Malaysia is the world's second-largest exporter of liquefied natural

gas and the second-largest oil and natural gas producer in Southeast

Asia, and is strategically located amid important routes for seaborne

energy trade.

Malaysia's energy industry is a critical sector of

growth for the entire economy, and it makes up almost 20% of the total

gross domestic product. New tax and investment incentives, starting in

2010, aim to promote oil and natural gas exploration and development in

the country's deepwater and marginal fields as well as promote energy

efficiency measures and use of alternative energy sources. These fiscal

incentives are part of the country's economic transformation program to

leverage its resources and geographic location to be one of Asia's top

energy players by 2020. Another key pillar in Malaysia's energy strategy

is to become a regional oil and natural gas storage, trading, and

development hub that will attract technical expertise and downstream

services that can compete in Asia.

Malaysia, located within

Southeast Asia, has two distinct parts. The western half contains the

Peninsular Malaysia, and the eastern half includes the states of Sarawak

and Sabah, which share the island of Borneo with Indonesia and Brunei.

The country's western coast runs alongside the Strait of Malacca, an

important route for the seaborne trade that links the Indian Ocean and

the Pacific Ocean. Malaysia's position in the South China Sea exposes

the country to various disputes among neighboring countries over

competing claims to the sea's resources. While it has bilaterally

resolved competing claims with Vietnam, Brunei, and Thailand, an area of

the Celebes Basin remains in dispute with Indonesia. Potential

territorial disputes with China, Vietnam, and the Philippines could

emerge as exploration initiatives move into the deepwater areas of the

South China Sea.

Malaysia

has unveiled several major upstream and downstream oil and natural gas

projects, some coming online in the next few months, as part of the

country's strategy to enhance output from existing oil and natural gas

fields and to advance exploration in deepwater areas. The incumbent and

long-ruling Barisan Nasional party (BNP) won the May 2013 general

election. The BNP has a track record of promoting hydrocarbon investment

and intends to continue boosting oil and natural gas production, making

energy sector reforms to attract investment, and developing the

country's energy infrastructure.

Primary energy consumption

As

Malaysia targets economic development and increased manufacturing, the

country is focused on securing energy through cost-effective means and

diversifying its fuel supply portfolio. Petroleum and other liquids and

natural gas are the main primary energy sources consumed in Malaysia,

with estimated shares of 40% and 36%, respectively in 2012. About 17% of

the country's energy consumption is met by coal. Biomass and waste make

up another 4%, and hydropower contributes 3% to total consumption.

Malaysia's heavy reliance on oil and natural gas to sustain its economic

growth is causing the government to emphasize fuel diversification

through coal imports and to promote investments in renewable energy.

Malaysia's primary energy consumption, 2012

Petroleum and other liquids

Malaysia's

oil reserves are the fourth-highest in Asia-Pacific after China, India,

and Vietnam. Nearly all of Malaysia's oil comes from offshore fields.

According

to the Oil & Gas Journal (OGJ), Malaysia held proved oil reserves

of 4 billion barrels as of January 2014, the fourth-highest reserves in

Asia-Pacific after China, India, and Vietnam. Nearly all of Malaysia's

oil comes from offshore fields. The continental shelf is divided into

three producing basins: the Malay basin offshore peninsular Malaysia in

the west and the Sarawak and Sabah basins in the east. Most of the

country's oil reserves are located in the Malay basin and tend to be

light and sweet crude. Malaysia's benchmark crude oil, Tapis Blend, is a

light and sweet crude oil, with an API gravity of 42.7° and a sulfur

content of 0.04% by weight.

Sector organization

Energy

policy in Malaysia is set and overseen by the Economic Planning Unit

(EPU) and the Implementation and Coordination Unit (ICU), which report

directly to the Prime Minister. Malaysia's national oil and gas company,

Petroliam Nasional Berhad (Petronas), holds exclusive ownership rights

to all oil and natural gas exploration and production projects in

Malaysia, and is responsible for managing all licensing procedures. The

company is directed by the Prime Minister, who also controls

appointments to the company board. Petronas holds stakes in the majority

of oil and gas blocks in Malaysia, and it is the single largest

contributor to Malaysian government revenues, up to 45%, by way of taxes

and dividends. Since its incorporation in 1974, Petronas has grown to

be a world-renowned integrated international oil and gas company with

business interests in more than 30 countries. Under legislation enacted

in 1985, Petronas is required to hold a 15% minimum equity in production

sharing contracts (PSC) with all foreign and private companies.

ExxonMobil,

Shell, and Murphy Oil are currently the largest foreign oil companies

by production volume. New opportunities for investment in Malaysia's

energy sector have attracted small- and medium-sized foreign oil

independents such as Talisman Energy (Canada), Lundin Petroleum

(Sweden), Roc Oil Company (Australia), and Petrofac (UK).

In 2010,

Malaysia provided tax incentives for upstream investment in both

enhanced oil recovery (EOR) and marginal field development projects.

According to Malaysian Investment Development Authority (MIDA), the

income tax rate for marginal fields dropped from 38% to 25%, and the

government waived export duties on total oil production from these

smaller fields. Malaysia also provided income tax allowances of up to

100% of capital expenditure for EOR projects. Additionally, the

government announced more tax incentives for oil and gas trading

companies in late 2012.

Malaysia's oil and gas policy historically

has focused on maintaining the reserve base to ensure long-term supply

security while providing affordable fuel to its population through

subsidized fuel sales. High international oil prices and Malaysia's

increasing crude oil import levels have put pressure on government

expenditures. As part of Malaysia's goal to lower the government's

budget deficit and lift some of the financial burden on Petronas to

allow the company to invest more upstream, the government began

introducing subsidy reforms. In July 2010, the government initiated the

first subsidy reductions for gasoline, diesel, and liquefied petroleum

gas (LPG) with the aim of phasing out fuel subsidies by 2015. Public

sensitivities over higher fuel costs stalled the reforms until September

2013, when the government increased the price of gasoline and diesel by

10.5% and 11.1%, respectively.

Exploration and production

Declines

in production at Malaysia's major producing oil fields in the past

decade have led government efforts to encourage investment in enhanced

oil recovery and development of smaller and marginal fields, as well as

deepwater fields.

