The Board of Directors (the "Board") of China Merchants Holdings (International) Company Limited (the "Company", HKSE Code: 0144) is pleased to announce the interim results of the Company and its subsidiaries (the "Group") for the period ended 30 June 2015.

Mr. Li Jianhong, Chairman of the Board, said, "Benefited by contribution from overseas ports, in particular the Sri Lanka project, container throughput handled during the first half of 2015 rose 5.3% year-on-year to 41.35 million TEUs. Notwithstanding the challenging external environment where global economy is growing at a slower than expected pace and where China's trade growth is decelerating, profit from the Group's core ports operation continued to expand steadily, as contributed to, on one hand, the Group's dedicated efforts in facilitating the transformation and upgrade of its terminals, which helped in optimizing resources allocation, improving asset's efficiency, synergizing existing operations and encouraging innovation; and on the other, factors such as the increasing investment return derived from the Group's overseas ports."

Profit attributable to equity holders of the Company amounted to HK$2,781 million for the six months ended 30 June 2015, an increase of 29.4% over the same period last year, while recurrent profit attributable to equity holders of the Company grew 17.1% year-on-year to HK$2,466 million. Basic earnings per share increased by 8.5% year-on-year to 90.54 HK cents, while profit derived from the Group's core ports operation increased by 10.4% year-on-year to HK$2,413 million.

For the period under review, revenue (Note 1) generated from the Group's core ports operation amounted to HK$10,746 million, up 4.7% year-on-year. Ports operation recorded an EBITDA (Note 2) of HK$5,420 million, and an EBIT (Note 3) of HK$3,931 million, representing a year-on-year increase of 3.8% and 2.1%, respectively.

Port-related manufacturing operations of the Group has demonstrated a stable performance overall. China International Marine Containers (Group) Co., Ltd. ("CIMC") sold a total of 0.82 million TEUs of dry cargo containers and reefers in the first half of 2015, or an increase of 18.2% comparing to that of the same period last year. Thanks to the profit growth of its other businesses, CIMC contributed to the Group an EBIT of HK$711 million, up 46.6% year-on-year.

To reward shareholders for their continuous support, the Board proposed an interim dividend of 22 HK cents per ordinary share (interim dividend for 2014: 22 HK cents), translating into a dividend payout ratio of 20.5%. Shareholders may elect to receive the interim dividend in cash or by way of scrip dividend.

The Group maintained its leading position amongst China port operators

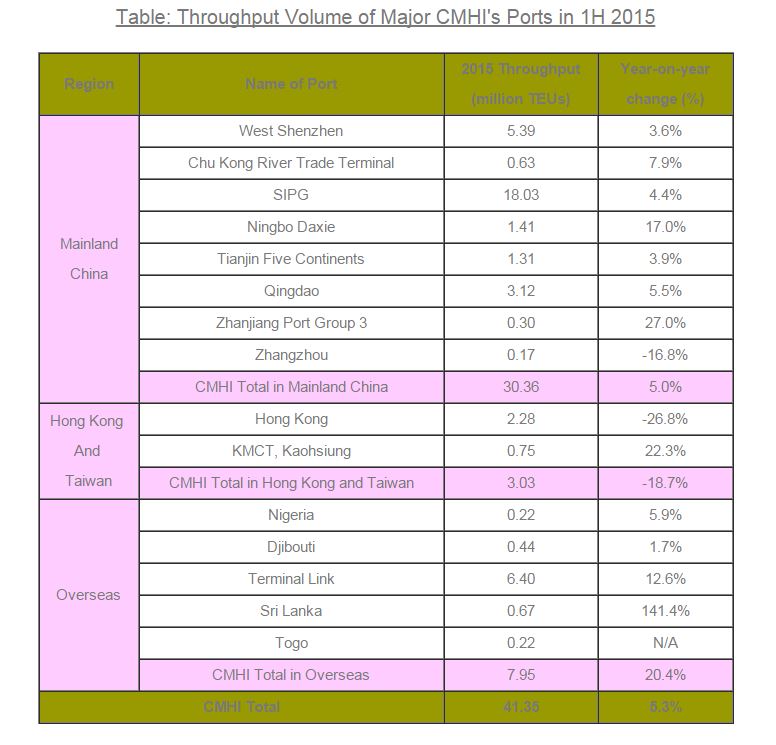

Container throughput handled by the Group's ports during the first half of the year amounted to 41.35 million TEUs, up 5.3% year-on-year, amongst which, the Group's ports in Mainland China delivered container throughput of 30.36 million TEUs, or an increase of 5.0% year-on-year, enabling the Group to sustain its leading position amongst China port operators. The Group's operations in Hong Kong and Taiwan delivered an aggregate container throughput of 3.03 million TEUs, a decline of 18.7% over the same period last year. Container throughput handled by the Group's overseas projects grew by 20.4% year-on-year to 7.95 million TEUs, as rapid business growth was seen at Colombo International Container Terminals Limited ("CICT").

