Diesel demand in the U.S. Gulf Coast (PADD 3) has shown remarkable year-on-year growth in 2017 and 2018, according to Genscape Supply Side data, linked to the resurgence in Permian Basin crude oil production. However, this year-on-year diesel demand growth slowed in May and June as rig counts flattened. For the remainder of 2018, additional crude oil production growth should continue to support PADD 3 diesel demand increases above 2017 levels per Genscape’s U.S. Crude Production Forecast.

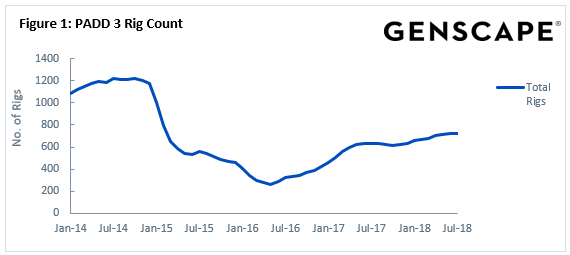

While diesel is primarily used in the U.S. for commercial trucking and some passenger vehicles, it is also a key fuel for crude oil exploration and production activity. Diesel-powered trucks transport equipment, water, and frac sand to rigs and to transport crude oil to gathering hubs. Diesel is also important for completion operations that power frac fleets and drilling operations to run rig generators. Since the bottom in rig count in May 2016 at 262 rigs, PADD 3 rig count increased by 464 rigs to average 614 rigs in July, according to RigData. The region currently accounts for 65 percent of total U.S. drilling activity with the majority of activity centered in the Permian Basin. Eagle Ford activity also increased with rigs climbing from 40 at the bottom to 122 as of week ending July 27.

U.S. Gulf Coast PADD 3 total rig count year-over-year (Source: RigData)

From January 2017 through March 2018, diesel demand in PADD 3 showed double digit growth relative to the previous year. According to Genscape Supply Side and EIA Prime Suppliers data this is driven by the rapid increase in drilling activity. December showed the largest increase in year-on-year PADD 3 diesel demand growth, 25.8 percent above 2017 levels. This was due to increased Permian and Eagle Ford drilling activity and a lack of freeze-offs in December Permian Basin crude oil production compared to 2017.

Monthly data of PADD 3 diesel demand year-over-year change compared to EIA PADD 3 Diesel 2017 and 2018

This trend in diesel demand growth slowed in May and June, according to an analysis of Genscape Supply Side monthly data. Year-on-year demand growth rates for those two months slowed to 5.04 percent and 5.11 percent, respectively, relative to 2017 EIA Prime Suppliers data.

In May a decrease in drilling activity in the Permian likely caused this temporary stall in diesel demand growth, as illustrated in Figure 3. From January to April, nine rigs per month were added to the Permian Basin, however from April to May, the rig count did not see an increase month-over-month, remaining flat at 437 active rigs, according to RigData. In June, rig activity picked up again, climbing to average 455 rigs, an increase of 18 rigs from May. There was also a corresponding reduction in production growth, according to Genscape, with production climbing on average 88,000 bpd month-over-month from January to April, while from April to June that growth slowed to average just 73,000 bpd month-over-month. Field maintenance and the beginning of bottlenecks in outbound pipeline capacity likely contributed to the May and June slowdown.

Monthly data of PADD 3 diesel demand year-over-year change and rig counts (Source: Genscape, Rig Data)

Based on current oil and gas prices and the economics of the Permian and Eagle Ford plays, rig activity should continue to grow, increasing by 68 to 794 rigs by December 2018, further increasing demand for diesel used in drilling and completion operations, according to Genscape (Figure 3). PADD 3 crude oil production is also expected to continue its growth trend, increasing from 7mn bpd in July to nearly 7.5mn bpd by year end. Since the bottom in September 2016 at 5.3mn bpd, production in PADD 3 has grown by just over 1.7mn bpd to average 7mn bpd, which accounts for 65 percent of total U.S. production as of July. Genscape forecasts the Permian Basin will account for nearly all the growth in the PADD 3 market.

This expected increase in drilling activity and crude oil production is already evident in PADD 3 diesel demand. July PADD 3 diesel consumption hit 1.032mn bpd, 12.26 percent above 2017 EIA Prime Supplier levels (Figure 3), according to Genscape Supply Side data. This aligns with the increase in Permian rig counts, increasing by eight rigs in June to 463 in July for the basin.

With this burgeoning growth in drilling activity and crude oil production in PADD 3, the need to transport crude from a wellsite to long-haul pipelines to carry the crude to a market has increased. Recently, the growth in production caused transportation constraints on pipelines out of the Permian resulting in a need for rail as an alternative form of transportation. Rail transportation also contributes to the increased in diesel demand in the region. Pipeline constraints out of the Permian Basin are not expected to be alleviated until late 2019 and into 2020, supporting higher demand for truck and rail transportation over the next year.

PADD 3 crude production growth from 2014-2019 by region

Source: Genscape Inc.