Malaysia is Southeast Asia's second-largest oil

producer behind Indonesia. Petroleum and other liquids production

(including crude oil, lease condensates, natural gas liquids, biofuels,

and refinery processing gains) in 2013 was nearly 670,000 barrels per

day (bbl/d), hovering around the same level since 2011 and down from the

country's peak production of 844,000 bbl/d in 2003. More than a fourth

of Malaysian oil production currently originates from the Tapis field in

the offshore Malay Basin. The country's oil production has experienced

overall decline as a result of maturing fields, particularly larger

fields in the shallow waters offshore Peninsular Malaysia. Some recent

drilling efforts in the area such as Lundin Petroleum's Bertam oilfield

in the Penyu Basin are expected to offset some production declines from

mature fields.

Malaysia's

domestic oil consumption has risen while production has fallen over the

past decade, leaving smaller volumes of oil available for exports.

Petronas is working to attract new investment opportunities and reverse

production declines by enhancing output from existing fields through

advanced EOR techniques and developing small, marginal fields through

risk service contracts (RSCs). These contracts are designed for

companies to share the risk, where Petronas is the project owner, and

investors are the service providers receiving revenues for oil produced

throughout the entire life of the project. IOCs are also tapping into

new oil and natural gas discoveries in deepwater offshore areas of the

Sarawak Basin and the Sabah Basin. These deepwater offshore fields pose

more technical challenges, requiring greater investment by Malaysian and

foreign energy firms. In 2013, Petronas reported plans to spend more

than $61 billion over five years in Malaysia's oil and natural gas

sector to boost oil and natural gas production and offset the current

declines from ageing fields.

Enhanced oil recovery (EOR) projects

Petronas is conducting several EOR projects to extend the production

life of Malaysia's oldest oil fields. ExxonMobil and Petronas began work

on the Tapis EOR project, which lies 118 miles off Terengganu, in the

second half of 2014. Tapis is one of seven mature fields offshore

Peninsular Malaysia that ExxonMobil and Petronas agreed to develop as

part of a 25-year production-sharing contract that was finalized in June

2010. Under the agreement, which includes provisions for the deployment

of EOR, work is being carried out on the seven fields that are part of

the Tapis crude oil blend — Seligi, Guntong, Tapis, Semangkok, Irong

Barat, Tebu, and Palas. The project is expected to extend the fields'

lives by 30 years and add another 25,000 bbl/d to current production.

In

2011, Shell and Petronas agreed to invest $12 billion over 30 years in

two EOR projects offshore Sarawak (Baram Delta offshore covering nine

fields) and Sabah (North Sabah development area covering three fields).

The projects are expected to boost production by 90,000 bbl/d and use

the world's first offshore, chemical injection process for resource

recovery. In 2014, Petronas expanded the Baram Delta EOR PSC to include

natural gas production, which will be used both for reinjection purposes

to assist in oil extraction and for direct gas sales to the domestic

and international markets.

Risk service contracts (RSC) projects

In

addition to its EOR projects, Malaysia is also maximizing its

production potential by issuing RSCs for smaller, underexplored fields

beginning in 2011. These contracts involve risks shared between

Petronas, the project owner, and the contractors (foreign and domestic

companies), which act as service providers. These companies receive

compensation for cost and a return on investment.

As part of its

RSC licensing rounds, Petronas has awarded six RSCs since 2011. As of

mid-2014, three of these RSCs have commenced production of oil and

natural gas including the Berantai fields and the Kapal, Benang, and

Meranti cluster located offshore Peninuslar Malaysia, and the Balai

cluster located offshore Sarawak. These fields were producing more than

30,000 bbl/d in 2014.

Deep water projects - Sarawak and Sabah

Several

major projects are under development in the deepwater area offshore the

Sabah state, which could bolster Malaysia's oil production over the

next decade. The Kikeh oil field, operated by Murphy Oil in partnership

with Petronas, is currently Malaysia's only producing deepwater oil

field. The Kikeh field came on stream in 2007 at an initial rate of

20,000 bbl/d, and estimated production in 2013 was 60,000 bbl/d of oil.

Output has been hampered by operational delays. Murphy Oil has been

working to restore production, which is expected to peak at 120,000

bbl/d.

Also, in offshore Sabah, the Gumusut/Kakap project is under

development and will include the region's first deepwater floating

production system from 19 subsea wells. The Kakap field came on stream

at the end of 2011 with production of 25,000 bbl/d. Production from

Gumusut will commence in 2014, and production from both fields is

expected to ramp up to 120,000 bbl/d by 2015, according to FGE. Project

shareholders are operator Shell with 33%, ConocoPhillips with 33%,

Petronas with 20%, and Murphy Oil with 14%. The system will be connected

via pipelines to the new Sabah Oil and Gas Terminal being built in

Kimanis in the northeastern Sabah state.

The Malikai oil and

natural gas field, first discovered in 2004, is another deepwater find

located offshore northwestern Sabah and has a peak production capacity

of 60,000 bbl/d. The Malikai project will use a tension-leg platform and

will tie into the Kebabangan Northern Hub development project (KBB) via

a petroleum liquids and dry natural gas pipeline. Shell, the operator

and a 35% stakeholder, expects to bring Malikai online at the end of

2016. Other project partners include ConocoPhillips (35%) and Petronas

(30%).

Development is underway at the KBB slated to begin

operations in late 2014. KBB will be a floating platform hub for the

development of a cluster of deepwater natural gas fields offshore Sabah

and will tie in the Malikai oil field. The KBB platform has a design

capacity of 825 MMcf/d of natural gas and 22,000 bbl/d of condensate.

Boundary disputes

Malaysia

began cooperating with neighboring countries bordering the South China

Sea (SCS) to exploit the area's significant hydrocarbon potential. The

country holds estimated reserves of 5 billion barrels of crude oil and

liquids and 80 trillion cubic feet of natural gas in the South China

Sea, the largest of any of the border countries (see South China Sea

Analysis Brief). In May 2009, Malaysia submitted SCS territorial claims

to the United Nations Commission on the Limits of the Continental Shelf

and disputes China's territorial claims through its nine-dash line, a

series of lines encompassing most of the South China Sea and based on

China's historical territorial claims. Malaysia has not filed a legal

case against China and has preferred to advance bilateral relations

between the two countries.