Bulk cargo volume handled by the Group's ports decreased by 3.9% year-on-year to 174 million tonnes, within which bulk cargo handled by the Group's ports in Mainland China was 172 million tonnes, a decrease of 4.2% year-on-year. On the overseas front, Port de Djibouti S.A. ("PDSA") delivered a bulk cargo volume of 2.41 million tonnes, or an increase of 31.8% as compared to the same period last year.

The breakdown of the Group's container throughput by region is as below:

Aggregate container throughput contributed by overseas ports grew more than 20%

During the first half of the year, aggregate container throughput handled by the Group's overseas operations increased by 20.4% year-on-year to 7.95 million TEUs, amongst which throughput handled by CICT in Sri Lanka rose significantly by 1.4 times to 0.67 million TEUs. Container throughput handled by Tin-Can Island Container Terminal Limited in Nigeria was 0.22 million TEUs, an increase of 5.9% year-on-year. PDSA in Djibouti handled a total throughput of 0.44 million TEUs, up 1.7% year-on-year. Lom?Container Terminal S.A. in Togo, which commenced trial operation in the second half of 2014, contributed an incremental container throughput of 0.22 million TEUs during the period under review. Container throughput handled by Terminal Link SAS ("Terminal Link") reached 6.40 million TEUs, representing an increase of 12.6% year-on-year.

The Company entered into a strategic cooperation framework agreement with CMA CGM SA in July 2015, whereby investment opportunities in connection with ports, logistics and related infrastructures along the "One Belt, One Road" will be actively investigated and evaluated, with the co-owned Terminal Link as a platform, which is expected to be conducive in terms of synergizing and complementing the global ports layout of, and thereby bringing mutual benefits to, the parties involved.

With its existing ports network highly coherent to "One Belt, One Road", the Group has been looking for breakthroughs in the overseas portfolio, in terms of scale, strategic positioning and mode of development by capitalizing on the opportunities arising from the development of the "One Belt, One Road" initiatives.

Elevating the competitiveness of the ports operation by facilitating the transformation and upgrading of the Shenzhen Homebase Port

During the first half of 2015 which was prevailed with adverse external operating environment, the Group, strived to enhance efficiency in asset utilisation and capital deployment, and in turn, achieve higher return on capital, through various measures including integration of resources, transformation and upgrade of businesses, and capital operations. At the same time, the Group sought to fully capture the opportunities offered by the strategic initiatives promoted by China, and, with clear vision, to deepen its efforts in the implementation of its domestic, international and innovative strategies in order to enhance the competitiveness of the Group's homebase ports in West Shenzhen while achieving breakthroughs in overseas expansion and innovation developments.

Regarding the on-going establishment of its West Shenzhen homebase port, an implementation and investment plan on the widening of Tonggu Channel, which will effectively improve the navigation environment in the West Shenzhen Port Zone, has been formulated after continuous discussion with the Shenzhen Government. The Group had also commenced the development of "Mawan Smart Port", which involves converting the multi-purpose berths owned by Shenzhen Haixing Harbor Development Co., Ltd., a subsidiary of the Group, into two intelligent 200,000-tonnes container berths, as a modern and industry-leading container terminal that is automated, intelligent, green and low-carbon. Furthermore, applying the concept of "Port +" while leveraging on the advantages offered by the "Free Trade Zones", the Group has also been exploring ways in building an intelligent port ecosystem which stems from a port as its core and at which trade flow, logistics flow, information flow and capital flow converges, with an aim to enhance the overall competitiveness and service quality of the Shenzhen homebase port.

As for the Group's port operation in other parts of China, the Company entered into a strategic cooperation agreement with Dalian Port Corporation Limited in February 2015, pursuant to which both parties will explore opportunities for multi-level and multi-area co-operation in the core ports business, and to pursue the development of a North-east Asia maritime centre in Dalian. In regards to innovative development, the implementation of "integrating business operations with internet technologies" and "reinforcing active capital management of existing portfolio" have been further deepened and widened. With regards to operational management, its corporate-level knowledge database built upon the experience accumulated through the Group's business development and operational management across domestic and overseas projects over the years, will enable the Group to establish a "knowledge + data" information sharing platform that is capable of providing the "best practicable solutions" to its projects.

Attributed to the remarkable achievements in innovation development, personnel training, service quality, operating efficiency and market reputation, the Group was awarded the "Terminal Operator of the Year" by Containerisation International, a UK magazine, which reflects a high regard for the Group's port investments, management and operations by the industry.

