021.

* Forward commitments to newbuildings increased by 73% in 2022, compared to a decrease of 36.77% in 2021.

* The rise of western currency interest rates has accelerated loan prepayments. Loan production has increased for most banks but many ‘are running to keep still’.

* Cash flows for most shipping sectors increased in 2022 and owners used this liquidity in part to prepay loans.

* Greek banks’ appetite to increase their loan portfolios remains high. However, many clients are adopting a ‘wait and see’ attitude towards newbuilding orders in anticipation of new technology in the years to come, content to be building up their liquidity.

The future of Credit Suisse’s Greek portfolio is uncertain.

HSBC has announced its withdrawal from Greek ship finance and its presence in Greece and already part of its portfolio has been committed to be sold to other banks. It is likely that next year Greek banks shall be the largest lenders with 4 entries in the top 10 banks. Comparing 2022 to 2021, 9 banks have increased their loan portfolios and 16 banks have showed reduction (not including the banks under the OTHER BANKS category, further down).

Source: Petrofin Research©, By Ted Petropoulos, Head, Petrofin Research©