The 20-year dispute between Malaysia

and Brunei over land and sea boundaries, particularly in the Baram Delta

Basin, was resolved when the two countries signed a boundary agreement

in April 2009. Oil blocks L and M were ceded to Brunei, while Limbang,

on the Sarawak-Brunei border, was ceded to Malaysia. Since the

agreement, energy cooperation between Malaysia and Brunei has

strengthened. In 2010, Petronas and the Brunei government agreed to

jointly develop the two blocks offshore Borneo Island, and they signed a

40-year PSA for newly named Blocks CA1 and CA2. Drilling commenced in

2011, along with further investment plans. The two countries signed

several energy cooperation agreements in 2013 for joint development of

some deepwater fields and for Brunei to purchase a 3% share as part of

Petronas' stake in the Canadian Pacific Northwest LNG export terminal.

Malaysia

and Vietnam share the 520-square mile area of the PM-3 Commercial

Arrangement Area (CAA) in the Malay Basin. PM-3 CAA commenced production

in 1997 and contributes to the country's oil production from six

offshore fields. Talisman Energy (Canada) holds operating interests in

the Northern and Southern oil fields in the CAA. Talisman holds a 41%

interest, Petronas holds a 46% interest, and PetroVietnam has a 13%

interest.

As discussed in further detail below in the natural gas

section, Thailand and Malaysia signed an agreement in 1979 to jointly

develop oil and natural gas reserves from the Malaysia-Thailand Joint

Development Area (MTJDA), which overlap the maritime borders of both

countries.

Other areas in the South China Sea such as the Celebes

Basin that borders Indonesia and Malaysia have remained underexplored

because there are competing territorial claims between the two

countries. Shell holds an exploration contract with Petronas for two

deepwater blocks off the east coast of Sabah; however, Indonesia also

awarded separate PSCs for the blocks and claims them. It is likely these

PSCs will be dormant as long as territorial maritime disputes remain

unresolved.

Oil pipelines

Malaysia has a

relatively limited oil pipeline network and relies on tankers and trucks

to distribute products onshore. Malaysia's main oil pipelines connect

oil fields offshore Peninsular Malaysia to onshore storage and terminal

facilities. The 124-mile Tapis pipeline runs from the Tapis oil field

and terminates at the Kerteh plant in Terengganu, as does the 145-mile

Jerneh condensate pipeline. The oil pipeline network for Sabah connects

offshore oil fields with the onshore Labuan oil terminal. This network

is currently expanding following the launch of development projects

including the Kebabangan cluster, the Malikai, Gumusut/Kakap, and Kikeh

oil fields. For Sarawak, there are a few other oil pipelines connecting

offshore fields with the onshore Bintulu oil terminal. The majority of

pipelines are operated by Petronas, although ExxonMobil also operates a

number of pipelines connected with its significant upstream holdings

located offshore Peninsular Malaysia.

An international oil

products pipeline runs from the Dumai oil refinery in Indonesia to the

Melaka oil refinery in Melaka City, Malaysia. An interconnecting oil

products pipeline runs from the Melaka refinery via Shell's Port Dickson

refinery to the Klang Valley airport and to the Klang oil distribution

center.

Oil trade

Malaysia remained a net oil

exporter of crude oil and petroleum products in 2013 despite the

narrowing gap between production and consumption in the past several

years. Malaysia exports about half of its crude oil production because

the crude quality (light and sweet) is attractive to the Asian markets

and fetches a higher premium compared to other crude oil blends. In

return, Malaysia imports lower-cost heavy sour crude oil, about half

from the Middle East and the rest from several other regions, for its

refineries and domestic needs. In 2013, Malaysia imported 183,000 bbl/d

of lower-cost crude oil for processing at its oil refineries.

Malaysia

exported 240,000 bbl/d of crude oil in 2013, according to Global Trade

Atlas, significantly lower than the 400,000 bbl/d export volume in 2000.

All of Malaysia's crude oil is exported within Asia Pacific, the bulk

of which is sent to Australia, India, Thailand, and Japan. Japan began

buying more crude oil for direct burn in 2011 after it lost nuclear

electric generation following the Fukushima accident.

The

country's imports of petroleum products have grown faster than its

exports in the past few years. Much of Malaysia's oil product trade

occurs in Asia, especially with neighboring Singapore. Gasoline is the

key import product, making up about 45% of product imports and about a

third of all oil product demand.

Refining, storage, and transit terminals

As

a result of rising regional and domestic demand for crude oil and oil

products, Malaysia plans to become a regional oil trading and storage

hub by increasing the country's refining and storage capacity.

According

to FGE, Malaysia has 591,000 barrels per day (bbl/d) of refining

capacity at six facilities. Malaysia invested heavily in refining

activities during the past two decades and is now able to meet most of

its demand for petroleum products domestically, after relying on

refineries in Singapore for many years.

As part of Malaysia's goal

to compete with the oil refining and storage hub in Singapore, Petronas

plans to build a $16 billion refining and petrochemicals integrated

development project (RAPID) in Johor state at the southern tip of

Peninsular Malaysia. This project includes a 300,000 bbl/d refinery,

which industry expects will turn Malaysia from a net oil product

importer to a net oil product exporter once it is operational. The

project, which was sanctioned in 2011, has incurred several delays,

although Petronas made a final investment decision in 2014. The NOC

plans to bring the refinery online in 2019.

Malaysia is expanding

its oil terminal and storage capacity as the need for more oil storage

and trading grows within Asia and as its neighbor, Singapore, lacks the

space to continue increasing its massive storage capacity. Most of

Malaysia's oil product and crude oil terminals are located along the

eastern coast of Peninsular Malaysia and offshore as floating storage

and production facilities. Malaysia intends to expand its storage

capacity to about 83 million barrels by 2020 and is in the process of

constructing several projects in the next few years.

Malaysia is

developing several storage terminals in Johor, adjacent to Singapore.

Malaysia International Shipping Corporation (MISC), and global oil

trader, Vitol Group, are expanding storage capacity at the new ATT

Tanjung Bin Terminal by 2015. This terminal brought 7 million barrels of

oil storage capacity online in 2013.

