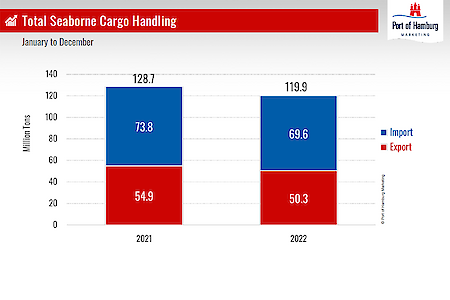

In 2022, international crises impacted the Port of Hamburg’s seaborne cargo throughput. Hamburg terminals handled 119.9 million tons, or 6.8 percent less than in the previous year. With growth of 11.2 percent to 1.4 million tons, the trend for conventional general cargo was positive. Yet handling of general cargo was 5.8 percent down at 83.7 million tons. At 36.2 million tons, throughput of bulk cargoes in the port was 8.9 percent lower. “The war in Ukraine plus the related sanctions against Russia, along with worldwide supply chain problems caused by the corona pandemic, impacted Port of Hamburg throughput during the year. This was compounded by labour disputes in the port at the beginning of the second half of the year and very high inflation in the course of the autumn, which caused consumer spending to fall to a low point,” explained Axel Mattern, Port of Hamburg Marketing’s CEO. Lower volumes of bulk cargo are both directly and indirectly attributable to stiffer sanctions against Russia. Falls occurred in both suction cargo – down 6.0 percent at 6.0 million tons and grab cargo – 6.3 percent lower at 20.2 million tons – as well as liquid cargo – down 15.2 percent at 10.0 million tons.

Whilst taking downturns last year in bulk cargo handling, the Port of Hamburg is in the process of preparing for new products and volumes. Its transformation into a cutting-edge energy hub has already commenced. In February 2022 we signed an agreement with Air Products, the world’s largest hydrogen producer, providing for exploration of the opportunities for building up a comprehensive hydrogen added value chain throughout the Port of Hamburg. In November, Air Products and Mabanaft announced that Germany‘s first large import terminal for green hydrogen would be built on Oiltanking Deutschland’s site in the port. With this, the Port of Hamburg will be playing a pioneering role in hydrogen imports and helping ensure supplies for Germany,” said Friedrich Stuhrmann, CCO of der HPA – Hamburg Port Authority. By constructing shore power supply units at both cruise and container terminals, HPA will be well on the way to becoming a climate-neutral port, added Stuhrmann.

Container throughput maintains position vis-à-vis North Range ports

A total of 8.3 million TEU – Twenty-foot Equivalent Units – crossed quay walls in the Port of Hamburg last year, or 5.1 percent fewer than in the previous year. A quarterly comparison reveals a positive trend in the first half. Down by 12.3 percent, throughput fell steeply in the fourth quarter, however. “With Christmas coming, in the final quarter we should normally see a rise in throughput totals. That failed to happen last year. The main reasons were high energy costs and inventories in industry,” explained Mattern. At 4.2 million, seaborne container imports were consequently 6.1 percent lower. For comparison, 4.1 million TEU were exported, a 4.1 percent fall on the previous year.

China remains No.1 trading partner by a wide margin

The 2022 list of our Top Ten partner countries produces a few pleasant surprises. At 294,000 TEU, throughput with Poland was up by almost 25 percent, putting the country in fourth place. Throughput trends with Finland were similarly positive, a 22.3 percent gain to 213,000 TEU putting the country into sixth place. There was a further positive signal from Canada, with throughput up by 6.6 percent to at least 196,000 TEU and advancing the country from twelfth into ninth place.

Last year, 8.3 million TEU (Twenty-foot Equivalent Unit) passed over the quays in the Port of Hamburg.© HHM / Hasenpusch Productions

In 2022 China again headed the list of Top Ten partner countries with 2.46 million TEU – down by 3.8 percent. The USA followed in second place with 605,000 TEU, representing a fall of 2.1 percent. Nevertheless, the total number of loaded boxes in container traffic with the USA rose by 0.6 percent to 540,000 TEU. Singapore retained a steady third place with 423,000 TEU – down 1.1 percent.

Both Sri Lanka and Malaysia were encouraging elements in the extended list of partner countries. Malaysia climbed to thirteenth position with a 10.7 percent increase to 177,000 TEU, while Sri Lanka took seventeenth place with one of 8.8 percent to 128,000 TEU. While in the previous year Russia had been in fourth position as a top partner, in 2022 throughput of around 80,000 TEU still sufficed for twenty-seventh place.

Further increase in calls by Megamax containerships

With capacities of over 18,000 TEU, vessels in the ‘Megamax’ class made 234 calls in Hamburg, or six percent more than last year. “The growing number of Megamax containerships clearly indicates further acceptance of the fairway adjustment, even with its depth temporarily reduced. Shipping companies have rapidly adapted to the new conditions,” said Mattern. A five-percent increase also occurred in calls by the second largest category – vessels between 14,000 and 17,999 TEU. Yet those by ships with between 10,000 and 13,999 TEU decreased by 16.6 percent. The total number of calls by ‘large containerships’ therefore fell by 1.2 percent to 486.

Calls by medium-sized containerships with capacities of between 8,000 and 9,999 TEU, or VLCCs – Very Large Container Ships, grew by eleven percent. In the second half, especially, it was only small containerships and feeder vessels that were arriving in the port less often.

Hinterland services remain stable

Closer scrutiny of the container throughput totals reveals that transhipment trades were over 90 percent responsible for the decline there. Throughput dropped by 12.1 percent to 2.90 million TEU. Hinterland trades remained almost stable, with volume down by only 0.9 percent to 5.4 million TEU.

Rail retained its lead in the modal split on hinterland services. More than half of all containers were still being shifted by rail. At 50.5 percent – down 1 percentage point, the overall result may be slightly negative. Shifting 2.7 million TEU, however, rail remains the top mode of transport for the hinterland. Despite the 2.8 percent downturn, in this segment rail achieved the second-best annual result in its history.

Tonnage totals for the modal split for hinterland services reveal that rail actually achieved a 1.1 percentage-point advance, transporting 53.9 percent of freight. After 2021 and 2019, at 47.3 million tons, this was the third highest total ever for rail.

Prospects for 2023

The continuing uncertain situation on world markets makes it hard to deliver a forecast for the year 2023. “We hope the global economy will again recover. That will aid and boost throughput for the Port of Hamburg,” concluded HHM’s CEO Axel Mattern. Simultaneously, all players in the Port of Hamburg will actively be working in parallel on its transformation into an efficient, climate-neutral and state-of the-art port.

Source: Port of Hamburg