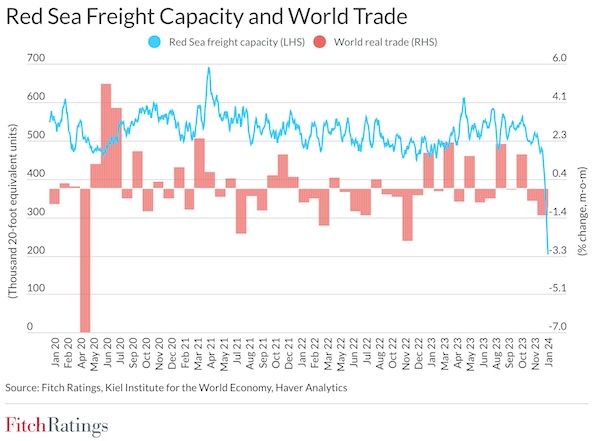

Reduced shipping via the Red Sea and re-routing around Africa following attacks on commercial ships has led to volumes being redistributed from ports in the affected area to terminals in the UAE and Africa, Fitch Ratings says. Larger operators with geographically diversified portfolios are less affected than single-asset regional operators, which may suffer volume losses from reduced services due to the disruptions.

Re-routing and a decline in shipping capacity between Europe and the Far East are leading to losses in volumes for the ports on the Red Sea coast and near the Suez Canal, and creating congestions in the terminals alongside alternative routes. Transhipment volumes of port operators in Egypt, Saudi Arabia and Turkiye are particularly affected, while origin and destination (O&D) shipments are more stable, supported by transportation demand from hinterland areas that are difficult to satisfy using alternative routes.

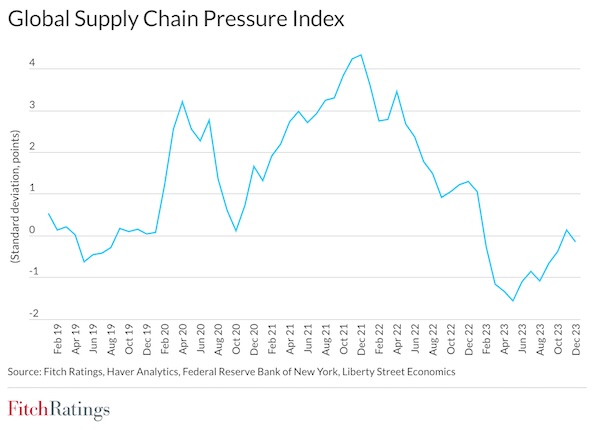

The scale of shipping disruptions is smaller and more localised than that seen during the pandemic, when port congestions were spread globally, while demand for goods was very high. We assume that the disruptions will be temporary, as the importance of the Red Sea trading route is globally recognised and a US-led coalition is trying to establish safe transit for commercial ships in the area. However, a period of prolonged disruptions, which is not our base case, may lead to greater supply-chain pressures and more severe operational consequences. This may require adjustments from port operators, including changes in capital expenditure, depending on location.

In our rated EMEA portfolio, large and well-diversified operators, such as DP World, are less affected by the disruptions, with volume declines in the ports of Sokhna (Egypt) and Jeddah (Saudi Arabia) offset by increased volumes in Jabel Ali (the UAE) and African ports. DP World has significant flexibility in adjusting its capital investments in case of longer-than-expected disruptions.

Singe-asset port operators in the eastern Mediterranean are most affected. Mersin’s transhipment volumes have come under pressure, while O&D freight volumes are resilient. In case of prolonged disruptions, import cargo can be transported to Mersin via transhipment ports in the region, such as Piraeus in Greece and Valletta in Malta, with feeders instead of main liner services or vice versa. LimakPort in Turkiye estimates its loss linked to suspended services by shipping lines due to the disruptions at about 15% of monthly volumes. However, the company expects this loss to last for only two or three months as, even if the disruptions persist, these volumes can be replaced by those from alternative routes and services calling at LimakPort.

Unlike flexible shipping freight rates, port prices are contracted with shipping lines for 12 to 18 months, and do not change quickly if volumes for certain ports increase. However, in-demand and congested ports could increase their revenue from storage fees, similar to the 2021-2022 congestion.

Source: Fitch Ratings