The Pengerang oil storage

terminal in Johor, Malaysia's largest commercial oil storage facility,

started operations in early 2014. The facility is owned by a joint

venture of Vopak (Dutch) and Dialogue Groups (Malaysia) and will have a

storage capacity of more than 10 million barrels to house crude oil and

oil products by the end of 2014 with a potential to expand to 41 million

barrels in the future. This terminal bolstered southern Malaysia's oil

storage capacity by 70% to more than 25 million barrels. Concord Energy

(Singaporean oil trading firm) and Dialogue proposed another Johor-based

terminal with a capacity of 16 million barrels.

As part of

Petronas' plan to invest in upstream and downstream activities in the

Sabah state, the national oil company (NOC) is constructing the Sabah

Oil and Gas Terminal (SOGT) in Kimanis, Sabah. The terminal is scheduled

to receive oil and natural gas by the second half of 2014. SOGT will

become a central hub for much of the hydrocarbon development in offshore

Sabah from new fields coming online recently – Gumusut/Kakap, Kikeh,

and Malikai. The terminal has a design capacity to process 300,000 bbl/d

of crude oil, more than 1 billion cubic feet per day (Bcf/d) of natural

gas, and 77,000 bbl/d of condensate.

Malaysia's existing and planned refineries

| Refinery |

Operator |

Capacity

(bbl/d) |

Notes |

| Existing LNG terminals |

| Melaka 1 (PSR-1) |

Petronas |

95,000 |

Distills sweet crude oil and condensate |

| Melaka 2 (PSR-2) |

JV of Petronas and ConocoPhillips |

125,000 |

Processes sour crude oil grades |

| Port Dickson |

Shell |

145,000 |

Supplies solely domestic market; can accept heavier crude oil grades |

| Port Dickson |

San Miguel/Petron (Philippines) |

85,000 |

|

| Kertih |

Petronas |

121,000 |

Processes naphtha condensates through a splitter |

| Kemaman |

Kemaman Bitumen Company |

20,000 |

Converts heavy crude oils to bitumen |

| Planned projects |

| RAPID |

Petronas |

300,000 |

Financial investment decision: April 2014. Operational: 2019 |

| Sources: FACTS Global Energy, International Energy Agency, OGJ, company websites |

Biofuels

Malaysia

produced negligible quantities of biofuels in 2013, although the

country plays a significant role in supplying palm oil, a key raw

material used in biodiesel production.

Although Malaysia produced

no significant quantities of ethanol and only 6,000 bbl/d of biodiesel

in 2013, the country plays a significant role in the industry by

supplying more than one-third of the world's total palm oil, a vegetable

oil and key product used in biodiesel production. Collectively,

Indonesia and Malaysia represent 85% of global palm oil production.

While a majority of this oil is used in food, both countries have also

marketed their palm oil for biodiesel production.

Currently, only

about 10% of global palm oil supply goes toward biofuels production.

However, palm oil is the second-largest feedstock (after soy oil) used

to produce biodiesel. In contrast to Indonesia, Malaysia historically

has not converted much of its raw palm oil to biodiesel locally.

Instead, Malaysia exports the palm oil to be refined elsewhere like in

neighboring Singapore or Europe. Singapore's large renewable diesel

plant is a particularly good destination since its advanced

hydrotreating capabilities result in a higher quality fuel product that

can be used at high blend levels without operational issues.

Despite

its currently low biodiesel fuel production, Malaysia has much higher

production capacity. Some analysts estimate the country has up to 50,000

bbl/d of capacity, which is 40% of U.S. capacity. However, since 2010,

Malaysia's biodiesel capacity has been significantly underutilized as

many consuming nations have added land-use criteria for feedstocks used

to comply with their biofuels mandates. Production has grown recently

from an estimated 1,000 bbl/d in 2011 to 6,000 bbl/d in 2013 and is

currently on a pace to increase production in the next few years.

New

blending mandates in Malaysia will likely increase local production

significantly for domestic consumption. The National Biofuel Policy in

2006 instituted limited B5 blending requirements (blending 5% of

biodiesel with 95% of diesel petroleum) in Peninsular Malaysia. A

national B5 program was scheduled to be rolled out on a national scale

in July 2014, but has since been delayed until December 2014, after

several necessary blending terminals could not be completed in time.

Malaysia is following up on the B5 mandate and plans to increase the

biodiesel blend to 7% in certain areas starting in 2014.

Increased

palm oil production also provides a significant amount of solid

biomass, which is mostly contained in the husk of the palm seed known as

an empty fruit bunch (EFB). There has been increasing interest

expressed in using EFB as a cellulosic fuel source. If successful, this

would open Malaysia to new markets in countries willing to pay a premium

for products capable of lowering greenhouse gas emissions.

Natural gas

Malaysia

was the world's second-largest exporter of liquefied natural gas after

Qatar in 2013. Although the country's growing domestic demand and

regional gas imbalances in the past few years caused the country to open

its first regasification terminal as another source of imports.

According

to the OGJ, Malaysia held 83 trillion cubic feet (Tcf) of proved

natural gas reserves as of January 2014, and it was the third-largest

natural gas reserve holder in the Asia-Pacific region. More than half of

the country's natural gas reserves are located in its eastern areas,

predominantly offshore Sarawak. Most of Malaysia's gas reserves are

associated with oil basins, although Sarawak and Sabah have an

increasing amount of non-associated gas reserves that have offset some

of the declines from mature oil and gas basins offshore Peninsular

Malaysia.

Sector organization

As in the oil

sector, Malaysia's state-owned Petronas dominates the natural gas

sector. The company has a monopoly on all upstream natural gas

developments, and it also plays a leading role in downstream activities

and in the LNG trade. Most natural gas production comes from PSAs

operated by foreign companies in conjunction with Petronas. Shell

remains the largest gas producer and a key player in the development of

deepwater fields in Malaysia.

MISC, which is 63% owned by

Petronas, owns and operates ships for transporting hydrocarbons and

chemicals around the world. The company has 27 LNG tankers, placing the

company as the second-largest LNG fleet operator in the world, according

to PFC Energy. The company also owns and charters 73 petroleum tankers

and 18 ships for chemical transport.

Gas Malaysia is the largest

non-power gas distribution company in Malaysia and the only one that can

operate on Peninsular Malaysia. Sarawak Gas Distribution Company which

is 70% owned by the state government, serves Sarawak gas consumers, and

Sabah Energy Corporation distributes gas in the Sabah state.

