Wood Mackenzie's annual Global Upstream Cost Survey results show, across the industry, cost increases are back. Most respondents expect the next 12 months to be a period of growing costs. This isn’t particularly surprising given the depth and duration of the oil price crash. However, there are indications that the scale of imminent cost increases is out of kilter with assertions from operators that “lessons have been learnt” and that low prices from suppliers have been “locked in”.

What our survey asked

We asked the industry about changes in spending levels over the past year and expectations for next year. We also asked about the various approaches taken to managing costs in the past year and the activities put in place to control future costs. This year we also asked a new question on the internal cost management practices that respondents were able to see within their organisation.

What were the main findings?

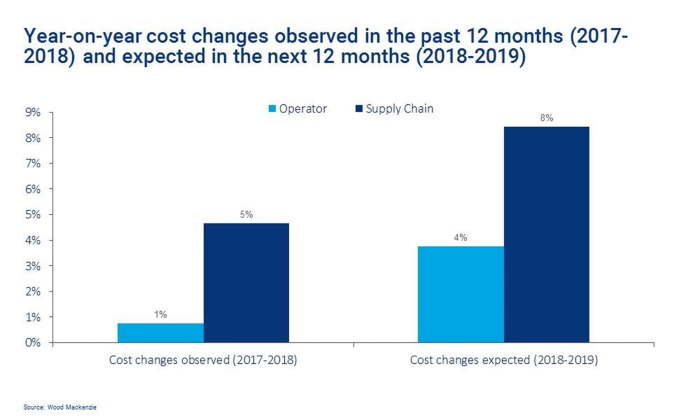

Overall the results highlighted the consistent expectation, from both operators and the supply chain, that costs will rise over the next 12 months. There was, however, a clear difference in expectations as to the level of these increases. Operators expect an average cost increase of 4% whereas respondents from the supply chain anticipate costs growing by 8%. Which position prevails will have a material impact on the sector's performance.

How accurate were last year’s predictions?

Respondents reported some level of cost increases over the previous 12 months. Suppliers in particular reported having observed prices beginning to rise already. While the cause of these results is uncertain, there is little doubt that the previous 12 months have not matched the expectations of our survey respondents from 2017. Last year's survey showed that across all of the eight major cost categories tracked, respondents expected to see continued cost reductions between 2017 and 2018. In fact, costs were observed to have stayed flat or marginally increased across almost all cost categories between September 2017 and September 2018.

An evolving story

The forward looking view of costs has also evolved significantly from previous years. For the first time respondents gave a consistent expectation of cost increases across all cost categories. This view was shared by operators and suppliers with suppliers consistently expecting a higher level of cost inflation in the next 12 months, regardless of category.

And some of the anticipated rises in costs are substantial. For example, on average suppliers expect costs on rigs, drilling, logging and completion, and costs for well services to grow by 11%. This would represent a substantial reversal of the achieved cost reductions since 2014. The rapid pace of these changes in cost expectations means operators must ensure they have robust internal practices to manage the increasing upward cost pressure.

The consistent message seen in the results of the Cost Survey, and in the cost models developed by PowerAdvocate, is that inflation has already returned to upstream.

The response to the oil price crash had a dramatic effect on both capital and operating costs; nowhere is this more visible than in major equipment and service categories for operators in the Lower 48. Cost analysis by our sister company PowerAdvocate shows how rapidly operators moved to push suppliers to absorb some of the pressure put on operators' bottom lines.

We ask a consistent set of questions regarding the approaches operators and suppliers have taken to lowering their costs so that comparisons with previous year’s results are possible. Fill out the form to receive the full results, including comparisons to responses from 2015 and a Case Study on Costs in the Lower 48.

Source: Wood Mackenzie