During the first half of the year, riding on the rapid development of internet economy, the Group's bonded logistics operation achieved major breakthrough in the context of "integrating business operations with internet technologies". China Merchants Bonded Logistics Co., Ltd. ("CMBL"), a subsidiary of the Group, has cooperated with China Resources Vanguard Co., Ltd. ("CR Vanguard") for the establishment of "ewj.com", the first cross-border e-commerce outlet based in the Qianhai-Shekou Free Trade Zone.

Driven by the abovementioned new business model, CMBL successfully attracted the anchoring of various cross-border e-commerce players to the bonded logistic port zone, as reflected by the surging warehouse occupancy rate and the notable improvement in its operating results. Stemming from the successful precedent laid by the "ewj.com" pilot project, the Group will continue to explore opportunities with CR Vanguard to extend the co-operation on cross-border e-commerce business to the Group's similar operations in the Qingdao and Tianjin Bonded Zones, which would help to drive the bonded logistics business on the innovation front.

In January 2015, the Group entered into a share purchase agreement with China Merchants Group Limited, pursuant to which the Company agreed to dispose of its cold chain operation at a total consideration of HK$760 million. The exit from cold chain operation was consistent with the Group's strategy of reviewing and restructuring, as appropriate, non-core businesses from time to time.

Successful issue of US$700 million guaranteed notes support capital needs for further development of the comprehensive port business

To support the capital needs for development of the Company's comprehensive port business, China Merchants Finance Company Limited, a wholly-owned subsidiary of the Group, completed the issuance of dual-tranche fixed-rate guaranteed notes totaling US$700 million in August 2015. The issue consists of a 5-year tranche of US$200 million notes maturing in 2020, carrying a coupon rate of 3.50%, and a 10-year tranche of US$500 million notes maturing in 2025, with a coupon rate of 4.75%. These notes are listed on The Stock Exchange of Hong Kong Limited.

The Group's credit rating by Standard & Poor's and Moody's are presently maintained at BBB+ and Baa1 respectively, with a stable outlook. Our financial metrics, even after the issuance of the guaranteed notes, are still at a healthy level, which is in line with the prudent financial policies the Company has always adhered to.

Outlook for second half of the year remain stable

In its latest "World Economic Outlook" report published on 9 July 2015, the IMF revised downward its projections for 2015's global economic growth to 3.3%, down 0.1 percentage point as compared to that of 2014; within which developed economies were expected to grow by 2.1%, up 0.3 percentage point from 2014; while emerging markets and developing economies were expected to grow by 4.2%, down 0.4 percentage point as compared to that of 2014. In the first half of the year, though China was able to deliver a GDP growth that was broadly in-line with its annual target of 7%, prospects remain challenging as foreign trade growth turned negative.

The formation of mega shipping alliances will accelerate the consolidation of resources and intensify the inter-alliance competition, which, in turn, will affect the market order in the shipping space, while on the other hand, bringing about both new challenges and opportunities to the port industry. However, the Group sees ample opportunities and rooms for further development that are derived from a series of national strategies and reforms launched by the Chinese government, such as the initiation of "One Belt, One Road" strategy, the establishment of "Free Trade Zones" and the introduction of State-Owned Enterprises Reforms. Although the traditional peak season in the second half of this year is expected to support China's export trade, China's port industry would continue to be hampered as growth continued to slow owing to challenging external and domestic economic conditions. Notwithstanding, with steady expansion in its overseas projects, the performance of the Group's ports operation seen in the first half is expected to sustain throughout the rest of the year.

As Mr. Li Jianhong indicated, "During the first half of 2015 which was prevailed by unfavourable external environment, the Group's core ports operation was still able to grow steadily and deliver a container throughput level that leads the global league table. Looking into the second half, though global economic growth and trade velocity is not expected to accelerate from current pace, while China's foreign trade is expected to encounter challenges, with the Group seeking to fully capitalize on the extraordinary development opportunities brought by the policies promoted by China, to facilitate synergies among ports projects in China and overseas, to balance short-term gain with long-term growth, as well as to continue its adherence to a prudent financial policy, we are confident that we could overcome the challenges associated with the complex macroeconomic environments, and deliver better investment return for shareholders."

Note 1: Including revenues of the Company and its subsidiaries, and its share of revenues of associates and joint ventures.

Note 2: Earnings before net interest expenses, taxation, depreciation and amortisation, unallocated income less expenses and non-controlling interests ("Defined Earnings") for the Company and its subsidiaries, and its share of Defined Earnings of associates and joint ventures.

Note 3: Earnings before net interest expenses, taxation, unallocated income less expenses and non-controlling interests ("Adjusted Earnings") for the Company and its subsidiaries, and its share of Adjusted Earnings of associates and joint ventures.

Source: China Merchants Holdings