Natural

gas prices for end users are regulated by the Malaysian government,

which caps the domestic rates at a level more than half of that for

imported LNG. In an effort to reduce gas subsidies that the government

pays to Petronas and power producers and to create more incentives for

upstream natural gas investment, the government installed a price reform

in 2011 that seeks to raise the natural gas price for electric power

users every six months and eventually allow domestic natural gas prices

to rise to international market levels. Although gas prices remained the

same for more than two years, in January 2014 the government lowered

the natural gas subsidy level and effectively raised the prices of

natural gas for power users by about 11% to about $4.64/MMbtu. In May

2014, the government also raised the price for large non-power gas users

(industrial and commercial sectors) by an average of 20% to about

$5.86/MMbtu.

Exploration and production

Malaysia's

natural gas production has risen over the past two decades to serve the

growing domestic demand and export contracts. Recent foreign investment

in deepwater and technically challenging fields, primarily in the

Sarawak and Sabah states, provides impetus to maintain natural gas

production levels over the next few years.

Although

Malaysia's dry natural gas production has risen steadily over the past

two decades, reaching an estimated 2.3 Tcf in 2012, growth slowed

somewhat since 2007. Meanwhile domestic natural gas consumption has

increased, reaching 1.1 Tcf in 2013, and it accounted for about 50% of

production. The power sector consumed about 51% while the industrial

sector accounted for 33% of the Malaysia's natural gas market sales in

2013, according to FGE. Demand for power, especially in Peninsular

Malaysia, is expected to steadily increase, and gas demand for

industrial development is likely to remain strong as the government

pursues greater economic development. Rising domestic demand,

particularly in Peninsular Malaysia, and LNG export contract obligations

are placing pressure on the natural gas supply and driving Malaysia to

actively seek investments for reservoir development. There are several

ongoing projects that will expand natural gas production in Malaysia

over the near term. Exploration and development activities in Malaysia

continue to focus on offshore Sarawak and Sabah. Over the long term,

Malaysia needs to attract higher levels of investment and technical

capabilities to develop deepwater fields and those fields containing

high levels of carbon dioxide and sulfur.

Malaysia-Thailand Joint Development Area

One

of the most active areas for natural gas exploration and production is

the Malaysia-Thailand Joint Development Area (MTJDA), located in the

lower part of the Gulf of Thailand and the northern part of the Malay

Basin. The MTJDA covers 2,800 square miles of territory. The MTJDA

reportedly holds 9.5 Tcf of proved plus probable natural gas reserves.

The area is divided into three blocks, A-18, B-17, and C-19, and is

administered by the Malaysia-Thailand Joint Authority (MTJA), with each

country owning 50% of the MTJDA's hydrocarbon resources. Production at

Block A-18 started in 2005 at the Cakerwala field, and the project's

second phase brought on the Bumi, Suriya, and Bulan fields in 2008.

Initial gas production from Block A-18 was 390 MMcf/d, and the second

phase added 400 MMcf/d of contracted gas supply. Block B-17 came online

in 2009 with a contracted level of 270 MMcf/d. MTJA continues to explore

the area for more hydrocarbon discoveries.

Projects in Sarawak and Sabah

Most

of Malaysia's natural gas production is offshore Sarawak and supports

LNG exports from Bintulu. Shell has signed three oil and gas PSCs with

Petronas in 2012 and stepped up drilling efforts in 2011 to continue

developing gas and condensate production offshore Sarawak. The PSCs

cover blocks SK319, SK318, and 2B in the Central Luconia Basin.

In

2009, Murphy Oil announced the startup of several smaller new gas

fields located in Blocks SK309 and SK311. The Sarawak Gas Project,

located 137 miles offshore Sarawak, contains a cluster of fields that

are being developed as part of a multi-phase project to supply gas to

the Bintulu LNG Terminal. Murphy Oil holds an 85% interest in the

project, and Petronas holds a 15% interest. Murphy Oil holds a gas sales

contract with Petronas and provides up to 250 MMcf/d.

Newfield

Exploration, which recently divested its Asian upstream assets, made a

significant gas discovery in the SK-310 PSC offshore Sarawak in 2013.

The company claimed the find could boost gas resources by 1.5 Tcf. In

2014, SapuraKencana Petroleum, a Malaysia oil services company,

purchased Newfield's Malaysian upstream assets and now holds a 30% share

of the SK-310 Block, while Petronas and Mitsubishi have 40% and 30%

shares, respectively. SapuraKencana reported that it plans to bring the

fields on stream by 2017.

The Kebabangan Petroleum Operating

Company (KPOC), a consortium consisting of Petronas (40%),

ConocoPhillips (30%), and Shell, the operator, (30%), are developing

three contiguous gas and condensate fields including Kebabangan, Kamunsu

East, and Kamunsu East Upthrown Canyon (KBB Cluster) in the northwest

Sabah state. The Kebabangan gas cluster is estimated to hold 4.9 Tcf of

gas, according to PFC Energy. Production for KBB is expected to begin in

2014.

As part of the Sabah-Sarawak Integrated Oil and Gas

Project, Petronas is commissioning the Kinabalu Non-Associated Gas (NAG)

development. The Kinabalu NAG development, comprised of two gas fields

located offshore northwest of Sabah, is slated to begin producing by

2015.

Pipelines

Malaysia has an extensive gas

pipeline network running through Peninsular Malaysia and pipelines that

connect offshore fields in all three states to key infrastructure

onshore.

Malaysia has one of the most extensive natural gas

pipeline networks in Asia, totaling about 1,530 miles. The Peninsular

Gas Utilization (PGU) project, completed in 1998, expanded the natural

gas transmission infrastructure on Peninsular Malaysia. The PGU system

spans more than 880 miles and has the capacity to transport 2 billion

cubic feet per day (Bcf/d) of natural gas. Other natural gas pipelines

run from offshore gas fields to gas processing facilities at Kertih.

Also, a number of pipelines link Sarawak's offshore gas fields to the

Bintulu LNG facility. However, there is limited gas distribution

coverage in much of the Sarawak and Sabah states.

The

Sabah-Sarawak Integrated Oil and Gas Project, slated to be completed by

2015, includes the 325-mile Sabah-Sarawak Gas Pipeline (SSGP) that will

transport 1 Bcf/d of gas from Sabah's offshore fields to the Petronas

LNG complex for liquefaction and export. Some natural gas from the

terminal is also reserved for fueling downstream industrial projects and

for power generation in Sabah. The SSGP is expected to be ready for

operations in conjunction with the SOGT in 2014. Other pipelines link

natural gas fields located in offshore Sabah to the Labuan Gas Terminal.

The

Association of South East Asian Nations (ASEAN) is promoting the

development of a Trans-ASEAN Gas Pipeline system (TAGP) aimed at linking

ASEAN's major gas production and consumption centers by 2024. Because

of Malaysia's extensive natural gas infrastructure and its location, the

country is a natural candidate to serve as a hub in the ongoing TAGP

project, which currently has 1,800 miles of pipelines in operation out

of a proposed 4,500 miles. The first pipeline connected Malaysia with

Singapore and was commissioned in 1991. Singapore currently has two

contracts to import 84 Bcf/y of gas from Malaysia. Gas pipelines between

West Natuna, Indonesia, and Duyong, Malaysia were installed in 2002,

and Malaysia imported more than 40 Bcf of gas from Indonesia in 2013,

according to the BP Statistical Review 2014. The Trans-Thailand-Malaysia

Gas Pipeline was commissioned in 2005, which allows Malaysia to

transport natural gas from the Malaysia-Thailand JDA to its domestic

pipeline system.

A key component of expanding the TAGP is to

transit natural gas from the massive East Natuna gas field, located in

the South China Sea to Southeast Asia. The field is being developed by a

joint venture consisting of Pertamina (Indonesia), ExxonMobil, Total,

and PTT Exploration and Production (Thailand). Malaysia's Petronas

exited the project in 2012, and the field's development has encountered

several delays as a result of its remote location and high carbon

dioxide levels. These challenges to East Natuna's development could also

delay the TAGP, and several Southeast Asian countries are turning to

LNG imports to deal with the region's gas shortages.

LNG trade

Malaysia

remains a key exporter of LNG as the second-largest exporter in the

world after Qatar in 2013. However, the limited natural gas supplies and

rising demand in the western part of the country triggered investment

in regasification terminals, the first of which commenced in 2013.

Malaysia

remains a key global LNG exporter as the second-largest exporter after

Qatar in 2013. Malaysia is developing sizeable reserves in its eastern

region. However, growing natural gas supply shortages in demand centers

in the western region have prompted Petronas to construct the country's

first LNG import terminal in the western region to augment the supply

from pipelines.

LNG exports

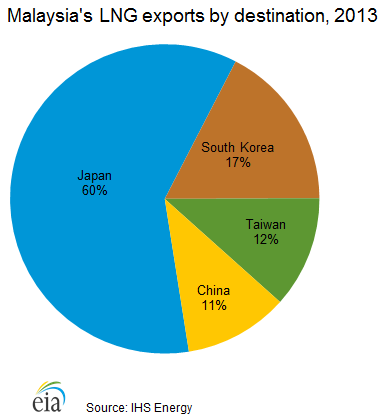

Malaysia shipped

more than 1.2 Tcf/y of LNG and contributed to 11% of LNG exports

worldwide, according to IHS Energy. Key importers of Malaysia's LNG are

Japan (60%), South Korea (17%), Taiwan (12%), and China (11%), all

holding medium- or long-term supply contracts with Malaysia. Malaysia

also has sold LNG cargoes to Petronas LNG Limited, a trading company

based in Malaysia, which ships spot LNG cargoes to many locations around

the world. Despite growing demand for natural gas at home, Petronas is

keen to maintain its long-term export contracts as they currently

capture a higher price than natural gas sold domestically where the gas

prices are regulated and subsidized.

The

Petronas LNG complex located in Bintulu in the state of Sarawak is the

main hub for Malaysia's natural gas industry. Petronas owns majority

interests in facility's three LNG processing plants (Dua, Tiga, and

Satu), which are supplied by the country's offshore natural gas fields.

Petronas LNG is one of the largest LNG complexes in the world, with

eight production trains and a total liquefaction capacity of 1.1 Tcf/y.

Japanese financing has been critical to the development of Malaysia's

LNG facilities. The complex at Bintulu also hosts Shell's GTL project,

which converts natural gas into nearly 15,000 bbl/d of petroleum

liquids. Petronas is currently developing a ninth train and a

small-scale expansion at Petronas LNG, and these facilities combined

will add 205 Bcf/y of capacity by the end of 2015.

Petronas

proposed two floating liquefaction terminals offshore Sarawak and Sabah

to capture greater economic value from the country's smaller, more

remote gas fields. These plants would have flexibility to serve the

export or domestic markets. The Petronas FLNG project, located off

Sarawak near the Petronas LNG complex, will have a capacity of 58 Bcf/y

and will use natural gas from the Kanowit field. Petronas plans to

market gas from the facility to the domestic market. The project is

under construction and is scheduled to commence in 2016. Rotan FLNG, the

second proposed offshore LNG terminal, will monetize gas production

from the Rotan field northeast of Sabah in the South China Sea. The

terminal has a design capacity of 72 Bcf/y and could serve some domestic

demand in Sabah by reprocessing at the proposed Lahad Datu

regasfication plant. The project partners intend for the project to be

online by 2018. Altogether, proposed liquefaction projects and

expansions are likely to add about 335 Bcf/y to Malaysia's export

capacity over the next few years.

Malaysia's existing and planned regasification terminals

| Project name |

Owners |

Peak output (Bcf/y) |

Target start year |

| Existing LNG terminals |

| Lekas LNG/ Malacca |

Petronas |

184 |

2013 |

| Planned projects |

| Pengerang LNG |

Petronas |

184 |

2016 |

| Pengerang LNG |

Dialogue Group (Malaysia) 46%, Royal Vopak (Netherlands) 44%, Johor state government 10% |

Not determined |

2016 |

| Lumut LNG |

Petronas |

Not determined |

Not determined |

| Lahad Datu LNG |

Petronas |

39 |

Delayed from 2015 |

| Pahang LNG |

Performance Management & Delivery Unit of Malaysia |

Not determined |

Not determined |

| Sources: IHS Global Insight, FACTS Global Energy, International Energy Agency, company websites |

Malaysia's existing and planned liquefaction terminals

| Project name |

Owners |

Peak output (Bcf/y) |

Target start year |

| Existing LNG terminals |

| Petronas LNG (Satu) |

Petronas |

389; 3 trains1 |

Operational |

| Petronas LNG (Dua) |

Petronas |

432; 3 trains |

Operational |

| Petronas LNG (Tiga) |

Petronas |

326; 3 trains |

Operational |

| Projects under construction |

| Petronas LNG Train 9 |

Petronas |

173 |

Q4 2015 |

| Petronas LNG Mini Expansion |

Petronas |

32 |

Q4 2014 |

| Petronas Floating LNG2 |

Petronas |

58; 1 train |

Q4 2015 |

| Rotan LNG |

Petronas 50%, MISC 25%, Murphy Oil 25% |

72; 1 train |

2018 |

1A train is an independent unit for liquefaction and purification.

2A floating terminal is at the site of an offshore gas field that produces, liquefies, stores, and transfers natural gas.

Sources: IHS Global Insight, FACTS Global Energy, International Energy Agency, company websites |

LNG imports

Although

Malaysia is one of the world's largest LNG exporters, the country

currently experiences a geographic disparity of natural gas supply and

demand among its regions. The Western Peninsular Malaysia demands more

natural gas to fuel the power and industrial sectors, while the eastern

states of Sarawak and Sabah, located on Borneo Island, produce natural

gas and currently lack the local demand for it. To meet pressing gas

needs in Peninsular Malaysia, Petronas is developing various

regasification terminals to secure supply from the global gas market.

Petronas

is the leading developer of several regasification projects slated to

start operations by 2017. Malaysia's first regasification terminal,

located near Malacca with a capacity of 184 Bcf/y, began operating in

May 2013. In 2013, Malaysia imported 76 Bcf of LNG from Lekas LNG. In

addition, Petronas Gas has plans to construct two regasification

terminals in Lahad Datu in Sabah and one in Johor in Peninsular Malaysia

over the next four years. Lahad Datu is the only project located in the

eastern region of Sabah. It is a smaller terminal designed to primarily

serve the proposed 300 megawatt (MW) power generator at Lahad Datu and

replace some of the diesel that is heavily used for power in the Sabah

state. Petronas' terminal in Johor is part of the NOC's RAPID project

that will include regasification and LNG storage and serve as a

strategic oil and gas trading hub for the Asian region. A consortium

composed of Royal Vopak, Dialogue Group, and the State Government of

Johor proposed a second terminal in Johor with a similar concept – to

be the first independent LNG trading facility in Asia, allowing users to

store and trade gas.

Petronas signed several agreements to supply

its planned regasification capacity for the next decade. The NOC has a

combination of long-term agreements with Qatargas and Gladstone LNG

(Australia) and short-term agreements with Pluto LNG (Australia),

Snohvit LNG (Norway), and GDF Suez for its global portfolio. Shell also

holds a contract with Brunei LNG to deliver LNG to Malaysia. Petronas

plans to source some of the gas from its new liquefaction projects

coming online in Sarawak. The NOC could also direct natural gas supply

from its stakes in liquefaction facilities in Australia and Canada to

the proposed regasification facilities, according to PFC Energy.

Although, Petronas has not signed any purchase contracts for the supply

from its proposed liquefaction projects.

Electricity

Malaysia's

electricity demand, mostly met by natural gas and to a lesser extent

coal, continues to expand rapidly. This growth coupled with insufficient

natural gas supply in high demand centers is driving the country to

diversify power generation fuel mix and add electricity capacity to

avoid future power shortages.

Malaysia's

economic development and population growth have resulted in

substantially higher electricity generation over the past decade. The

country's electricity generation doubled in the past decade, landing at

134 billion kilowatthours in 2012, according to MEIH data. The Malaysian

states anticipate that electricity demand will grow by more than 3% at

least through 2020. The high demand centers, particularly in Peninsular

Malaysia, are facing fuel shortages in natural gas and are experiencing a

need for greater generation capacity. Malaysia is seeking to diversify

its portfolio of power generation fuels and reduce the use of more

expensive fuel sources.

According to the Energy Commission of

Malaysia, the industrial sector is the primary source of power demand

and accounted for about 45% of the total in 2012. Commercial and

residential demand was 33% and 21%, respectively. Transportation and

agriculture made up less than 1%.

Sector organization

Each

of Malaysia's three states has a key state utility that holds a

monopoly in the transmission and distribution sectors. These companies

are the largest stakeholders in power generation, although there is a

sizeable private ownership through independent power producers (IPPs)

that generate about half of the country's electricity. Tenaga Nasional

Berhad (TNB) located in Peninsular Malaysia, held a 42% market share of

electric generation in the state in 2011, while Petronas Gas and IPPs

held the remaining shares. Syarikat SESCO Berhad, (a subsidiary of

Sarawak Energy) is responsible for the generation, transmission, and

distribution of power in Sarawak and sells all of Sarawak's power

generation through a government joint venture. Sabah Electricity Sdn

Berhad (SESB) is 80% owned by TNB and 20% by the Sabah government. IPPs

generate more than 50% of the electricity in Sabah.

The country

has three electric transmission grids located in Peninsular Malaysia,

Sarawak, and Sabah. The grid in Peninsular Malaysia, the largest of the

three, connects with electricity systems in Thailand and Singapore. TNB

plans to reduce transmission losses and increase electric supply

reliability in Peninsular Malaysia over the next two decades. Sarawak

Energy and Indonesia are constructing a transmission line from Sarawak

to West Kalimantan, Indonesia (also located on Borneo Island). Sarawak

Energy plans to export up to 230 MW to Indonesia starting in 2015.

One

of Malaysia's energy policies in recent years is to reduce government

energy subsidies by raising overall electricity and natural gas tariffs

and pass fuel costs to electricity end users. Malaysia raised

electricity tariffs on average by 7.1% in June 2011 to help reduce the

subsidy the government provides on behalf of electricity companies. The

country's domestic natural gas prices are also fixed by the government

at prices much lower than those of imported LNG. The government raised

the price of natural gas to power consumers in June 2011. The government

also planned to pass fluctuations in fuel prices and raise natural gas

prices paid by electric power generators every six months starting in

late 2011. However, natural gas prices remained at these rates for more

than two years until January 2014, when the government reduced the

natural gas subsidy for power generation and in essence raised the

natural gas price for power production by about 11%. The subsidy for

coal-fired power was also reduced, and prices for power production in

Peninsular Malaysia and Sabah increased by 15% and 17% on average,

respectively.

Electricity generation and capacity

Most

of Malaysia's electricity generation capacity is natural gas-fired,

although gas shortages in Peninsular Malaysia and growing electricity

demand in recent years have spurred the use of other fuels such as coal,

diesel, and renewable sources.

Total installed generation

capacity at the end of 2012 was 29.1 gigawatts (GW), located mostly in

Peninsular Malaysia, according to Malaysia's government. To meet the

country's projected electricity demand, the government anticipates an

additional 6 GW of new generation will come online between 2015 and

2020. The government's efforts are centered on meeting increasing

electricity demand through a more balanced portfolio of electric

generation using coal, renewable sources, and to a lesser extent natural

gas, in the next decade. Malaysia's policy to reduce power consumption

also entails reforming electricity prices to be more reflective of

market values and promoting demand-side conservation measures.

Fossil

fuels, primarily coal and natural gas, made up about 86% of Malaysia's

installed electric generation capacity and 92% of the country's

electricity output in 2012. Natural gas accounted for about 53% of the

country's total installed capacity and about 46% of the electricity

generation in 2012, according to MEIH. Many of these gas plants are

located in Peninsular Malaysia, and some have dual-fuel capabilities

allowing for greater flexibility in fuel type. Tightness of natural gas

supply in Peninsular Malaysia in recent years, particularly in 2011,

caused by the state's production declines has resulted in power outages

and has increased use of coal-fired generation and more expensive fuel

oil and diesel-fired generation. Peninsular Malaysia intends to import

LNG as well as diversify its power generation portfolio with other fuels

such as coal and hydroelectricity to alleviate power constraints.

TNB

is constructing a 1,071 MW combined-cycle gas turbine plant in Penang,

Peninsular Malaysia to be completed at the end of 2015. Also, Sabah is

building two 300 MW gas-fired plants including the Kimanis Power Plant,

which will purchase gas from the Sabah oil and gas terminal in 2015. The

Lahad Datu power plant is being developed to use gas from the adjacent

regasification terminal project.

Although petroleum products

currently account for a small portion of the capacity and generation and

have been replaced by natural gas and coal inputs, they have played a

critical role as an alternative fuel in the past few years to alleviate

power shortages when other fuels are in short supply. Also, diesel is

the main fuel used in the Sabah state. Diesel and petroleum products

accounted for 5% of Malaysia's electricity generation in 2012.

Coal,

which accounted for 26% of total installed capacity and 41% of

electricity generation in 2012, has become much more competitive with

natural gas-fired power in terms of fuel price and has gained a larger

share of power generation in Peninsula Malaysia in the past few years.

There are plans to increase coal-fired capacity in Peninsular Malaysia

and Sarawak by 2020. Malaysia signed construction contracts for the

country's first use of ultra-supercritical coal technology for two power

plants located at Manjung 4 and Tanjung Bin on Peninsular Malaysia. The

plants are scheduled to add 2 GW of coal-fired capacity by 2016. A

joint venture consisting of Mitsui of Japan and a subsidiary of

Malaysia's Ministry of Finance is constructing a 2 GW coal-fired plant,

Jimah East Power, to commence electricity generation by 2018.

As

part of the government's Sarawak Corridor of Renewable Energy (SCORE)

program designed to use Sarawak's vast energy resources to serve the

power needs of several proposed energy-intensive manufacturing projects,

the state intends to increase generation capacity from domestic

hydroelectricity, coal, and other renewable sources by a total of 28 GW

over the next two decades. Sarawak plans to use the country's limited

coal production, located on Borneo Island, for the Balingian project.

The 600 MW plant is under construction and is scheduled to commence

operations in 2018. The SCORE program includes expanding the state's

coal-fired capacity by 5 GW.

Malaysia produced only 3.4 million

short tons of coal in 2012, about 12% of its coal consumption, and is

limited in domestic coal reserves. Malaysia's coal imports, mainly from

Indonesia, have doubled in the past five years to about 24 million short

tons to fuel expanding coal-fired generation.

Hydroelectricity,

which accounted for 11% of total electric capacity and 7% of electricity

generation in 2012 in Malaysia, is undergoing significant expansion.

Most of the hydroelectric facilities are small or medium in size and are

located in Peninsular Malaysia. However, the Sarawak state has the most

potential for substantial hydroelectric growth considering its rainfall

and geography.

As part of the SCORE program, Sarawak intends to

harness the state's abundant hydro potential. Sarawak is in the process

of constructing several sizeable dams. In 2012, hydroelectricity was

about 35% of Sarawak's power generation and is anticipated to expand to

80% by 2020, replacing much of the natural gas-fired capacity with the

addition of several hydroelectric dams, according to the government.

Sarawak Hidro, a subsidiary of the Ministry of Finance, developed the

massive 2,400 MW Bakun Hydroelectric plant in Sarawak. The first 300 MW

unit came online in mid-2011, and the other seven turbines were brought

online a year later. The 944 MW Murum Dam is nearly complete and is

expected to be operational by 2015. The Sarawak government plans to

construct another nine hydro dams with a total generation capacity of 4

GW by 2025. According to the Sarawak government, total potential

hydroelectric capacity in the state is 20 GW.

As part of its

efforts to reduce carbon dioxide emissions 40% by 2020, compared to its

2005 level, and to diversify its electricity fuel mix, Malaysia

encourages investment in other types of renewable energy projects.

Besides hydroelectricity from large dams, another key renewable fuel

used to generate electricity is biomass based from palm oil, sugarcane

bagasse, and manure, among others. The government's goal is that

renewable sources, excluding large hydroelectric plants, will account

for 5.5% of electricity capacity by 2015 compared to 3% in 2012. As part

of this endeavor, Malaysia enacted feed-in tariffs for solar, biomass,

biogas, and mini-hydro projects. Malaysia envisions electricity capacity

from non-hydro renewables will grow from a reported 834 MW in 2012 to

2,080 MW in 2020.

Malaysia has also discussed building two nuclear

power facilities by 2021, although this project has encountered delays

resulting from industry reluctance following Japan's Fukushima nuclear

disaster in 2011.

Source: EIA